Cardano’s (ADA) price has recently surged by 10% in the last 24 hours, briefly sparking excitement among investors. However, this rally has brought ADA back to a familiar barrier: the $0.37 resistance.

In previous instances, ADA has struggled to break past this level, often settling into a rangebound pattern. Given the historical context, there is a strong chance Cardano may once again find itself restricted under this resistance.

Cardano Needs Bulls

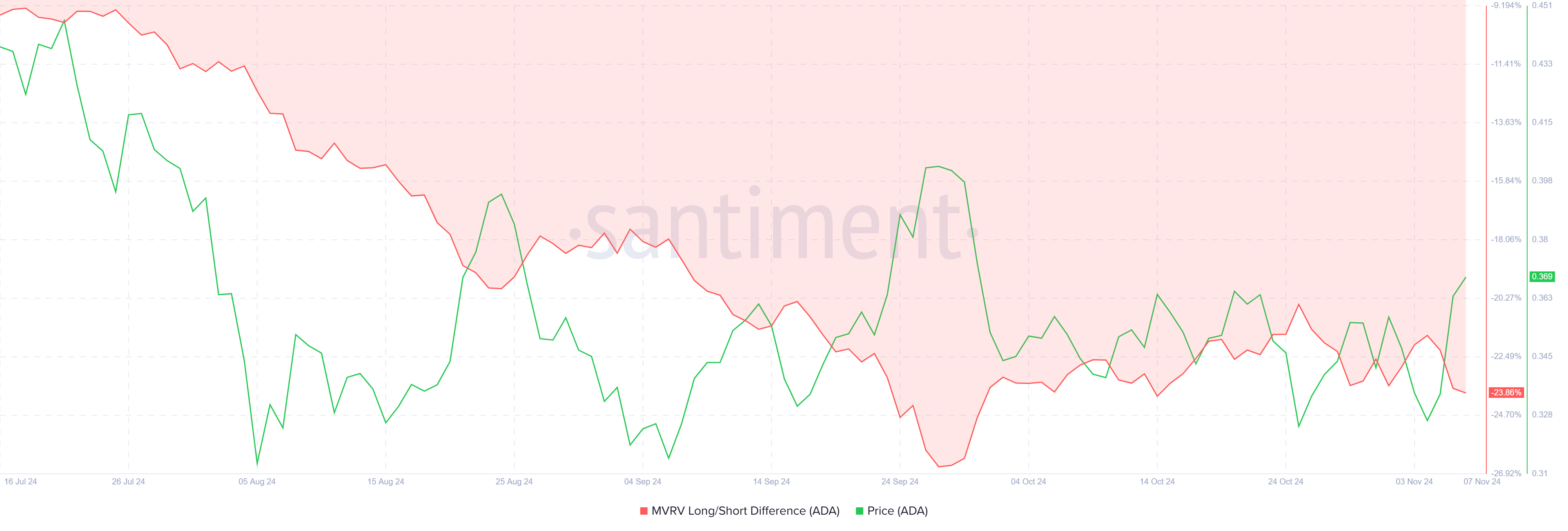

Cardano’s market sentiment reflects caution, as seen in the MVRV (Market Value to Realized Value) long/short difference, which currently sits at -23%. A negative MVRV long/short difference figure implies that short-term holders (STHs) are in profit, often resulting in these investors taking profits, leading to potential selling pressure.

Historically, negative MVRV long/short difference values suggest STHs are more likely to dominate the market, a bearish indicator as these investors tend to sell off more quickly than long-term holders (LTHs).

Conversely, extremely positive MVRV long/short difference values would signal that LTHs are in profit, which is usually an indicator of market stability as LTHs typically hold rather than sell. Currently, the market is influenced by STHs, who are in a position to capitalize on their profits, potentially exerting downward pressure on ADA’s price. As these short-term investors sell, the bearish sentiment may persist, hindering ADA’s efforts to breach the $0.37 level.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

