Bitcoin rose as the U.S. Consumer Price Index increased by 0.4% from Sep. 2022 to Oct. 2022, following slower price increases for cars and medical care as a result of hawkish tightening by the Fed.

The most significant contributor to inflation in Oct. 2022 was the cost of shelter, which made up half of the increase.

Crypto markets soar on CPI news

At press time, crypto markets mainly responded positively to the news, with Bitcoin breaching the $17,400 mark and Ethereum up 3.1% to hover around the $1,280 mark. Furthermore, XRP and ADA netted gains of over 2%, while a certain billionaire’s favorite memecoin rose 6.5%.

The crypto market cap has risen slightly to $889.8 billion after falling to $875 billion on Nov. 10, 2022.

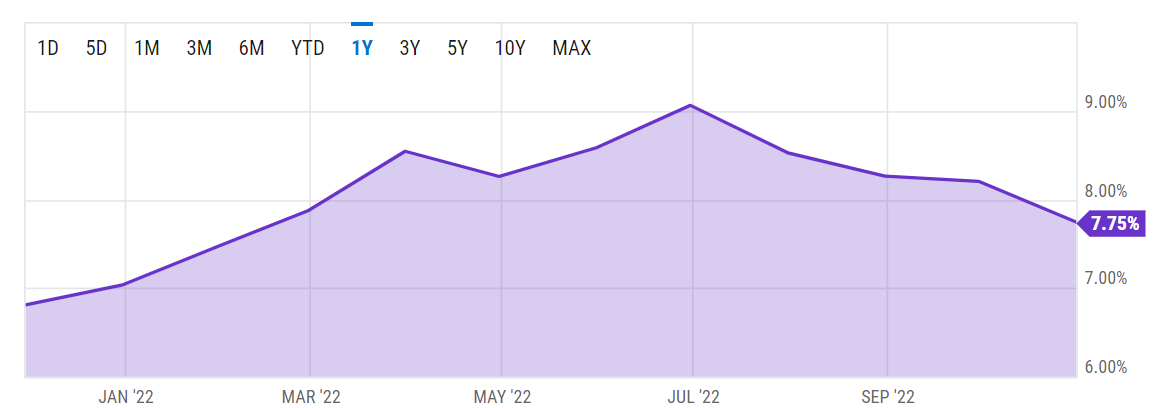

Year-on-year CPI for Oct. 2022 below Sep. 2022

The CPI rose 7.7% in Oct. 2022 compared with a year ago, which is the lowest year-on-year increase since Jan. 2022. It is down 8.2% compared to Sep. 2022. The CPI gives the U.S. Federal Reserve an idea of how much consumers pay for goods and services.

Core CPI, which excludes energy and food prices, rose 6.3% compared to a year earlier. Monthly, core CPI rose 0.3% in Oct. 2022 compared with the previous increase of 0.6% between Aug. and Sep. 2022.

The lower rates came from a reduction in the cost of cars, trucks, clothes, medical care, and airfare.

Time to buy Bitcoin?

Analysts had predicted that the CPI would rise 0.6% between Oct. and Sep. 2022. A lower number bodes well for risky assets like cryptocurrencies and stocks since it indicates that recent Fed interest rate hikes are doing their job. Accordingly, this negates the need for further aggressive hikes that could tip the U.S. economy into a recession and causes investors to dispose of risky assets like cryptocurrencies.

However, renowned gold bug Peter Schiff warned against acting too hastily on the CPI numbers:

Analysts predict that the Federal Reserve will increase the federal funds rate by 50 basis points at its next meeting in Dec. 2022. This reduction would be a departure from the last four meetings, where the Fed increased the interest rate by 0.75%, taking it to 3.75%-4%.

“The report provides ammunition for the Fed to begin pricing in sub 75 basis point tightenings,” says Eric Merlis of Citizens.

Stocks responded positively to the CPI news, with the S&P 500 futures up 3.25% in early trading and futures on the Dow Jones Industrial Average jumping 2.4%.

For Be[In] Crypto’s latest Bitcoin (BTC) analysis, click here.