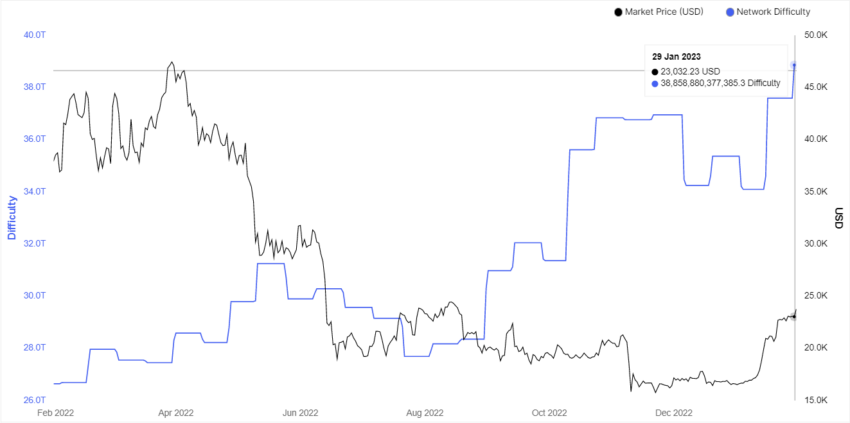

Bitcoin mining revenue rose $8 million, and mining difficulty spiked 5% in January 2023 as rising Bitcoin prices incentivized greater deployment of mining hardware.

Mining difficulty rose about 4.7% from two weeks ago to almost 40 trillion at press time, while revenues grew from around $15.3 million on Jan. 1, 2023, to roughly $24 million at press time.

Revenue Driven by Bitcoin Rally

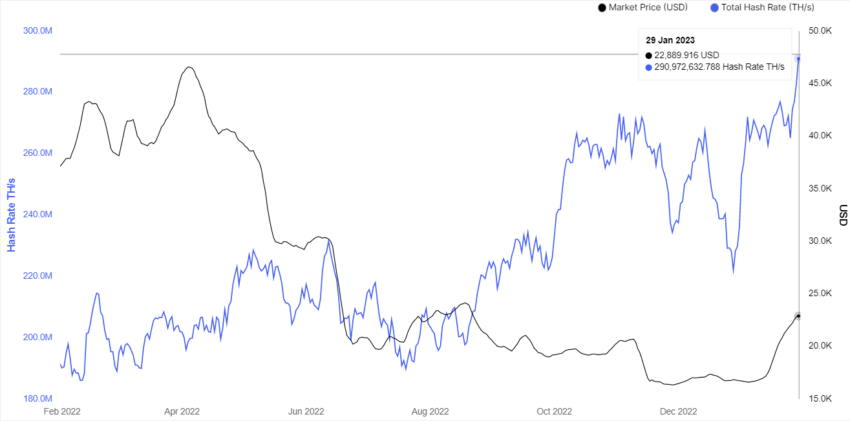

Bitcoin’s 41% surge since the start of 2023 significantly increases the value of the block reward miners receive, incentivizing them to deploy more resources.

Bitcoin miners are rewarded with Bitcoin by expending computing power to guess the correct hash of a block of Bitcoin transactions. Miners use special computers called ASICs to vary a value called a nonce to generate a hash value less than a predefined number.

The Bitcoin algorithm adjusts mining difficulty once every 2016 blocks or roughly every two weeks. It increases the difficulty if the average time to guess correct hashes for the previous 2016 transaction blocks is less than ten minutes. Lower verification time usually corresponds with increased computational power on the network.

To keep the block time at ten minutes, the algorithm increases the difficulty, making it harder for the new computers to guess the correct hash. Conversely, if fewer machines are online, the algorithm increases the hash threshold.

At press time, the difficulty was about 39 trillion, up from around 37.5 trillion two weeks ago.

A higher difficulty corresponds with a lower hash value threshold, requiring more guesses of the hash per second.

At press time, the hash rate of the Bitcoin network was around 290 exahashes-per-second.

Mining Industry Set to Consolidate in 2023: CoinShares

The 2022 bear market saw miners with high levels of debt struggle to remain profitable.

New York-based mining firm Greenidge sold machines to the New York Digital Currency Group as part of a debt restructuring plan. Core Scientific switched off a contingent of mining machines it operated on behalf of collapsed lender Celsius after the lender failed to pay for rising energy costs. Sydney-based Iris Energy chose to shut down a facility struggling to service a $108 million loan. At the same time, Argo Blockchain recently sold off its Helios facility in Dickens County, Texas, to crypto financial services firm Galaxy Digital. Stronghold Digital Mining recently extinguished about $18 million in amended notes in exchange for Class C amended shares.

CoinShares’ Matthew Kimmel suggested that while 2022 was brutal for most mining companies, 2023 will continue to flush out insolvent outfits and consolidate mining operations.

A steady Bitcoin price driven by the flushing out of companies built on aerated foundations of irresponsible debt and risk management will mean that mining companies can plan better, he predicted.

Miners with better cash flow can invest in more efficient mining machines, reducing their energy usage per hashing operation since the profitability of a mining operation depends heavily on the cost of electricity.

Sufficient debt eradication and lower overhead costs would also help companies stockpile Bitcoin for 2024, when the number of Bitcoin awarded to miners drops to 6.25 BTC per correctly guessed hash.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.