The last days of June set the all-time low (ATL) for the Exchange Net Position Change ratio. This means that investors are withdrawing their BTC from cryptocurrency exchanges at the highest levels ever.

Bitcoin withdrawals from exchanges are dictated by the prolonged bear market and the fact that BTC has once again fallen below $20,000. At the same time, they are an expression of investors’ belief that Bitcoin’s price is now relatively low, and that the largest cryptocurrency will rise in the future.

The problems of an increasing number of centralized services and decentralized cryptocurrency protocols are also not insignificant. Thus, Bitcoin’s record high exchange withdrawals may be a manifestation of the rapid loss of investor confidence in these entities. Could it be that on-chain data suggest a renaissance of the classic saying: “Not your keys, not your coins”?

Bitcoin exchange withdrawals reach ATH

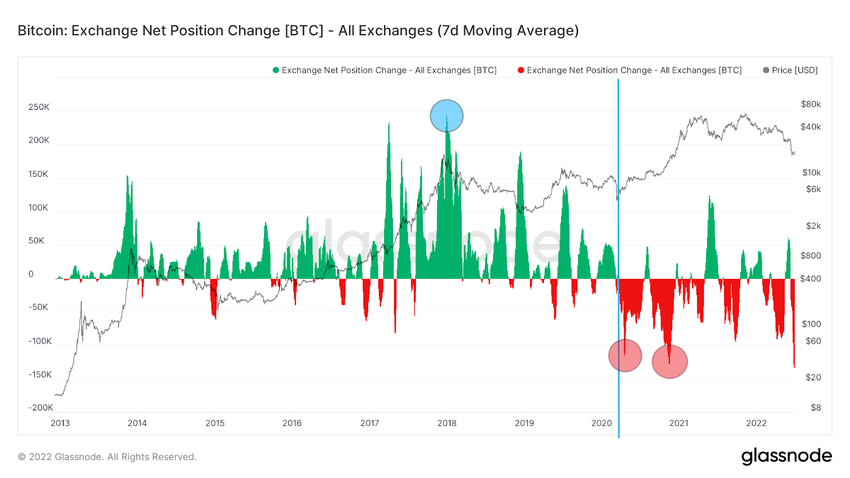

The Exchange Net Position Change indicator provides information about the 30-day change in the supply of exchange wallets. If the bars of its chart is green, the exchanges are experiencing a net BTC inflow to their wallets. If they are red – Bitcoin is being withdrawn from exchanges.

On the long-term chart of this indicator, we see a significant advantage of green bars over red ones. This advantage lasted until the end of 2019 (blue line), and reached its peak near the historic ATH at $20,000 in December 2017 (blue circle). At that time, a record amount of Bitcoin flowed into the exchanges with the peak of the 7-day moving average (7D SMA) at 245,000 BTC on December 28, 2017.

However, since the beginning of 2020, we have seen a gradual reversal of the dominance and increasing prevalence of Bitcoin exchange withdrawals. The previous two periods of highest BTC outflows were April 2020 – just after the COVID-19 crash – and November 2020 – the beginning of the parabolic rise of the previous bull market (red circles). Bitcoin outflows during these periods reached the 7D SMA lows at -115,000 BTC and -127,000 BTC, respectively.

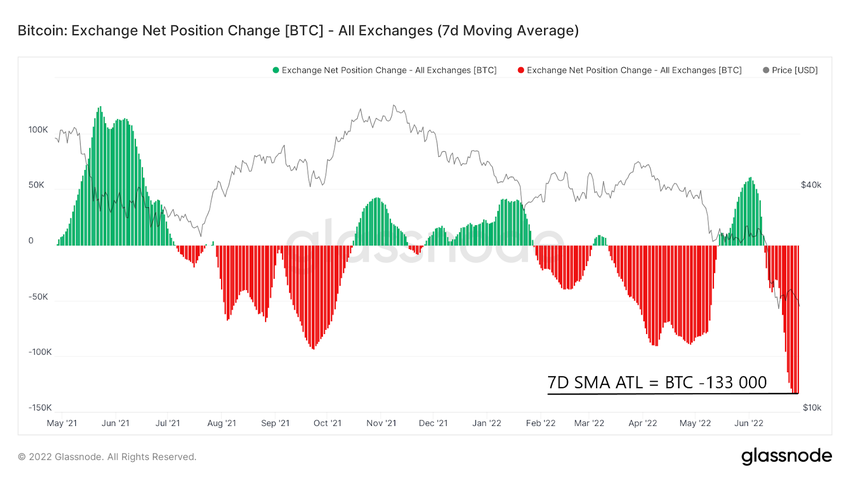

The third period in which Bitcoin exchange withdrawals reached ATH is now underway. During the last 4 days, we have seen the 7D SMA hold at a record low of -133,000 BTC.

