New York-based William Ichioka has been charged by the Commodity Futures Trading Commission (CFTC), the Securities and Exchange Commission (SEC), and the US Attorney’s Office for the Northern District of California (USAO) for running a crypto Ponzi scheme.

A Ponzi scheme is a financial fraud wherein the fraudsters use the funds of new investors to pay existing customers. With such activities, there is an illusion of profit, whereas the firm might not have been generating actual profits.

Ichioka Pleads Guilty

On Friday, regulators such as CFTC and the SEC filed complaints against the 30-year-old William Ichioka for running a crypto Ponzi scheme.

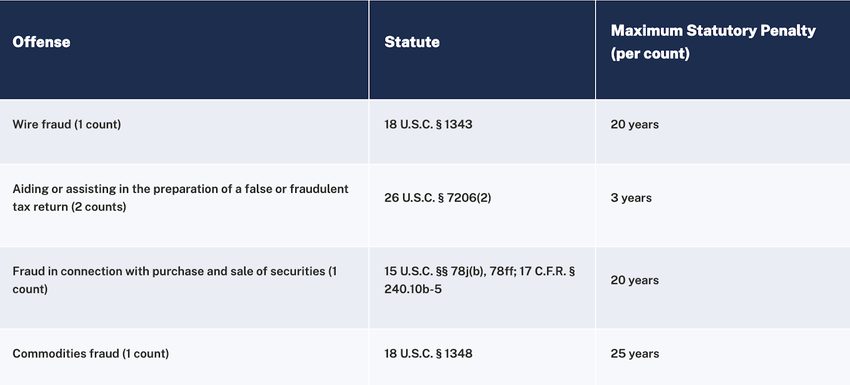

Lastly, the Department of Justice’s press release shows that Ichioka pleaded guilty to charges of wire fraud and other charges shown in the image below:

The New York resident owes over $21 million to non-family investors and over $40 million to his family members. Ichioka ran a Ponzi scheme, called Ichioka Ventures, which promised 10% returns within 30 days.

According to CFTC, Ichioka Ventures pooled funds from over 100 individual investors and firms to trade crypto and forex. To assure investors about the returns, Ichioka used to pay some of the customers through the funds of other customers. Moreover, he also prepared fake documents to show profits.

Read our beginner-friendly guide to forex trading here.

According to filings, Ichioka funded his day-to-day expenses with investors’ money and purchased luxury items such as vehicles, watches, and jewelry.

In March, another fraud, AirBit Club, pleaded guilty to running a $100 million crypto Ponzi scheme. AirBit Club claimed to operate a cryptocurrency mining and trading business but was using victims’ money to create an illusion of profit.

Got something to say about Ichioka’s crypto Ponzi or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.