The vice president of research at K33 argues that altcoins Chainlink (LINK), Arbitrum (ARB), and Binance Coin (BNB) were excluded from K33’s Vinter Quality Index because they offer uncertain value capture potential.

According to Anders Helseth, the Vinter Quality Index for May to July has excluded LINK, ARB, and BNB tokens because of questionable tokenomics post-FTX.

Vinter Quality Index Criticizes Value Proposition of Altcoins

K33’s quality filter selects coins in the top 10 cryptocurrencies by market capitalization to include in its quality index. BNB, ARB, and LINK were set aside before the quality filter.

Binance’s BNB didn’t make the grade because its price relies on a centralized exchange’s promises to buy back and burn the token. The report argues that the recent collapse of FTX means tokens need more backing than just the word of a centralized entity.

Binance burns BNB every quarter through an Auto-burn mechanism that recently saw $2.2 million BNB taken out of circulation.

The research firm said Arbitrum’s use of ETH for transaction fees and ARB’s lack of clear governance utility confuse its value capture proposition. The token was created to divest Arbitrum’s commercial arm Offchain Labs of centralized governance by forming a DAO of ARB holders.

K33 also excluded LINK, the native token of Chainlink’s oracle network. Chainlink data providers lock up LINK tokens to incentivize their production of reliable information for blockchain applications.

The firm argues that easily duplicated oracle data diminishes LINK’s value proposition. There is also little connection between data providers and consumers’ fees, making the data provision pro bono.

Bitcoin and ETH Rank Highly for Vibrant Ecosystem

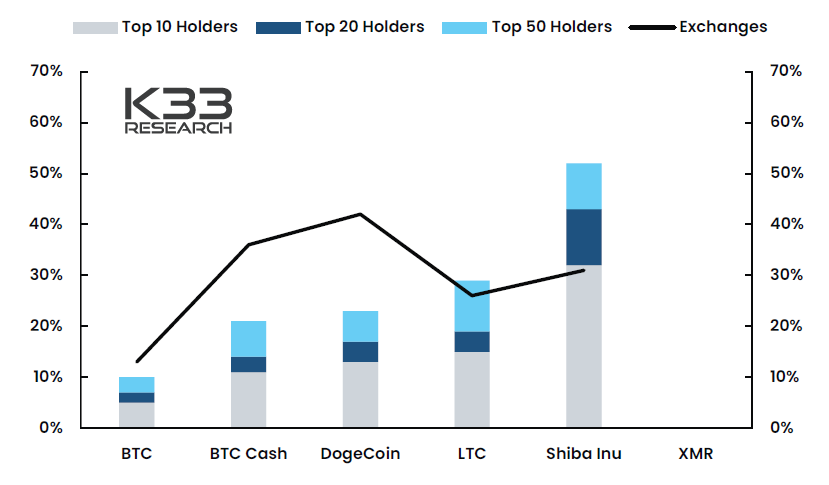

Of the coins used in payments, K33’s Vinter Quality Index argues that Bitcoin (BTC) has the best network effects, faces the least regulatory risk, and poses the lowest concentration risk.

The world’s oldest cryptocurrency also boasts the liveliest developer ecosystem of all payment coins.

On the other hand, despite the efforts of so-called killers, there is little evidence to suggest that Ethereum (ETH) will lose its crown as the premier blockchain for smart contracts. It still boasts the highest developer and ecosystem activity, followed by Polygon and Solana.

K33 also found that Ethereum’s longevity has ensured diverse ETH ownership, with the asset experiencing the best inflation levels. Solana, on the other hand, has concentrated ownership and the second-best inflation level.

Overall, the relative youth of smart contract tokens means vesting schedules could still concentrate ownership.

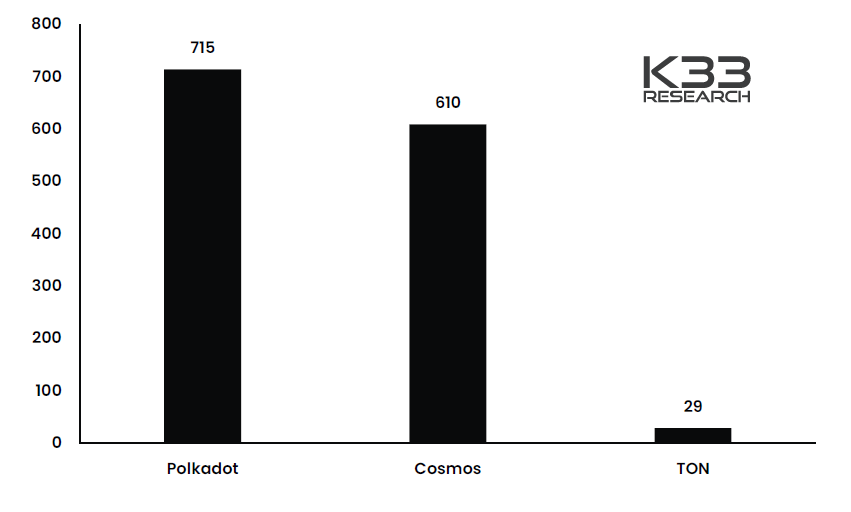

Cosmos (ATOM) scores highest among inter-blockchain protocols. K33 says ATOM’s planned utility expansion in the Cosmos Ecosystem increases its chance of capturing value for holders.

Conversely, the once-buzzy Polkadot (DOT) ecosystem has quietened with once multi-million dollar parachain slots now fetching peanuts. DOT holders have little reason to expect much value creation, according to K33.

K33’s Vinter Quality Index ranks Uniswap’s UNI token highest among DeFi tokens for its utility in determining Uniswap trade fees. Governance votes control UNI issuance, casting its inflation prospects in a favorable light.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.