Ethereum (ETH) price could be on the brink of another surge despite the recent pump to $2,800, according to several indicators analyzed on-chain.

Currently, ETH trades at $2,771. If the signs recently spotted are valid, the cryptocurrency’s value could hit levels not seen since the succesful spot ETF launch on July 23.

Ethereum Presents a Rare Chance as Accumulation Picks Up

Yesterday, during the early Asian hours, ETH traded at $2,624. Following remarks from Fed Chair Jerome Powell signaling a reinforced commitment to inflation reduction and potential interest rate cuts, the altcoin’s value surged. The ETH price increase brings the total gains over the last seven days to 6.93%.

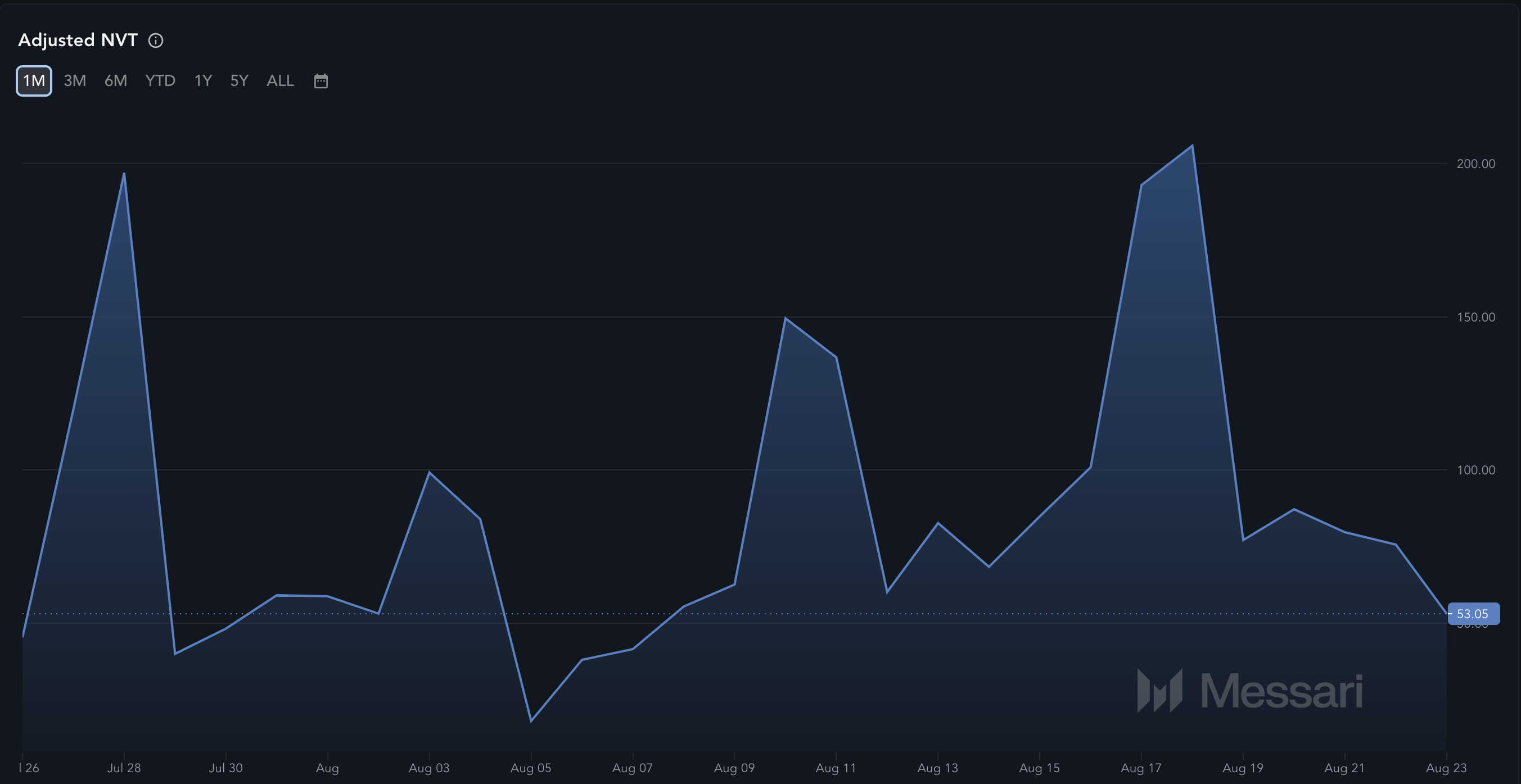

Messari data reveals that Ethereum’s adjusted Network Value to Transactions (NVT) ratio has dropped to -53.05. The NVT ratio reflects whether a network’s market cap is growing faster than its transaction volume. High NVT readings typically suggest that an asset is overpriced, often indicating market tops and overvaluation periods that may lead to a price decline.

Read more: Ethereum ETF Explained: What It Is and How It Works

However, in Ethereum’s situation, the massive drop in the ratio indicates that the network is undervalued, and ETH itself is at a discount. Therefore, it is not out of place to mention that the cryptocurrency is near its bottom, and the odds of a notable price increase in the coming weeks might be high.

