Optimistic long bets on crypto derivatives have once again come at a considerable cost to traders following a $1.93 billion wipeout over the past 24 hours.

The total crypto market cap is down over $70 billion amid a massive slump in prices of nearly all virtual assets with Bitcoin (BTC) retreating below the $17,000 mark.

Overleveraged Cryptocurrency Long Positions

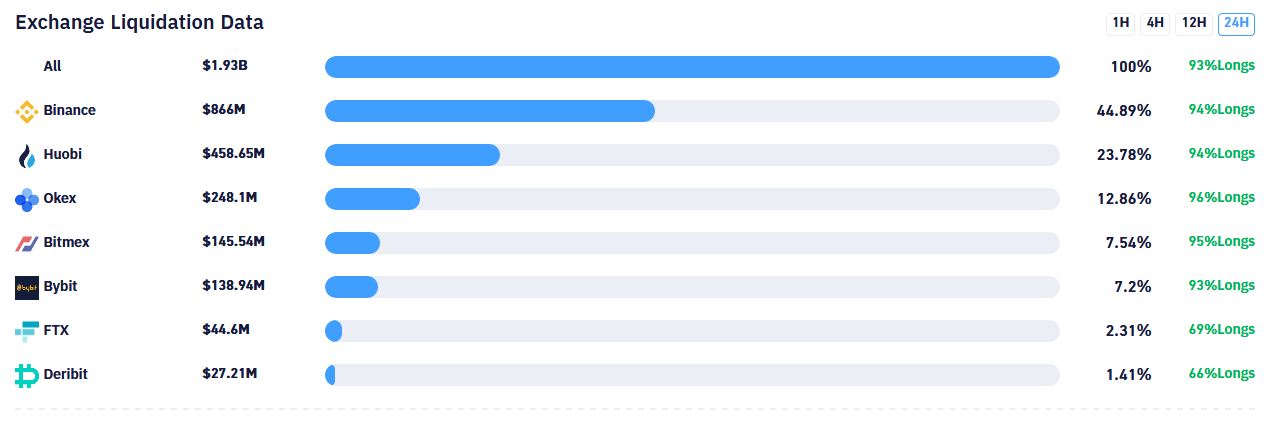

According to the crypto data aggregator bybt, total crypto derivative liquidations across exchange platforms over the past 24 hours is over $1.93 billion.

Many traders were likely caught up in the bullish euphoria and entering over-leveraged long positions.

Binance reportedly recorded $866 million in liquidations which amounts to almost 45% of the total sum. Over 94% of the liquidations on Binance were from long positions as cryptocurrency prices tanked on Thanksgiving day.

Open interest (OI) on Binance is down over 20% as well as on other derivative platforms like FTX and Bybit. This OI decline provides further evidence of an increase in over-leveraged longs on exchanges before Thursday’s price drop.

Perhaps indicative of the BitMEX decline in recent times, only $145 million (7.54%) of the total liquidations happened on the platform. In the past, BitMEX used to be the pantomime villain as far as crypto liquidations were concerned.

Of the $1.93 billion liquidation total, about $1.04 billion were from Bitcoin derivatives that saw traders lose over 62,000 BTC in the process. Ethereum (ETH) derivatives own the largest share of altcoin liquidations with a wipeout of about 770 ETH worth approximately $380 million.

Market Cap Down 15%

At the time of press, the total crypto market capitalization is down by over 15%. The cryptocurrency market value has lost about $70 billion in the last 24 hours as Bitcoin and altcoins experienced significant corrections.

After flying to a two year high of $0.90, XRP is now down to the $0.50 price mark. ETH and Litecoin (LTC) also posted double-digit percentage drops in the last 24 hours with the broader altcoin market firmly in the red.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.