A look at Bitcoin’s on-chain data, specifically the funding rate, to determine if the current market conditions favor bulls or bears.

We will also take a look at Average Spent Output Lifespan (ASOL) to determine if long or short-term holders did the selling that caused the current drop.

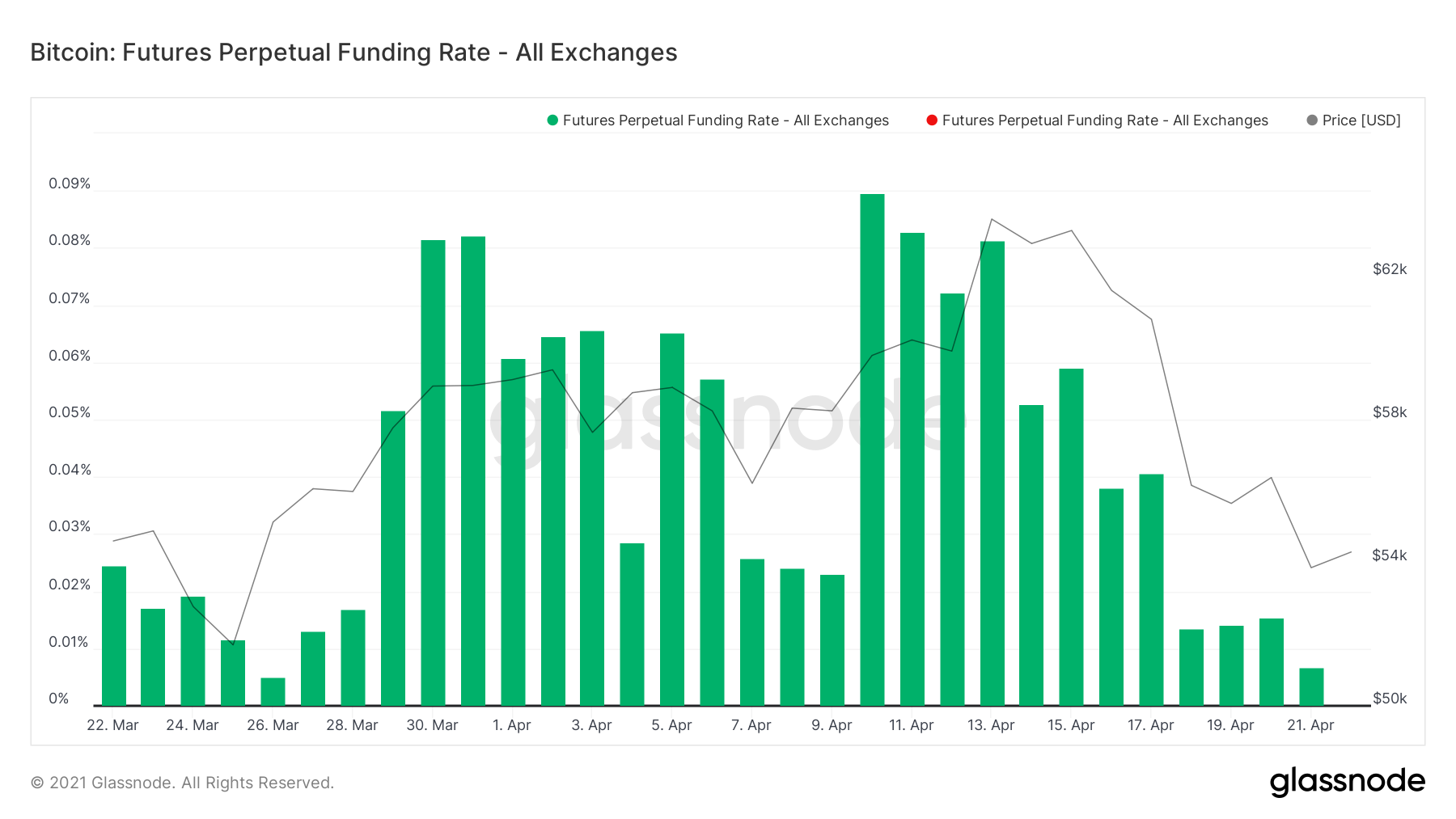

Funding Rate

The funding rate is a mandatory premium that futures traders have to pay to keep an open position. A positive funding rate means that long trades must pay a premium for the trade to remain open. The opposite is true when the funding rate is negative.

Throughout the past month, high funding rates have signified a local top. This was evident in the run-up to the April 2 high of $59,392 and April 13 high of $63,303.

On April 13, the funding rate was a positive 0.081%. It has been falling since, and yesterday it was at only 0.007%. The funding rates have not been negative in more than a month.

