The reaction of the Chainlink (LINK) price to the $7.40 minor resistance area could determine the direction of the next movement.

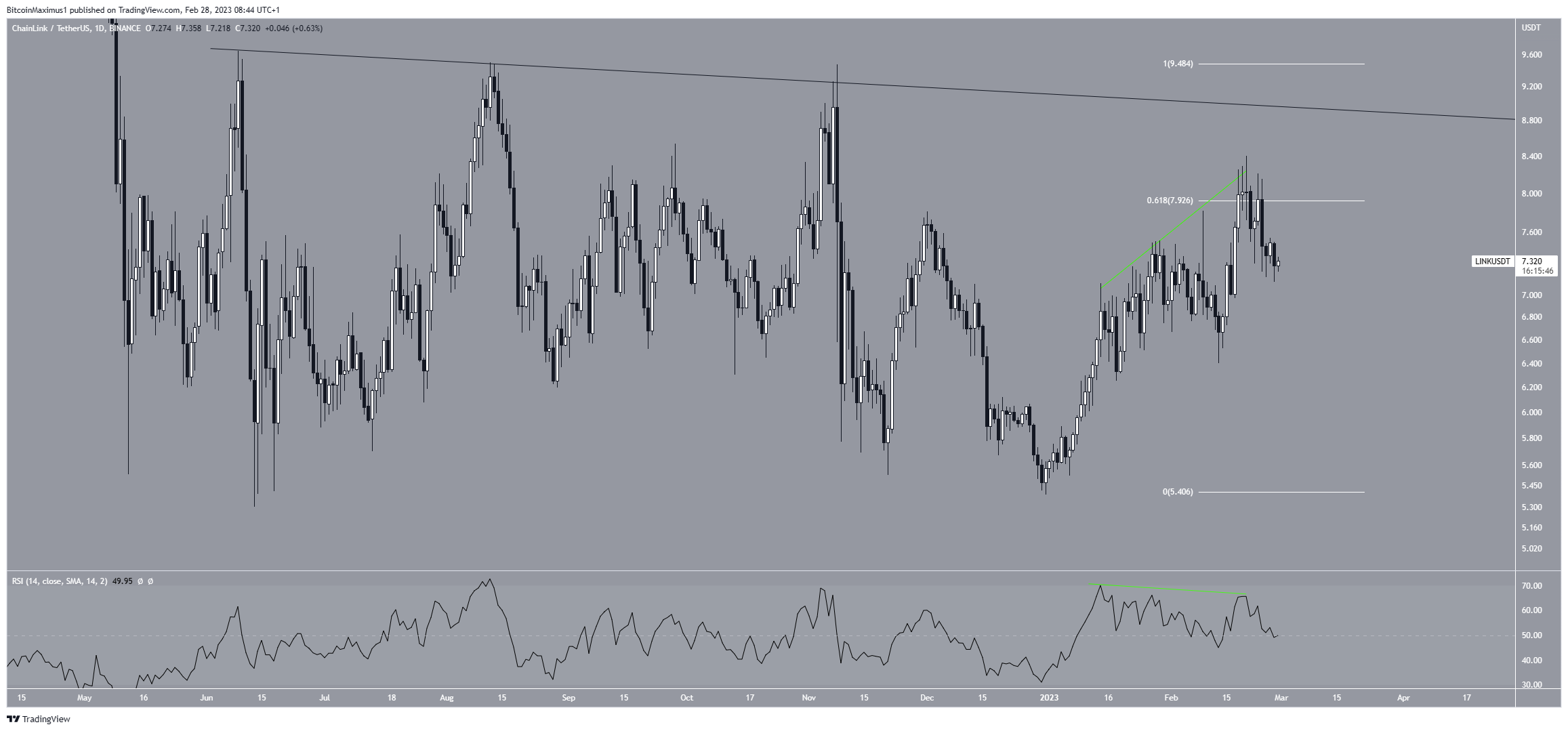

LINK is the native token of Chainlink, a proof-of-stake blockchain network created by Sergey Nazarov. Since May 2022, the Chainlink price has traded above the $5.75 horizontal support area. Despite falling to a low of $5.30, the LINK price remained above the $5.75 support level. While it fell slightly lower in some cases, it did not reach a close below the $5.75 area, which could trigger a breakdown.

The weekly RSI created bullish divergence (green line) throughout this time. Such a high time frame divergence is unusual. As a result, it frequently occurs before meaningful bullish trend reversals. The fact that the RSI moved above 50 further supports this possibility.

If the upward trend continues, $9 would be the next resistance level. The price has not closed beyond this level since May 2022. So, a close above it could accelerate the increase toward the next resistance at $18. This aligns with the weekly RSI readings. However, if the LINK token price closes below $5.75, it could fall to the next support at $4.30.

Chainlink (LINK) Falls After Rejection

Despite the bullish outlook from the weekly time frame, the technical analysis from the daily one shows weakness. This is visible in both the bearish divergence in the daily RSI and rejection from the $7.93 resistance, created by the 0.618 Fib retracement resistance level (white). While the LINK price initially increased above the area, it created a long upper wick and fell afterward.

