ADA, the native coin of the Cardano blockchain, has made a significant price breakthrough. It has surpassed the $1 mark for the first time in two years. As of this writing, the altcoin trades at $1.09, a price level last observed in April 2022. `

Over the past 24 hours, ADA’s price has rocketed by 24%, and its trading volume has increased by 131% during the same period. With heightening buying pressure, the Cardano coin price rally is poised to continue.

Cardano Holders See Green

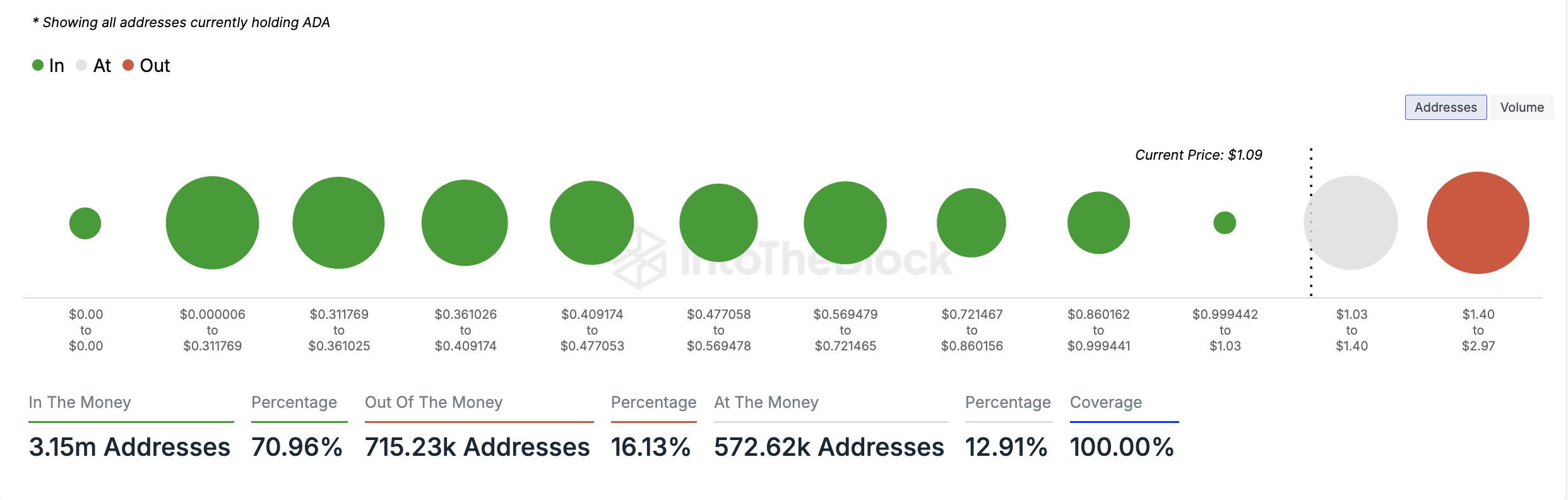

Cardano’s ascent above the $1 price mark has put many of its holders in profit. According to IntoTheBlock’s Global In/Out of the Money indicator, 3.15 million addresses, which comprise 71% of all ADA holders, are “in the money.”

An address is said to be “in the money” if the current market price of the asset it holds is higher than the average cost at which the address acquired those tokens. This means the holder would profit if they sold their holdings at the current market price.

Conversely, 715,230 addresses, which comprise 16% of all ADA holders, are “out of the money.” These addresses would incur a loss if they sold at the current price. Per IntoTheBlock’s data, this cohort of investors acquired their coins when ADA sold above $1.40.

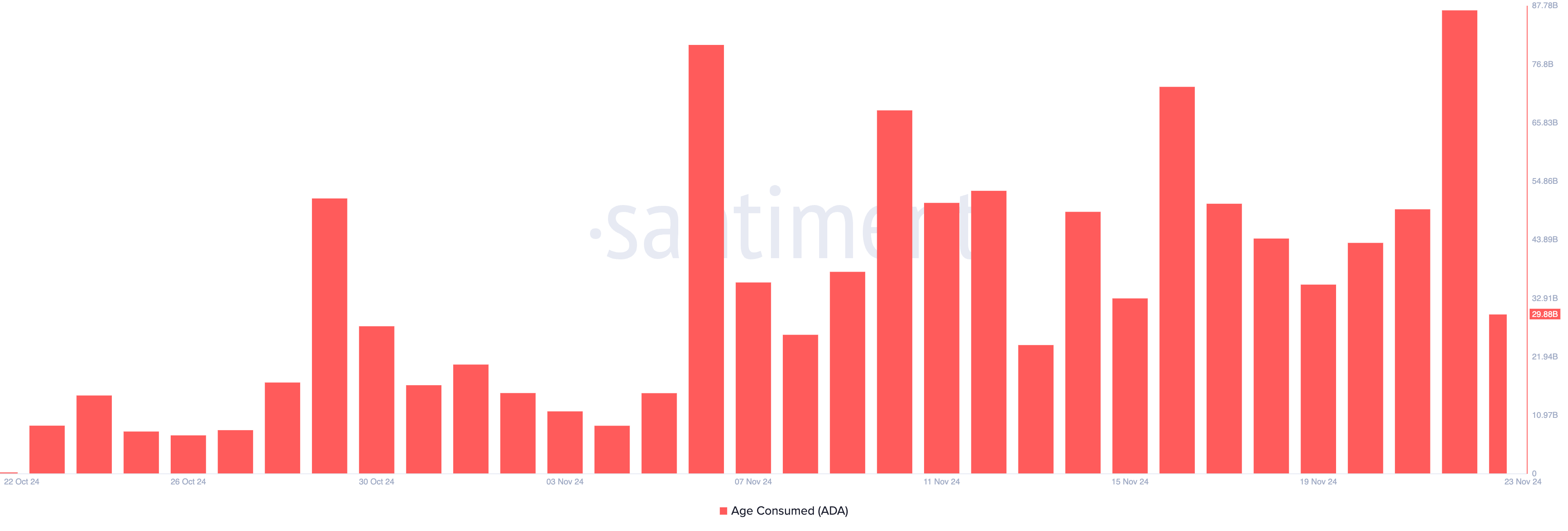

Notably, with many addresses now holding unrealized profits, long-term holders (LTHs) of ADA are repositioning, potentially to secure gains. This activity is reflected by the spike in ADA’s age-consumed metric, which, per Santiment’s data, skyrocketed to a monthly high of 86.91 billion on November 22, when the uptrend began.

This surge is notable because long-term holders rarely move their coins around. When they do, it often hints at a shift in market trends. Therefore, as in ADA’s case, if the spike is accompanied by increased trading volume and positive price action, it suggests that long-term holders are taking profits. This may fuel further price increases as new buyers enter the market.

ADA Price Prediction: The Upward Trend Is Strong

On the daily chart, ADA’s Aroon Up Line is at 100%. The Aroon indicator measures the strength and direction of a trend. When the Aroon Up line is at 100%, it indicates a strong upward trend, suggesting a recent high and a potential continuation of the bullish momentum.

If this holds and new demand continues to enter the market, the Cardano coin price rally will continue toward $1.24, a price high it last reached in March 2022.

On the other hand, if profit-taking intensifies and buying pressure weakens, ADA’s price may fall to retest support at $1. Should this level fail to hold, the downtrend will be confirmed, and ADA’s price will plunge to $0.85.