The hope of a potential bull market has been dealt a huge blow following a wider market downturn, which saw altcoins, including Cardano (ADA), hit low prices they hadn’t reached in almost a year.

At press time, ADA’s price is $0.30. This is one value it has failed to notch since November 2023. How has this affected token holders, and what’s next?

More Pain Ahead for Cardano Holders

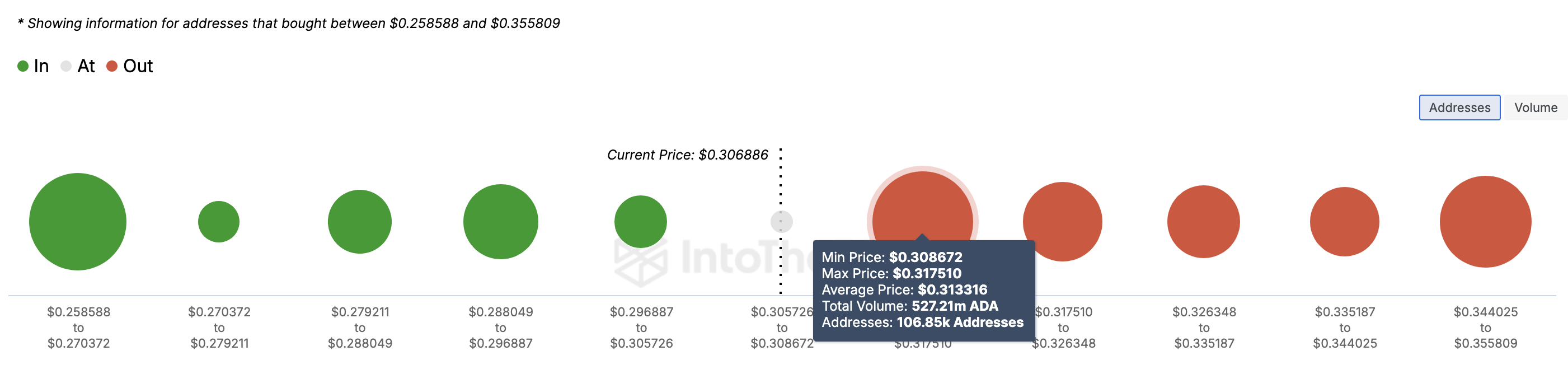

The sharp drop in ADA’s value marks the most significant three-day sell-off since the bear market of 2022. While Cardano may recover, data from the In/Out of Money Around Price (IOMAP) shows the road is not yet clear.

The IOMAP classifies addresses based on those profits, losses, and breakeven points at several price ranges. The higher the number of addresses at a price level, the stronger the support or resistance it offers.

According to IntoTheBlock, the total number of addresses in profits and purchased ADA between $0.28 and $0.30 are not up to the addresses lying in losses at $0.31.

Specifically, 106,850 addresses hold a total of 572.21 million tokens at $0.31. In contrast, only 35,460 addresses are profitable and purchased 451.95 million between $0.28 and $0.30.

Read More: How To Stake Cardano (ADA)

Considering the difference in addresses, Cardano may lose its hold on support at $0.30 due to the waiting sell-offs. If this happens, the cryptocurrency may face another decline. This time, it could drop as low as $0.28.