Least BTC on exchanges in almost 4 years

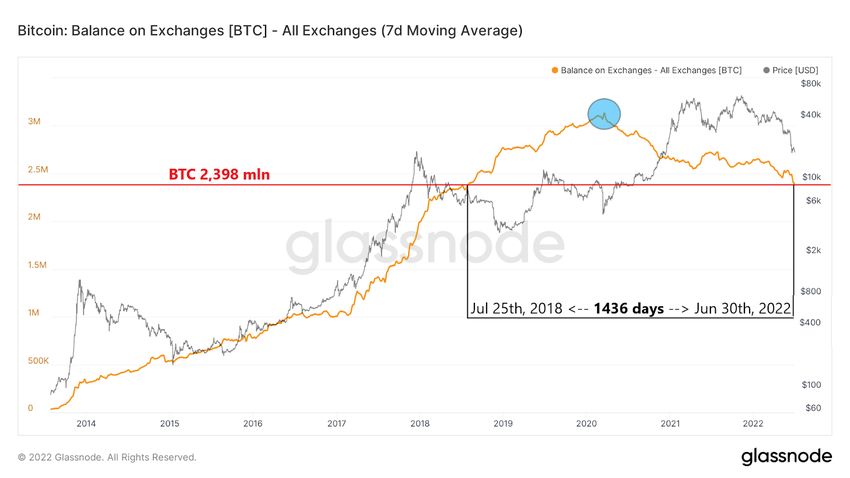

Confirmation of the ongoing trend of Bitcoin exchange withdrawals is provided by a long-term chart of BTC Balance on Exchanges. This indicator measures the total amount of coins held at exchange addresses.

Similar to the earlier chart, we see that the COVID-19 crash in March 2020 was a tipping point for the amount of BTC held on exchanges. At that time, the chart of the balance on exchanges set the ATH at 3.129 million BTC on March 17 (blue circle). Since then, the indicator has been falling.

The ongoing Bitcoin exchange withdrawals for more than 2 years have just led to a new local BTC low on the exchanges. Currently, the balance on exchanges stands at 2.398 million BTC and has reached its lowest level in almost 4 years. The last time the number of Bitcoin on exchanges reached such a low was on July 25, 2018, exactly 1436 days ago.

Investors are losing confidence in exchanges

Bitcoin’s withdrawals in the recent period, and especially in the final days of June, may be a manifestation of a twofold phenomenon. On the one hand, large Bitcoin exchange withdrawals have usually, but not always, correlated with either the bottom of the BTC market or the beginning of a long-term bull market. This expressed investors’ fundamental belief that the price of BTC was relatively low at the time and would rise in the future.

But on the other hand, the reason for the record-breaking drawdowns may be a deep loss of confidence in centralized and decentralized cryptocurrency brokers. The meltdown of the Terra ecosystem (LUNA) and the collapse of stablecoin UST were the main reasons for the recent destabilization of the crypto sector.

Falling prices and pervasive FUD led to difficulties for more lending companies and cryptocurrency funds with Celsius and Three Arrows Capital (3AC) leading the way. This has been compounded by recent news of job cuts at a number of leading cryptocurrency companies, such as Coinbase, Crypto.com, and BlockFi.

With such a volatile market, Bitcoin’s increased withdrawals from exchanges seem to be a natural consequence of investors’ concerns. It seems that the classic phrase and security guarantee of the crypto sector – “Not your keys, not your coins” – is experiencing a renaissance today.

Well-known on-chain analyst @WClementeIII in yesterday’s Twitter post summarizes the record Bitcoin exchange withdrawals as follows:

“Not sure how much relevance this has for the price, but do think this is to an extent a reflection of participants losing trust in centralized entities after recent events. People are realizing ‘not your keys, not your coins’.”

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here.