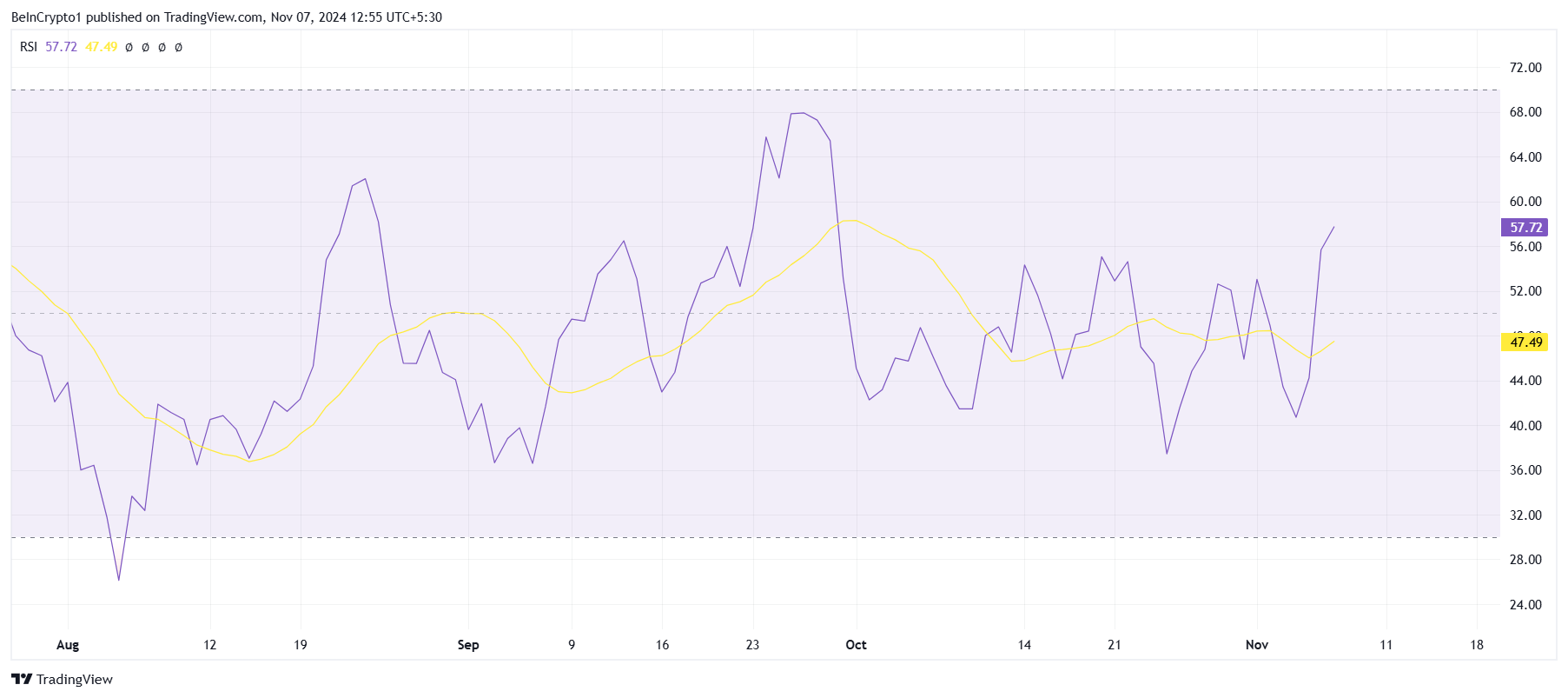

Cardano’s broader macro momentum remains uncertain, with technical indicators such as the Relative Strength Index (RSI) revealing mixed signals. While the RSI is positioned above the neutral line of 50.0, it has not yet flipped it into solid support, a critical level that typically signifies sustained bullish momentum.

This indicates that Cardano’s rally may not yet be fully supported by strong upward momentum, adding to concerns about its ability to break through resistance. Furthermore, the struggle of the RSI to establish bullish dominance reflects ongoing indecisiveness in ADA’s market strength. Despite showing potential, the cryptocurrency’s momentum remains precarious, suggesting that ADA may need additional market support to break free from its rangebound state.

ADA Price Prediction: Remaining Rangebound

Cardano’s recent 10% rally has brought it back to the critical resistance level of $0.37. Although the upward movement has sparked optimism, this could merely mark the beginning of another consolidation phase. Historically, ADA has struggled to maintain upward momentum above this price, often stalling at $0.37.

In the past, ADA has consistently fluctuated between support at $0.33 and resistance at $0.37. Should ADA fail to surpass $0.37, it’s likely to remain within this range. This could lead to Cardano failing to make a rise towards $0.40 to recover the 14.5% loss from the late September crash.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

However, if ADA does manage to breach the $0.37 resistance, a rally toward $0.39 could be on the horizon, effectively invalidating the current bearish outlook. This breakout would signal stronger buying pressure and may propel Cardano into a new growth phase.