Research by OKEx analyzed BTC/USDT trading patterns from August through November 2020 and found that retail traders lost out to whales.

In their research, the OKEx team filtered transactions by trade size and direction to see how various types of market participants acted during the August – November 2020 bull run.

Getting Directions

According to the researchers, sorting by trade size is straightforward. However, trade direction is challenging, and the researchers carefully explained their methodology.

The authors look at trades from a taker’s perspective according to an algorithm from Kaiko. That is, they look at the type of order being placed and whether sell orders or buy orders were being filled for each size of order.

Sizing Up

Bitcoin traders were put in four categories based on the size of the trade. These were:

- < 0.5 BTC

- 0.5 < 2 BTC

- 2 < 5 BTC

- 10+ BTC

The OKEx team writes that these groupings fit the market’s personas and are generally called retail traders, professionals, large traders or whales, and institutions. The behavior of each type of trader roughly falls into these categories and volumes.

So, What Happened?

According to OKEx, smaller retail traders were on a buying spree as BTC continued to trend upwards to about $15,000. Retails sellers joined the mix after that.

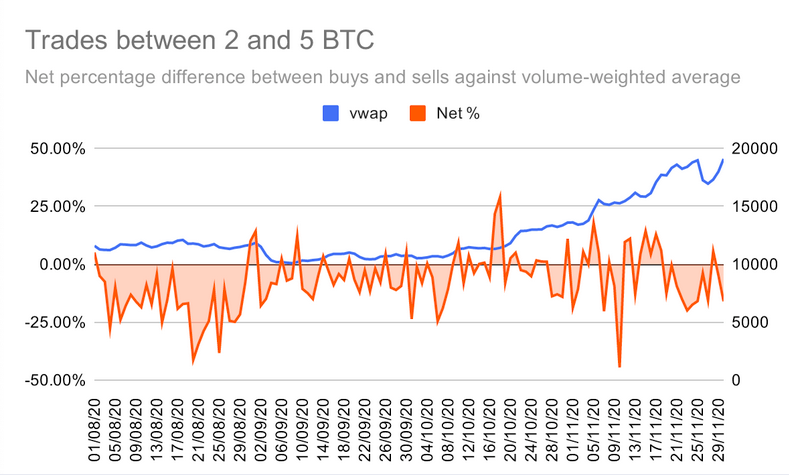

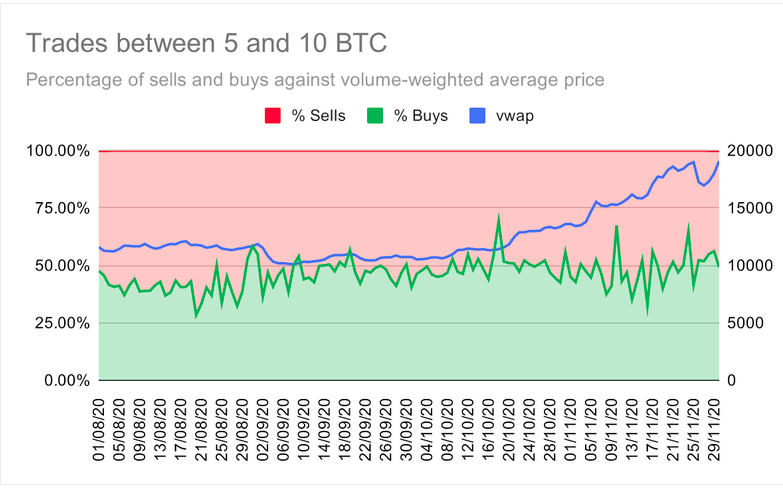

Transactions under two BTC remained largely buys up through the end of November. However, trades above two BTC were more often than not sells, according to the data. The following charts provide a good idea of the trend:

Source: OKEx

However, a careful reading of the charts shows that the 2+ BTC trading band turned ‘buyish’ in late November. This buying occurred during the Thanksgiving correction, when smaller traders were more wary of returning to the market.

Known Unknowns

The authors are careful to note the limitations of their research as well. They back up their claims based on the transactions on one exchange over a limited period of time.

Moreover, even adding in data from other exchanges is not enough. Over-the-counter (OTC) trades, which are also an important part of professional and institutional trading, cannot be captured in this way.

For example, OTC orders sometimes take days to fill. The preliminary, or parent, order gets broken up into child orders that hinders identifying such trades.

Another issue is that larger traders don’t want to move the market so much. Even when trading on exchanges, they may separate large-scale operations into smaller pieces in order to keep the market dynamic as it is.