Celsius is dragging its investor, Fabric Ventures, to court for not fulfilling its commitment to invest $8M in a Series B round.

In 2021, when the bulls were in control of the market, Venture Capital (VC) money flowed into various Web3 businesses. With the Quantitative tightening, FED’s rising interest rates, and the prolonged bear market, the money is now being sucked out of the market.

The VCs are becoming more cautious about making new investments. Some of them are allegedly breaking the earlier commitments made to various organizations.

The now-bankrupt crypto lender Celsius is dragging its investor, Fabric Ventures, for not staying true to its commitment of investing $8 million.

Celsius Accuses Fabric Ventures of a Breach of Contract

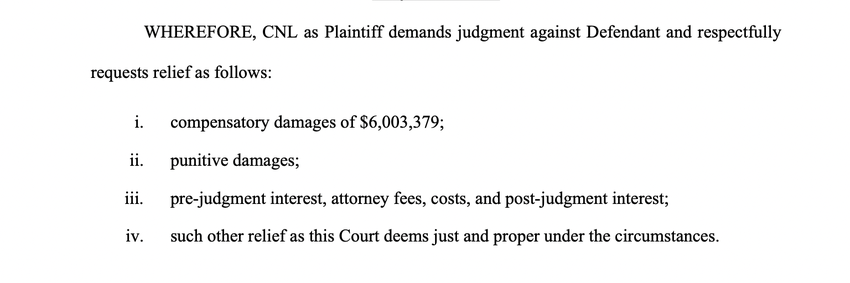

According to a court document filed to the US Bankruptcy Court, Southern District of New York, Celsius seeks damages worth over $6 million from Fabric Ventures.

Fabric Ventures committed to investing $8 million in Celsius in a Series B round held in 2021. They entered a Series B agreement with Celsius’s existing shareholders and leading investors on Dec. 3, 2021.

The court document reads, “Fabric agreed to pay $8,003,379 in three installments: $2,000,000 in May 2022, $2,000,000 in June 2022, and $4,003,379 in July 2022.” However, it made the first scheduled payment but refused to make the other two.

Celsius requests relief worth over $6 million for various damages.

Court Battles Post Bankruptcy

Celsius Network filed for bankruptcy in July 2022 and has been involved in various court battles. Most recently, New York Attorney General Letitia James sued former CEO and co-founder of Celsius Network, Alex Mashinsky.

The Attorney General alleged that Alex Mashinsky defrauded over 26,000 New Yorkers by making false and misleading statements regarding Celsius’ safety.

While Celsius is dragging its investor to court, another bankrupt lending protocol – Vauld rejected the acquisition proposal from Nexo. Vauld believes that Nexo should prove its solvency and capabilities to fulfill the $400 million hole in the balance sheet.

Vauld fears that if Nexo is not solvent, the customers will struggle with a second liquidity crisis.

Got something to say about this article or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here