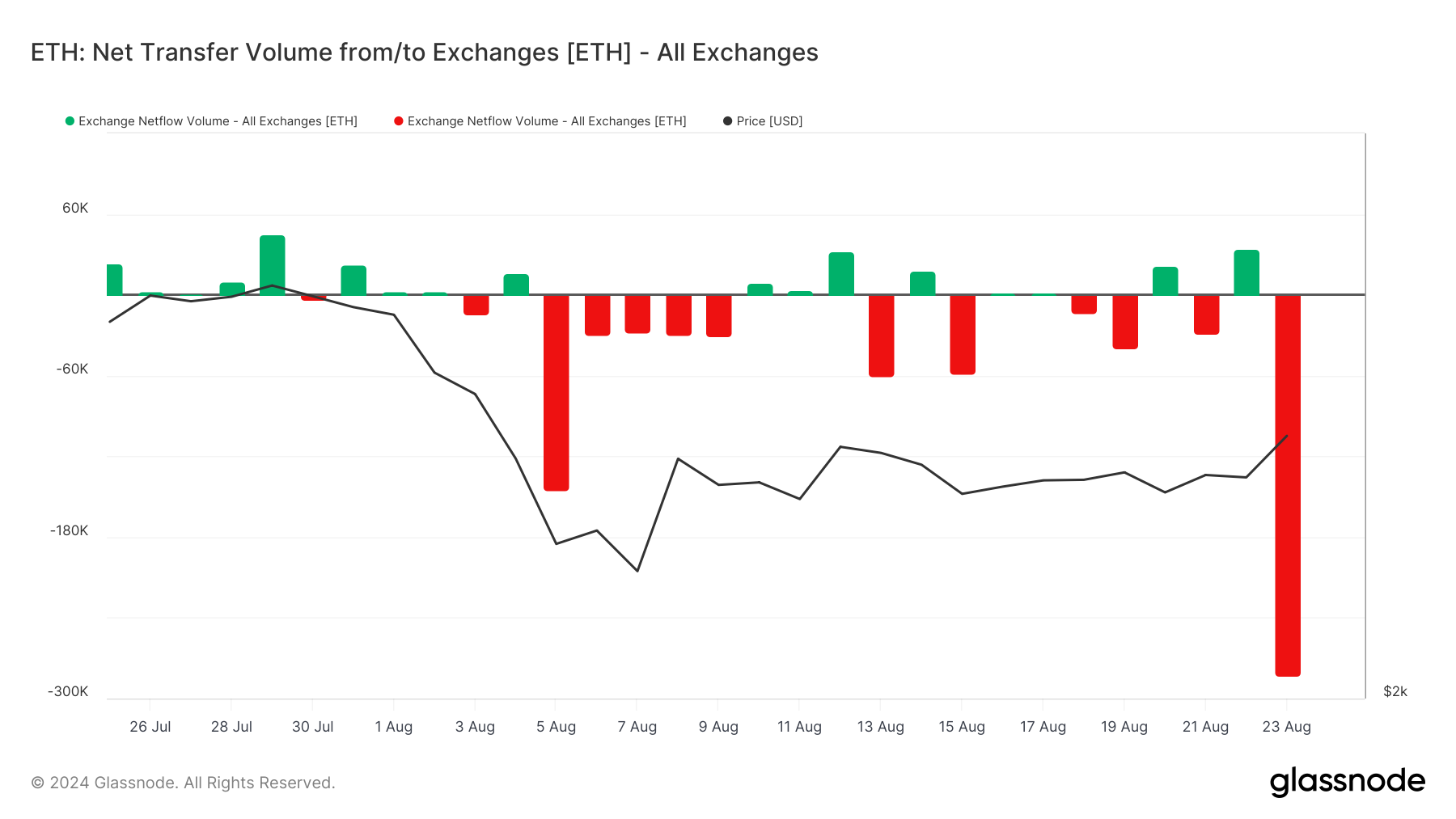

Besides this, Ethereum is experiencing a high level of exchange withdrawals. Based on Glassnode’s data, the exchange net transfer volume saw a notable decline of over 280,000 ETH on August 23.

This volume measures the difference between coins flowing into an exchange and those taken out. A positive value indicates that more coins are being sent into exchanges — a sign of selling pressure.

Therefore, the recent withdrawals, valued at almost $800 million, confirm a surge in buying pressure. If sustained, this could validate the bias of buying ETH at the current market value.

ETH Price Prediction: Ready to Rally

According to the daily ETH/USD chart, Ethereum’s failure to break below the $2,536 support level played a key role in its recent bounce. Had it slipped below this level, ETH could have dropped to $2,345, potentially creating a bearish outlook.

The recent buying momentum, highlighted by the Moving Average Convergence Divergence (MACD) indicator, suggests ETH’s price could reach $2,829.50 in the short term. The MACD measures momentum, with positive readings indicating bullish sentiment and negative readings signaling bearish trends.

Additionally, the Fibonacci retracement indicator, which identifies key support and resistance levels based on historical price movements, provides further insights. If ETH surpasses $2,829, the next potential target could be around $3,265.60.

Read more: How To Buy Ethereum (ETH) With a Credit Card: A Step-by-Step Guide

In the meantime, macro market analyst Matthew Hyland shared his thoughts on ETH’s price action. In a video posted on X, Hyland mentioned that the cryptocurrency needs to close above $2,800 to rally to the height it reached in July.

“If Ethereum can close weekly above $2,800, then it could see a majour push toward the upper $3,500 to $3,600 area,” the analyst explained.

However, ETH risks invalidating this bullish outlook due to a recent decision by the Ethereum Foundation. Historically, it has sold large amounts of ETH for various reasons, often leading to price drops. Earlier today, on-chain data revealed that the foundation transferred 35,000 ETH to Kraken.

Like previous times, the transfer could eventually lead to a sell-off. If it sends another round again, ETH’s price could be affected, and a decline to $2,516.21 could be next.