The Cardano price is up around 3% over the past 24 hours, trading near $0.26 at press time. This stands out as the broader crypto market remains mostly flat. On the chart, ADA is starting to form a familiar rebound structure that has led to rallies before. But on-chain and derivatives data suggest this setup may lack strong backing.

This creates a clear conflict between improving technical signals and weak investor conviction.

Rebound Pattern Is Forming Again — Just Like In December

Since early December, Cardano has been building a familiar structure. Between December 1 and February 11, ADA made lower lows while the Relative Strength Index, or RSI, made higher lows. RSI measures momentum by tracking buying and selling strength. When the price weakens while the RSI improves, it indicates that selling pressure is fading.

This is called a bullish divergence. It often appears near short-term bottoms.

The same pattern formed between December 1 and December 31, 2025. At that time, ADA printed lower lows, RSI made higher lows, and the price rebounded soon after. That rebound pushed Cardano up by about 32% before sellers returned.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Now, the structure looks similar again. On paper, this suggests that downside momentum is slowing.

But technical patterns only work when large participants support them. This time, that support is missing.

Whales and Derivatives Are Not Backing This Reversal Attempt

The biggest difference between December and now is whale behavior. In December, large Cardano holders were accumulating aggressively. Wallets holding between 10 million and 100 million ADA increased their supply from around 13.15 billion to nearly 13.5 billion. That steady buying helped fuel the rebound.

This time, the opposite is happening. Since mid-January, these same whales have been reducing exposure. On January 14, they held around 13.67 billion ADA. That figure has now dropped closer to 13.3 billion. The overall trend has shifted from accumulation to distribution.

Instead of preparing for upside, large holders are slowly exiting. That weakens the entire reversal structure.

Derivatives data tells the same story. Open interest, which measures the total value of active futures positions, is far lower than it was in early January, when the Cardano price last peaked. On January 5, open interest peaked near $884 million. It is now close to $407 million, down more than 50%.

This matters because strong rallies usually need leverage participation. When open interest is rising, it means traders are committing capital to directional moves. When it is falling, momentum tends to fade quickly. Funding rates are also only mildly positive. That shows traders are not aggressively betting on upside. Nor is there enough short leverage power to trigger a short squeeze.

In simple terms, whales are not buying, and derivatives traders are not committing. That leaves the rebound dependent on spot buyers alone.

Spot Flows Are Turning Negative, Keeping Pressure On the Cardano Price

Spot market data explains why confidence remains weak.

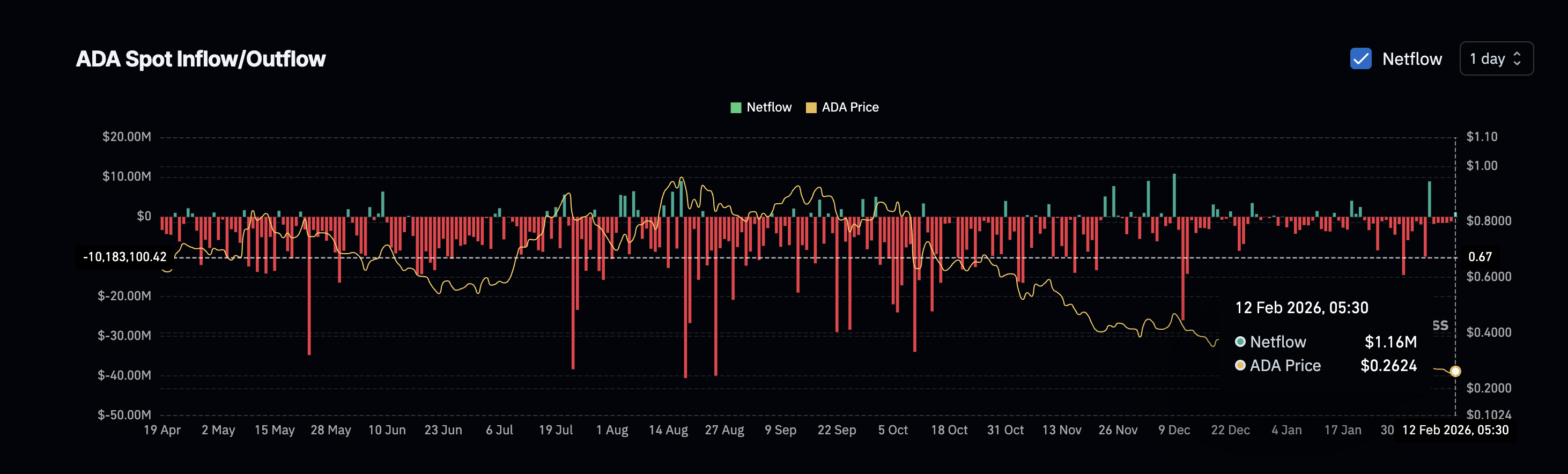

One key indicator is Exchange Netflow. This tracks whether coins are moving into or out of exchanges. When netflow is negative, coins are leaving exchanges, which usually suggests accumulation. When netflow turns positive, it shows increasing selling pressure. Between February 7 and February 11, Cardano saw mild outflows. That suggested some early buying interest.

But on February 12 (post the divergence flashing on the chart), netflow turned positive again, with inflows near $1.16 million. That means traders have started moving ADA back onto exchanges to sell. This shift is important.

It shows that even short-term buyers are not committed. Instead of holding through the setup, they are taking quick exits. When spot selling returns this early, rebounds usually struggle. With whales absent, derivatives weak, and spot flows turning negative, conviction remains low.

From a price perspective, $0.28 is now the first level that matters. A clean break above $0.28 would show that buyers are finally gaining control. If that happens, ADA could attempt a move toward $0.32 and possibly $0.35 (a 30%+ upmove), similar to the December rebound’s size.

But without stronger support, that scenario remains unlikely.

On the downside, $0.24 is the first key support. A sustained break below this level would expose $0.22. If $0.22 fails, the entire rebound structure would be invalidated. Right now, Cardano is caught between improving technical momentum and weakening investor confidence.