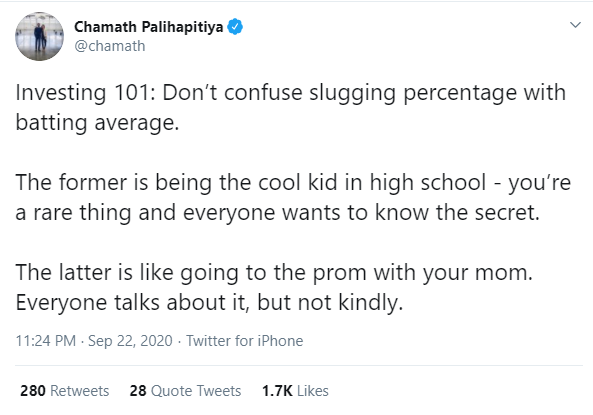

Social Capital chief Chamath Palihapitiya is engaging with his Twitter followers and offering up some investment advice.

In a thread entitled, ‘Investing 101,’ the venture capitalist — who is also a bitcoin bull — shares his thoughts on the difference between a “slugging percentage” and “batting average,” urging investors not to get confused between the two.

He went on to say that “it’s easy to focus on the batting average and miss the obvious,” using Tesla stock as a theoretical example of missing the forest from the trees: “I didn’t buy TSLA at $300 so I’ll pass at $1,000.” The same theory can easily be applied to bitcoin.

Bitcoin Bull

Palihapitiya’s own batting average is rather impressive. His big bets include the likes of bitcoin in 2012, Amazon in 2015 and Tesla in 2016 and he is also a backer of space tourism startup Virgin Galactic. He has a history of picking winners, and his timing isn’t too shabby either.

It is that timing, in fact, that led Palihapitiya to tout his bitcoin bet as his single greatest wager, saying “nothing compares” to it and “sizing up.” He prefers to let his “slugging percentage do all the talking” when it comes to his bitcoin win — he reportedly bought when the price was hovering at $100 — while reminding his followers to “hold.”

Palihapitiya is a bitcoin bull who has not shied away from offering a price forecast and has previously made the case for $1 million BTC, saying on a podcast with Anthony Pompliano,

“This is either zero or it’s millions.”

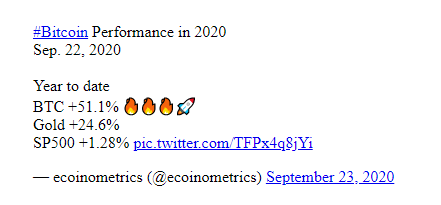

It may not be trading in the millions yet, or even six-digit range, but bitcoin has been a top-performing asset year-to-date.

‘Feels Like Bitcoin in 2012’

Palihapitiya’s latest play is a housing startup called Opendoor, which will be going public via his blank-check partnership Social Capital Hedosophia II. The Social Capital chief explained how Opendoor gives homeowners cash for their home in as fast as three days, a process that is automated online, and then flips the real estate for a profit. The company has more services in its sights, including mortgage lending, title, escrow, etc. that traditionally require hundreds of documents and can now be streamlined in a mobile app.

According to Palihapitiya on CNBC, Opendoor boasts 70% of the market, generated $4.7 billion in revenue last year and is targeting nearly $10 billion in revenue for 2023. At this pace, he believes the tech unicorn will do $50 billion in revenue.

“I really believe in this business. This to me feels like bitcoin in 2012, Amazon in 2015, Tesla in 2016, Virign last year. This is an enormous bet for me and I think that Opendoor is going to build a huge, huge business.”

BeIncrypto asked Palihapitiya about his bitcoin strategy these days and will update this article if we receive a response.