Bitcoin (BTC) price is up 3% in the last 24 hours. Still, the rally has been relatively muted despite two major developments: the SEC revoking SAB 121 policy, allowing banks to custody crypto, and Trump creating a Digital Asset Stockpile by executive order.

The 7-day MVRV Ratio indicates more room for short-term growth, while whale activity has dropped to its lowest level in a year, signaling a potential shift in large-holder behavior. With BTC’s EMA lines reflecting bullish sentiment but showing signs of consolidation, the market faces a decisive moment between testing new highs or retreating to key support levels.

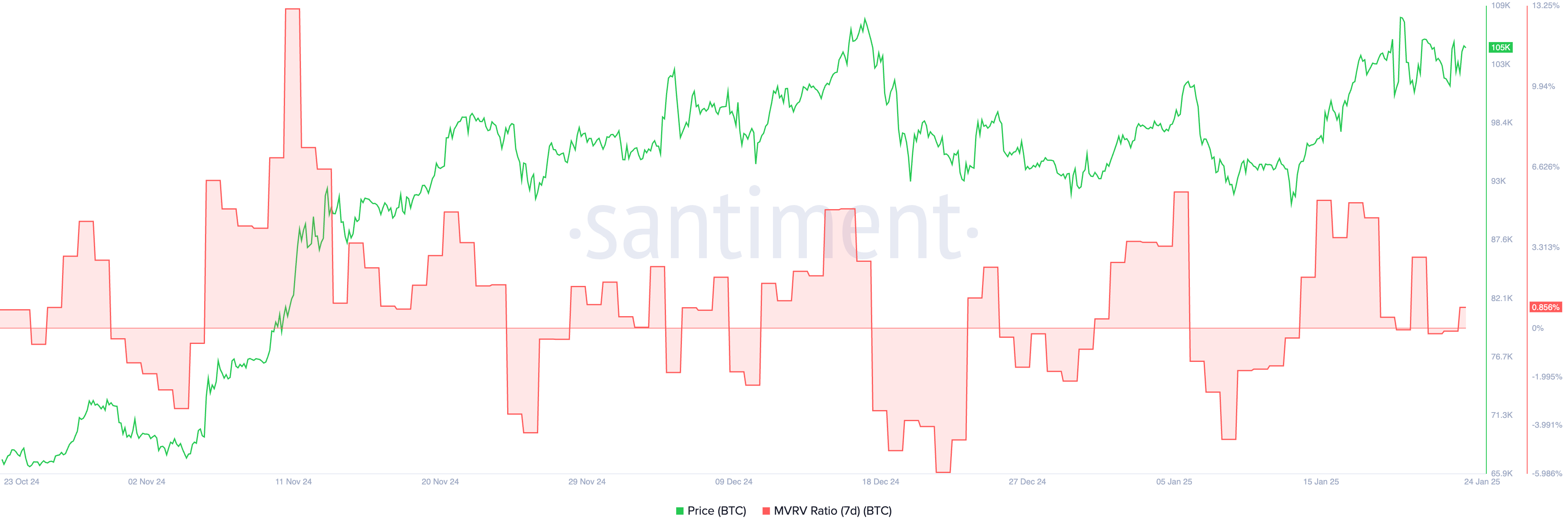

MVRV Ratio Shows More Room for Growth

The 7-day MVRV (Market Value to Realized Value) Ratio for Bitcoin currently stands at 0.85%, following a period of stability near 0% over the past two days. This metric measures the average profit or loss of BTC holders who have acquired their coins within the last seven days.

A positive MVRV ratio indicates that recent holders, on average, are in profit, while a negative ratio suggests unrealized losses. The recent move into positive territory suggests that market sentiment among short-term holders is shifting toward profitability, reflecting a potential uptick in momentum.

Historical trends show that Bitcoin’s 7D MVRV Ratio often rises to levels around 5-6% before experiencing a significant price correction. This indicates that BTC has historically demonstrated more room for short-term growth from current levels before encountering resistance or selling pressure.

At the current 0.85%, the metric suggests that the market is far from overextended, leaving ample space for additional upside before reaching typical profit-taking thresholds.

