Prime Factor Capital was the first cryptocurrency-focused hedge fund to obtain a license from U.K. lawmakers. The move was heavily celebrated by the crypto community, as it meant a step closer to adoption.

Unfortunately for the founders, the fund is shutting down. Failure to attract enough investors has spelled doom for the fledgling firm. The March 2020 market crash may have put the final nail in the coffin.

From Prime to No Capital

Back in 2018, former employees of global investment firm BlackRock launched a new cryptocurrency-focused hedge fund. They named it Prime Factor Capital Ltd. It was the first crypto hedge fund to win the seal of approval from the Financial Conduct Authority (FCA). U.K. regulators approved it as a full-scope alternative investment fund. The fund was authorized to hold more than €100 million in assets under management. And although the fund caused great hype within the crypto community, it failed to attract institutional interest. Cryptocurrency enthusiasts have been waiting for institutional money to jump on board for years. The theory is that if and when institutional investors do, crypto will have hit the mainstream. It looks like hardcore fans will have to wait a bit longer. Prime Factor Capital has closed down all its operations despite solid returns, according to Nic Niedermowwe, Prime Factor’s chief executive:“We can confirm that the fund, despite having delivered an average monthly performance in excess of 4%, is being wound down due to insufficient demand from institutional investors.”The fund also failed to sell its fund management license to another cryptocurrency firm due to the volatility of the sector.

The State of Crypto Hedge Funds

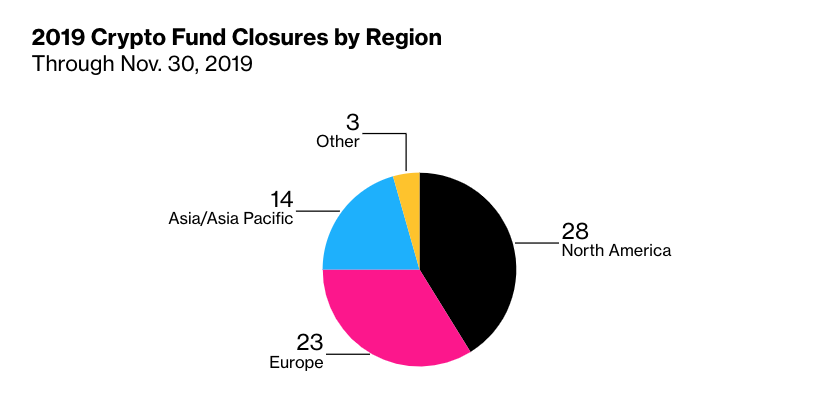

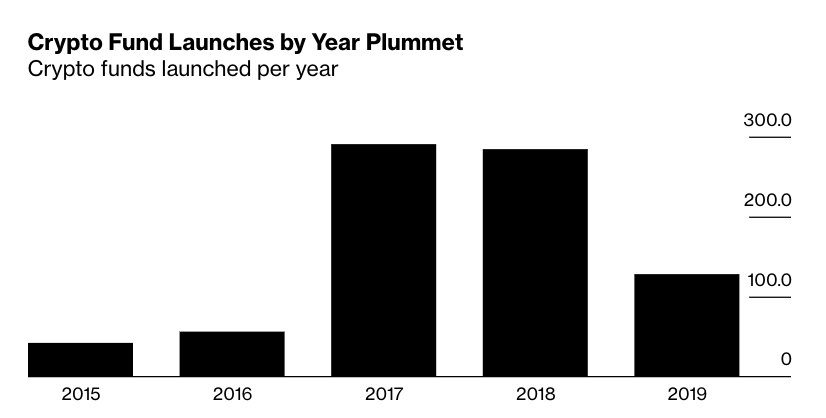

Primer Factor Capital is hardly the first crypto-centric fund to close. During 2019, almost 70 cryptocurrency-focused hedge funds closed their doors.

The Bear Case for Institutional Money

The COVID-19 induced market crash of March 2020 certainly added some fuel to the fire. Cryptocurrency focused funds witnessed their second-worst monthly loss in nearly five years. On average, they lost a hefty 27%. Mainstream hedge funds lost less than 10% on average, as crypto volatility added doubt to large-scale players.

Institutional Money, Good or Bad?

After the 2017 – 2018 ICO madness, retail money headed for the exits as the bubble exploded. Crypto firms had to look for investors outside of retail, attempting to make their businesses appealing to venture capitalists and hedge funds. According to Spencer Bogart, a general partner at San Francisco-based Blockchain Capital LLC:“Taking a step back, I think some would argue that the levels of institutional adoption are disappointing or underwhelming but, of course, this view depends entirely on expectations.”He adds:

“To me, the fact that there is any institutional adoption for Bitcoin only 10 years into existence is a radical success and beyond what anyone could have imagined just 3 or 4 years ago.”There’s an atmosphere of uncertainty, fuelled by global central banks printing money non-stop. Big investors are looking for protection against inflation, and many are turning to gold and other precious metals. As BeInCrypto reported recently, gold bug Peter Schiff continues to punt the shiny metal, backed by mainstream media.

The appeal of precious metals, and the cheap price of other commodities like oil, might divert big money from crypto into the safe, old, boring hard assets. Does a lack of institutional money make a bearish case for crypto? Or will the trend only attract additional retail investors? Only time will tell.Luminaries are lining up behind gold, visionaries are lining up behind bitcoin. https://t.co/cF4fYliv2g

— Cameron Winklevoss (@cameron) May 18, 2020

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Tony Toro

Tony has worked for several financial companies in London during the last seven years, gaining experience in traditional finances and trading. Passionate about direct democracy, digital rights and privacy, he has been involved with cryptocurrency since 2013.

Tony has worked for several financial companies in London during the last seven years, gaining experience in traditional finances and trading. Passionate about direct democracy, digital rights and privacy, he has been involved with cryptocurrency since 2013.

READ FULL BIO

Sponsored

Sponsored