China’s central bank has reiterated its intention to continue the pilot program for the digital yuan. The CBDC is currently undergoing a pilot program in 17 provinces.

The People’s Bank of China will continue to expand the pilot program for its central bank digital currency (CDBC) after having introduced the currency in 17 provinces. The Financial Association stated that the central bank would focus on creating a system that lets consumers “scan with one code.”

The central bank hopes to “continue to carry out innovative applications of digital renminbi to realize

the interconnection between the digital renminbi system and traditional electronic payment tools.” It has put in a lot of effort in the bid to make the digital yuan a payment medium with utility. China is already a digital payments-focused country, and a CBDC aligns with this.

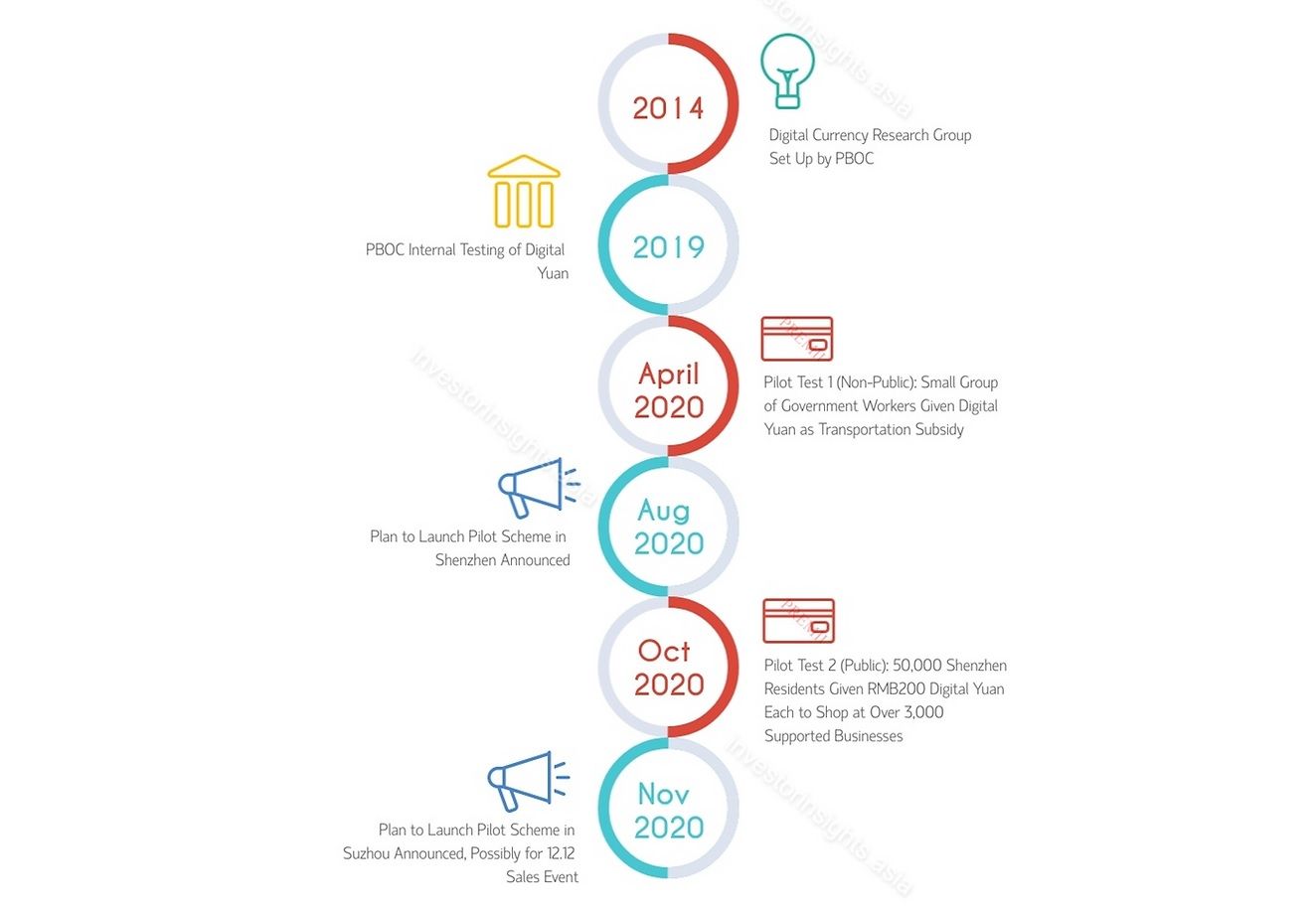

The central bank has steadily expanded the scope and presence of the CBDC over the past 18 months. As noted in the announcement, the PBOC has carried out nearly 30 “red envelope activities” in pilot areas with the goal of promoting consumption and low-carbon travel.

It’s clear that China is eager to get its digital yuan out for a full launch. The CBDC has been in the works for years, and many countries are beginning to see the value of a digital currency.

Digital Yuan: Offline Payments and Smart Contracts

China is also hoping to bring improvements to the digital yuan. The two most notable of those already launched are offline payments and smart contract capabilities. Both of these would introduce significantly more utility for the CBDC.

The offline payment feature launched on Jan. 23. It lets users make payments without an internet connection or power using NFC technology to confirm payments. The smart contract feature was also included earlier this month on the e-commerce app Meituan. The smart contract functionality lets users win a daily prize of $1,312 that is divided among winners.

Wealth Management Products Using the CBDC

The digital yuan is bringing other changes to its utility as well. The central bank recently stated that it would introduce wealth management products that allow CBDC payments in pilot provinces.

Investment bank China Galaxy Securities will offer wealth management services, and only a select number of customers can access them. It’s a big step forward though, and could herald a more public offering.