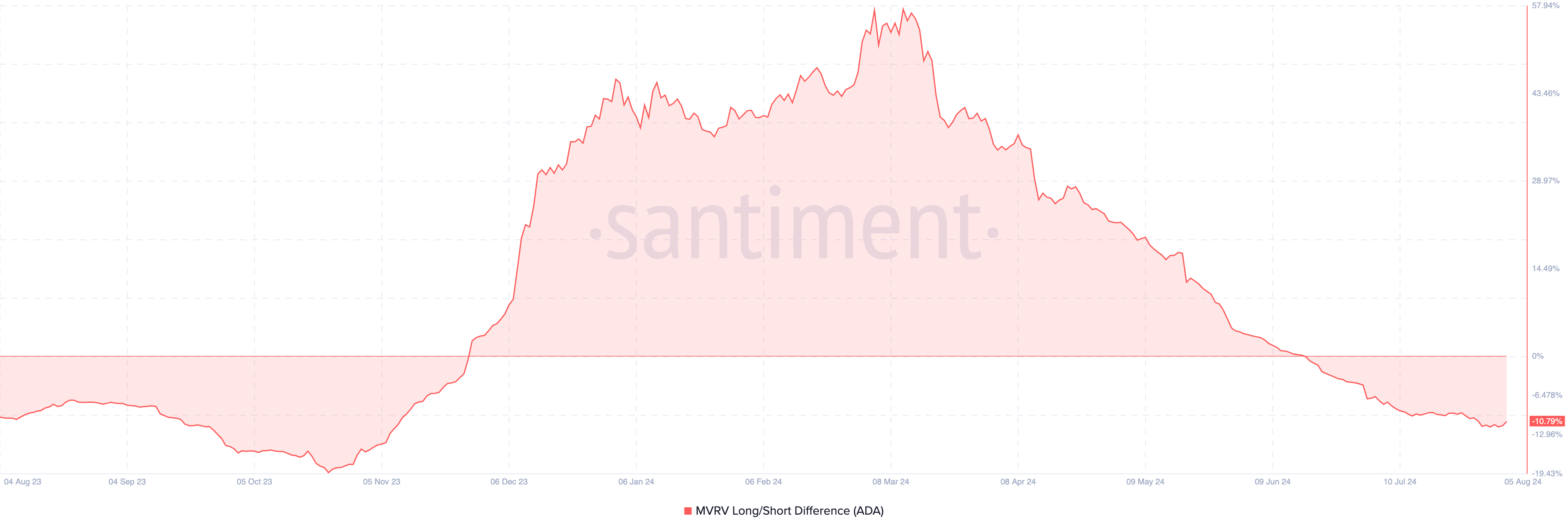

Beyond that, the Market Value to Realized Value (MVRV) Long/Short Difference is -10.79%. The MVRV difference shows if long-term holders are realizing more profits than short-term holders.

When the reading is positive, it means that long-term holders are realizing more profits. However, since it is negative for ADA, it implies otherwise.

This decline could also mean that the cryptocurrency is getting close to a bear phase, as a reading at -19.33 % historically shows that a token may no longer be in a bullish cycle. Should ADA’s price decline again, the chance of a fall into the bear market will increase.

ADA Price Prediction: Correction to Continue

Since August 2, multiple sell signals have appeared on Cardano’s daily chart, which is one reason the token experienced an accelerated drawdown.

For example, the Supertrend, which shows price direction and generates buy and sell signals, was above ADA when the price was $0.42. Typically, if the red segment of the Supertrend is above the price, it is a sell signal. When the green area is below the price, the indicator flashes a buy signal.

Therefore, it is not out of place to assume that Cardano had exhibited signs of a collapse before this day. The parabolic stop-and-reverse (SAR) was in a similar situation.

Like the Supertrend, it shows direction and can identify an entry and exit point. A look at the chart above shows that the parabolic SAR flashed a similar sign when ADA traded at $0.42 as the dotted lines positioned above the price.

Furthermore, the prevailing market structure indicates weakness, suggesting that ADA may undergo another correction. The Fibonacci retracement, a technical using percentages to spot resistance and support points reinforces this prediction.

ADA’s price is below the 23.6% nominal pullback, indicating that the bears were in full control of the price action. If selling pressure increases, the cryptocurrency’s value may drop to $0.27.

Read More: Cardano (ADA) Price Prediction 2024/2025/2030

ADA’s price is below the 23.6% nominal pullback, indicating that the bears were in full control of the price action. If selling pressure increases, the cryptocurrency’s value may drop to $0.27.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.