Chainlink (LINK) price soared by over 10% as the global crypto market cap momentarily regained positive momentum.

Volatility was the mood of the market, with swift lows and highs keeping traders hooked to their screens. Despite the larger bearish narrative, Chainlink price managed to make some strides in the upward direction.

LINK price finally broke free from the bearish momentum that had plagued the token and reclaim the $6 mark. At press time, LINK traded at $6.29, charting 10.23% gains on the 24-hour window.

Looking at the Chainlink price breakout

High trade volumes supported the recent upward momentum that LINK saw as day traders rejoiced in short-term gains. The 24-hour trade volumes LINK soared in tandem with price reaching $504.26 million, appreciating by 67.64% in the last day.

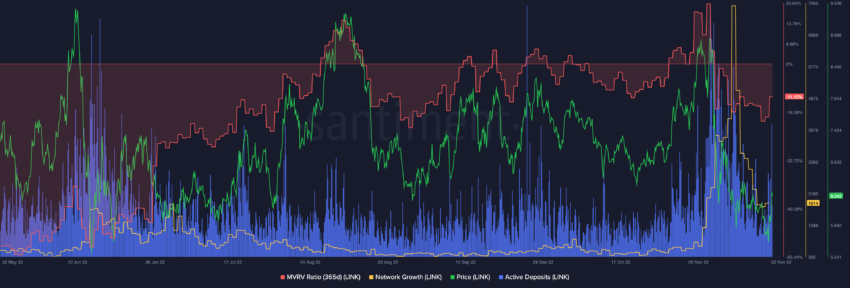

The reason why LINK stood out in a bear market was that Chainlink price jumped on Monday despite Bitcoin and Ethereum prices falling. Santiment data highlighted that the bigger story was that the LINK saw a sudden active address surge, which began approximately when the FTX fallout occurred.

The spike in active addresses after the market fall could most likely be sellers in the market. However, the active address rise maintained the higher level, still up at one-year high levels. After soaring to a high of 8174 on Nov. 10, active addresses saw a 50% pullback but still maintained above-average levels.

Despite the rise in active addresses, LINK holders could be in for some losses in the near term in case market momentum turns negative.

Rising deposits spelling trouble for Chainlink

Active deposits for LINK presented a spike on Nov. 22, almost doubling from the previous day. A spike in active deposits alongside a drop in active addresses usually produces a bearish price reaction.

Another bearish trend plaguing LINK was its drop in network growth. Meanwhile, even though MVRV 365 days saw a bump, it was still trading in the negative territory, as seen above.

One of the key reasons behind the recent pump in LINK price could be the announcement of the upcoming launch of Chainlink Staking v0.1.

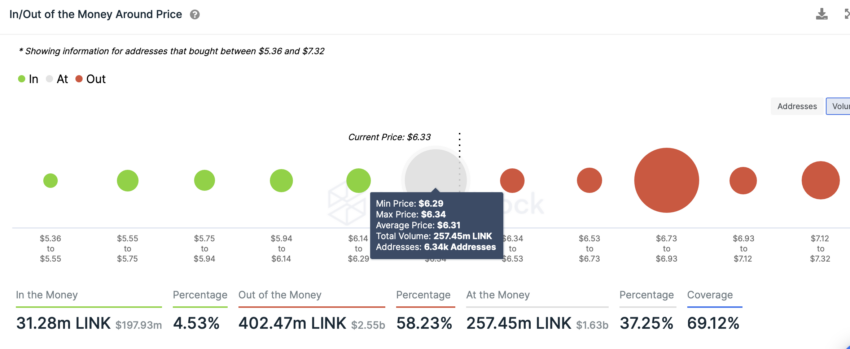

Going forward, for LINK bulls, it would be crucial to maintain the price above the $6.31 mark according to In/Out of Money Around Price Indicator.

At the $6.31 mark, 6340 addresses held 257.45 million LINK tokens. If bulls are able to keep prices above this level, price action can maintain its positive momentum. However, with the current market momentum in place, a pullback could be expected. In/Out of Money Around Price, the indicator suggests now major support for LINK prices till the $5.45 mark.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.