This reset could signify the potential bottom since the funding rate now does not support either bulls or bears. However, it could also signal the potential beginning of a downward trend.

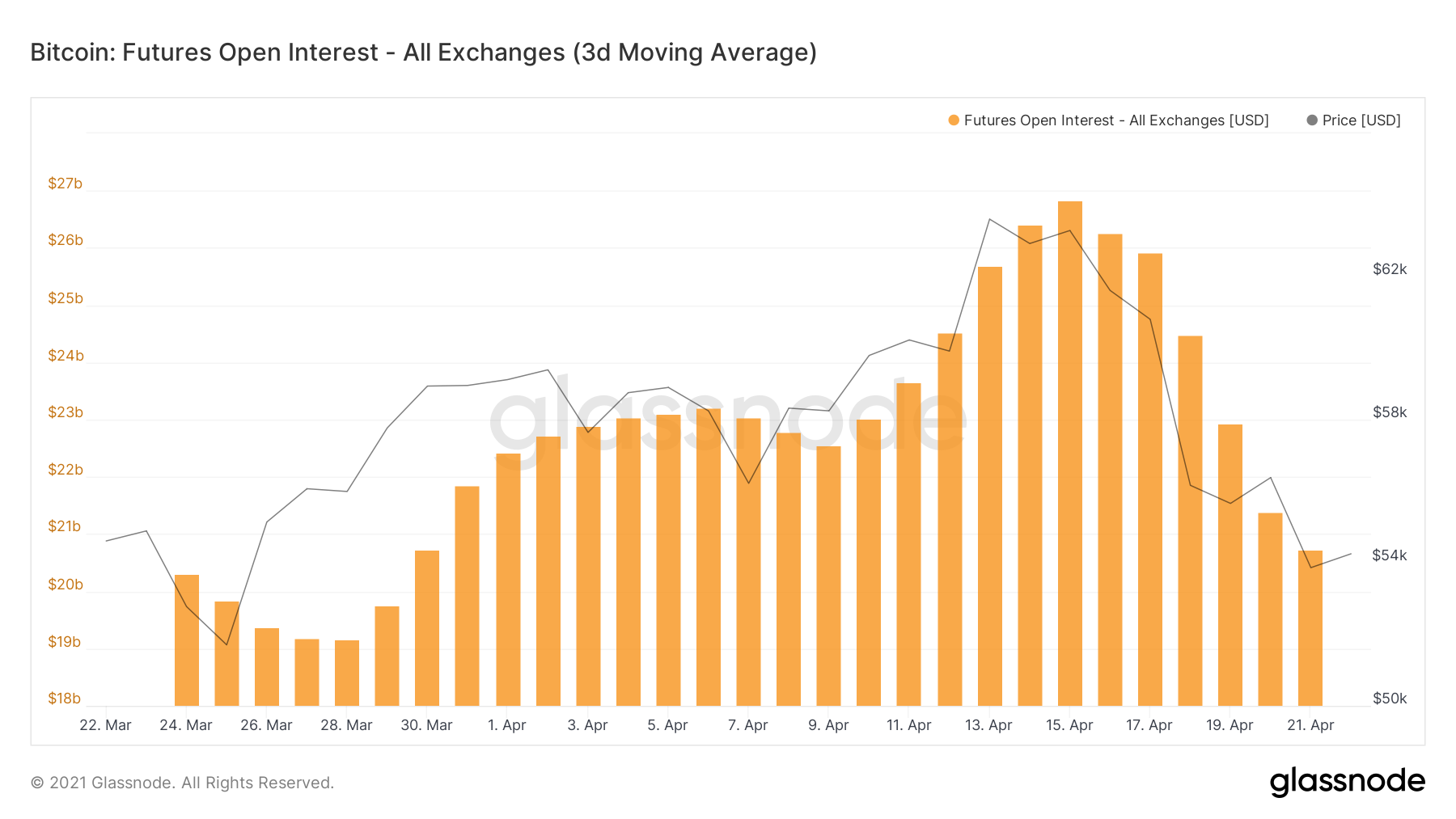

The open interest also shows a decreased interest in futures trading. It reached a peak of $26,838 million on April 15, but it has been decreasing since.

The open interest disregards the direction of the trade, meaning it measures the long and short trade volume the same.

Therefore, it seems that futures traders are expecting a trend confirmation before resuming their trending.