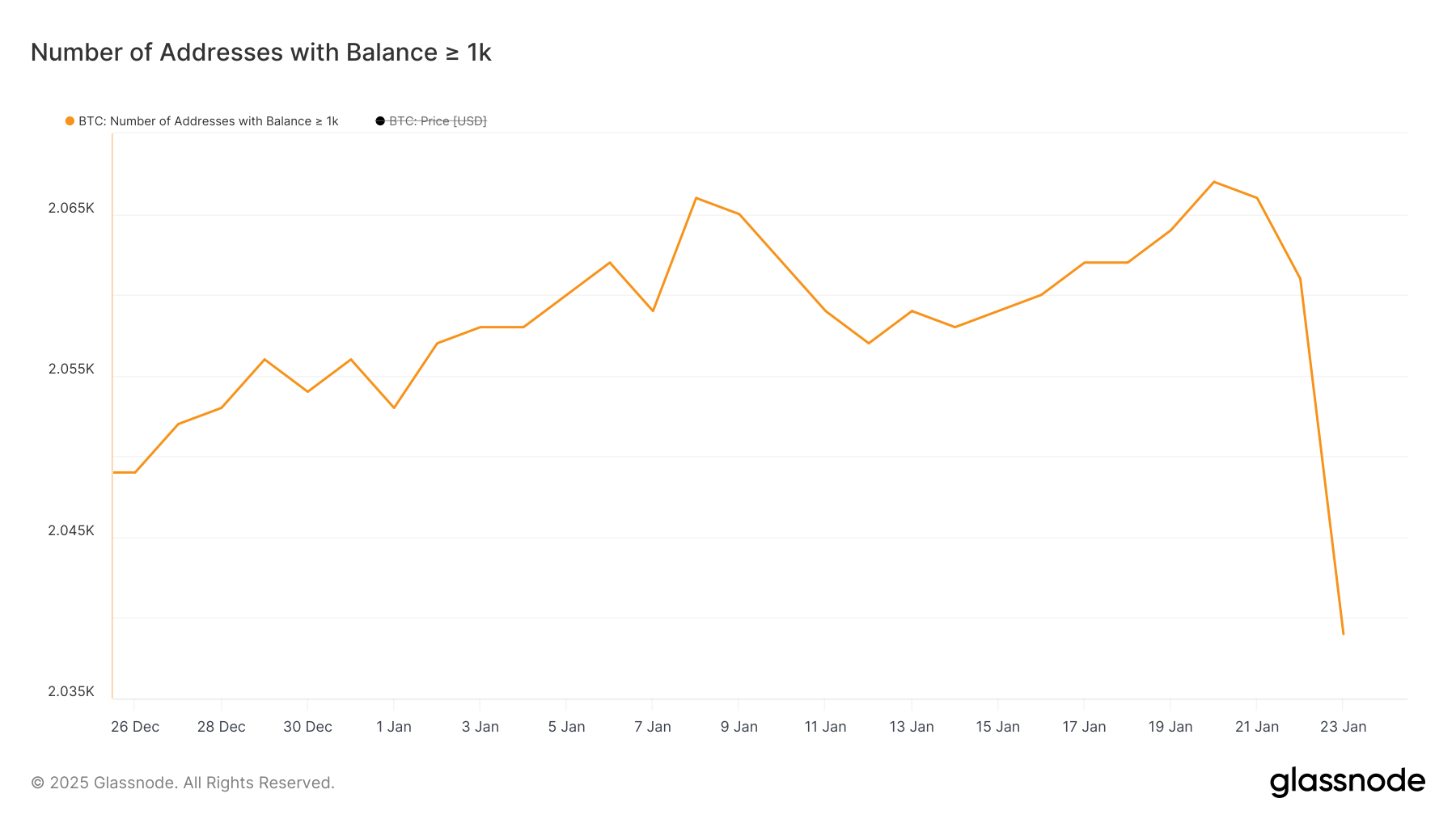

Bitcoin Whales Reached Its Lowest Level In One Year

The number of Bitcoin whales – wallets holding at least 1,000 BTC – dropped sharply from 2,067 on January 20 to 2,039 on January 23, reaching its lowest level since January 30, 2024.

Whale activity is a key metric to watch as these large holders often influence market trends through significant buy or sell decisions. This recent decline suggests a shift in strategy among major BTC holders, potentially signaling caution or reallocation of funds, even after SEC revoked SAB 121 policy allowing banks to custody crypto.

This drop could reflect whales awaiting further details on Bitcoin-related executive orders expected from the Trump administration. Alternatively, some whales might be rotating their capital into other assets now that BTC has stabilized above the $100,000 mark.

“The amount of Bitcoin held by long-term holders has decreased by 1.5 million BTC (approximately $150 billion) in the last year. Their selling accelerated since Trump’s election in November, with 500,000 BTC (around $50 billion) leaving long-term holder addresses since then. This trend resembles a pattern from previous bull cycles, where these holders started selling after prices reached new all-time highs and accumulated following 50%+ retracements,” Lucas Outumuro, Head of Research at IntoTheBlock, told BInCrypto.

BTC Price Prediction: Will It Stay Above $100,000?

Bitcoin’s EMA lines are currently bullish, with short-term lines positioned above long-term lines, but their lack of upward movement suggests the market may be entering a consolidation phase.

“There is a combination of institutions and short-term speculators driving the demand-side. Onchain data shows that the amount of Bitcoin held by addresses that have been holding for under 12 months is at its highest since early 2022. This suggests high speculative activity and traders being in control of market dynamics. From the institutional side, Trump’s DeFi protocol, World Liberty Financial, bought over $47 million of wrapped Bitcoin on Ethereum, along with ETH, AAVE, and other tokens. It is unclear what the plan for these assets is, but it appears that World Liberty Financial could become an increasingly relevant player in the space,” Outumuro added.

If Bitcoin regains its strong uptrend, it could test the resistance at $108,561, and a breakout above this level could lead to BTC reaching $110,000 for the first time ever. This could be sparked as soon as more details about the Digital Asset Stockpile are out.

However, if the trend reverses and Bitcoin price enters a downtrend, it may test the support at $99,486, with a potential drop to around $95,800 if that support is broken.