The LINK price also follows a descending resistance line that is currently close to $9. This increases the significance of the previously outlined $9 resistance area.

Therefore, the future trend can only be considered bullish if LINK breaks out above this confluence of resistance levels.

Chainlink (LINK) in Crucial Short-Term Pattern

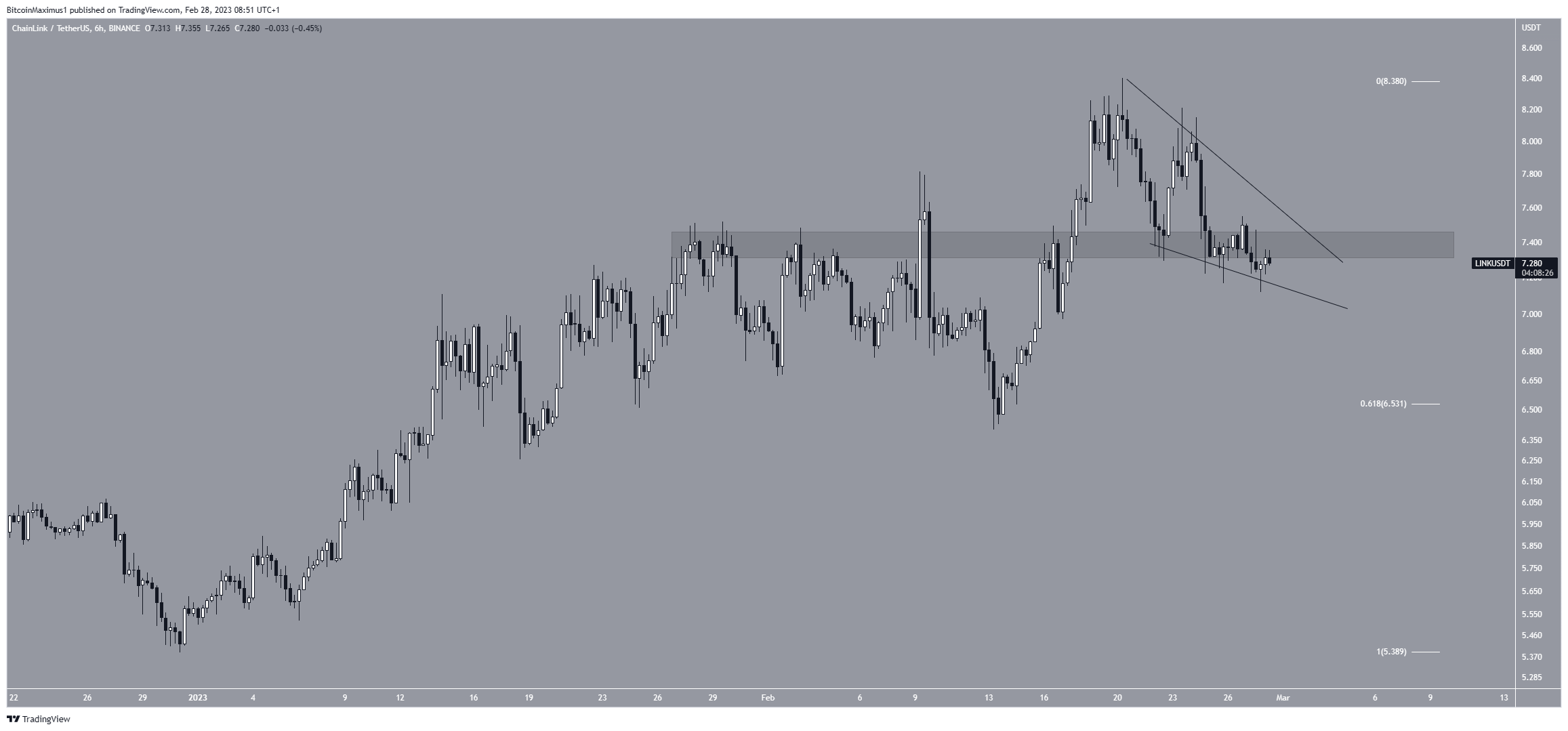

Finally, the short-term six-hour time frame shows that the LINK price trades at a crucial level. There are two main reasons for this.

Firstly, the price trades just below the $7.40 horizontal area. The area previously provided support and has now seemingly turned to resistance. Therefore, whether the LINK price reclaims it or gets rejected could determine the future trend.

Secondly, the price trades in a descending wedge, which is considered a bullish pattern. If the LINK price breaks out from it, it will also reclaim the $7.40 resistance area. This could occur in the next 24 hours.

However, if the price breaks down from the descending wedge, it could fall to the 0.618 Fib retracement support level at $6.53.

To conclude, whether the Chainlink price breaks out or down from the current wedge pattern could determine the future trend. A breakout could lead to an attempt at breaking out above $9, while a breakdown could lead to a fall to $6.53.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.