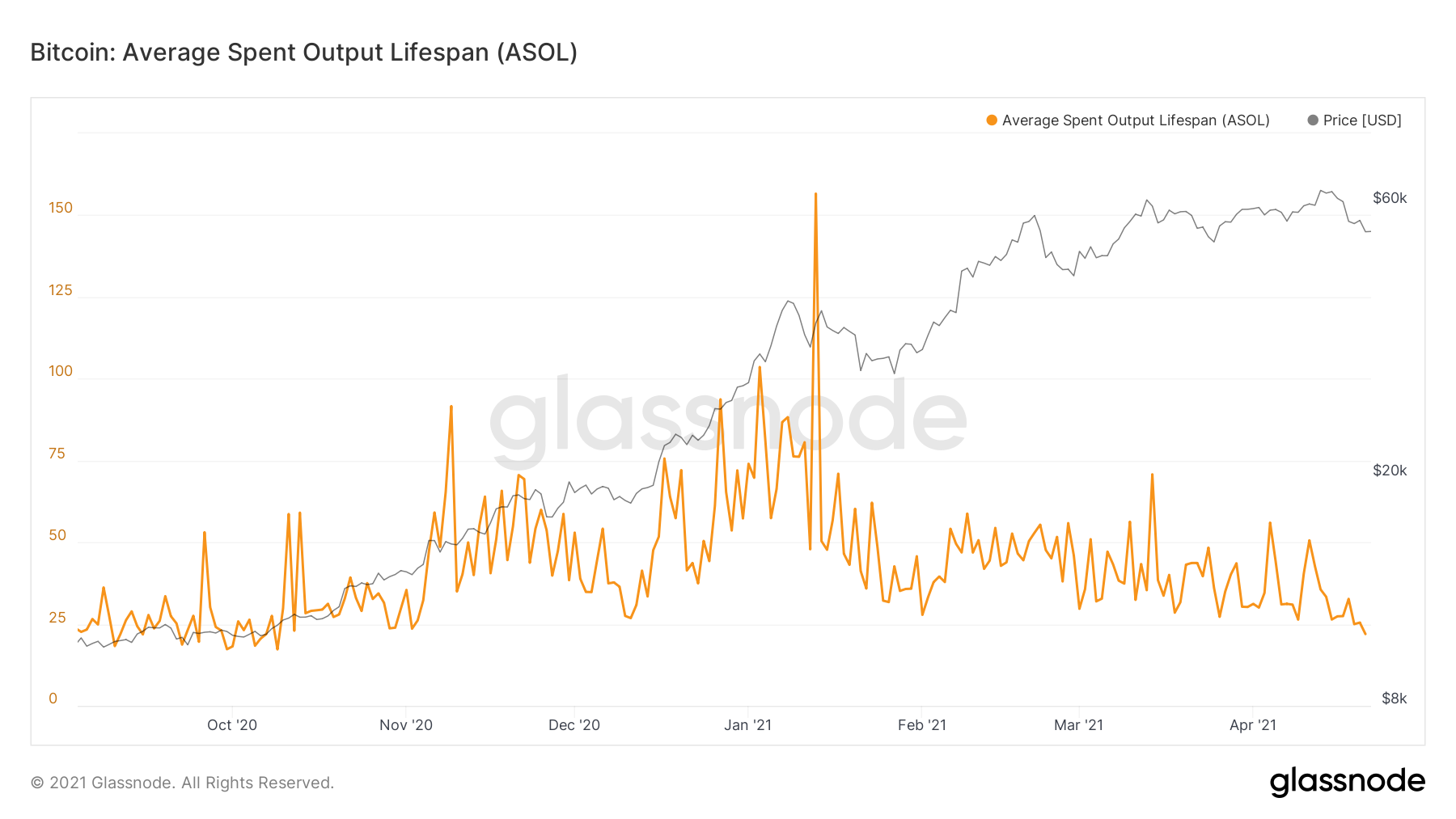

ASOL

Average Spent Output Lifespan (ASOL) measures the average age (in days) of each transaction. It discards transactions with a lifespan of less than an hour.

Since the beginning of the current upward movement in Sept. 2020, ASOL has reached two peaks:

- Nov. 9, 2020, when transactions had an average age of 91.6.

- Jan. 13, 2021, when transactions had an average age of 156.5.

These two days mark the dates in which long-term holders took some profit.

On the contrary, the April 18 drop had an ASOL value of 32.68. The indicators have been decreasing since March 14. This shows that short-term holders have mainly caused the ongoing price decline.

Conclusion

To conclude, funding rates have reset, and open interest is at a monthly low. These two indicators do not currently confirm the direction of the trend.

ASOL shows that long-term holders did not fuel the current decrease. It rather marked new coins changing hands.

For BeInCrypto’s latest bitcoin (BTC) analysis, click here.