Bitcoin (BTC) is currently attempting to reclaim the middle of a short-term parallel ascending channel.

Ethereum (ETH) has bounced since re-testing its all-time highs.

XRP (XRP) is trading close to long-term resistance at $0.60.

Steem (STEEM) has broken out from a nearly two-year-long resistance area and validated it as support afterward.

Similarly, Augur (REP) has broken out from a long-term resistance area before validating it as support.

BitTorrent (BTT) and Swissborg (CHSB) are mired in parabolic upward movements. They have potentially reached their local tops.

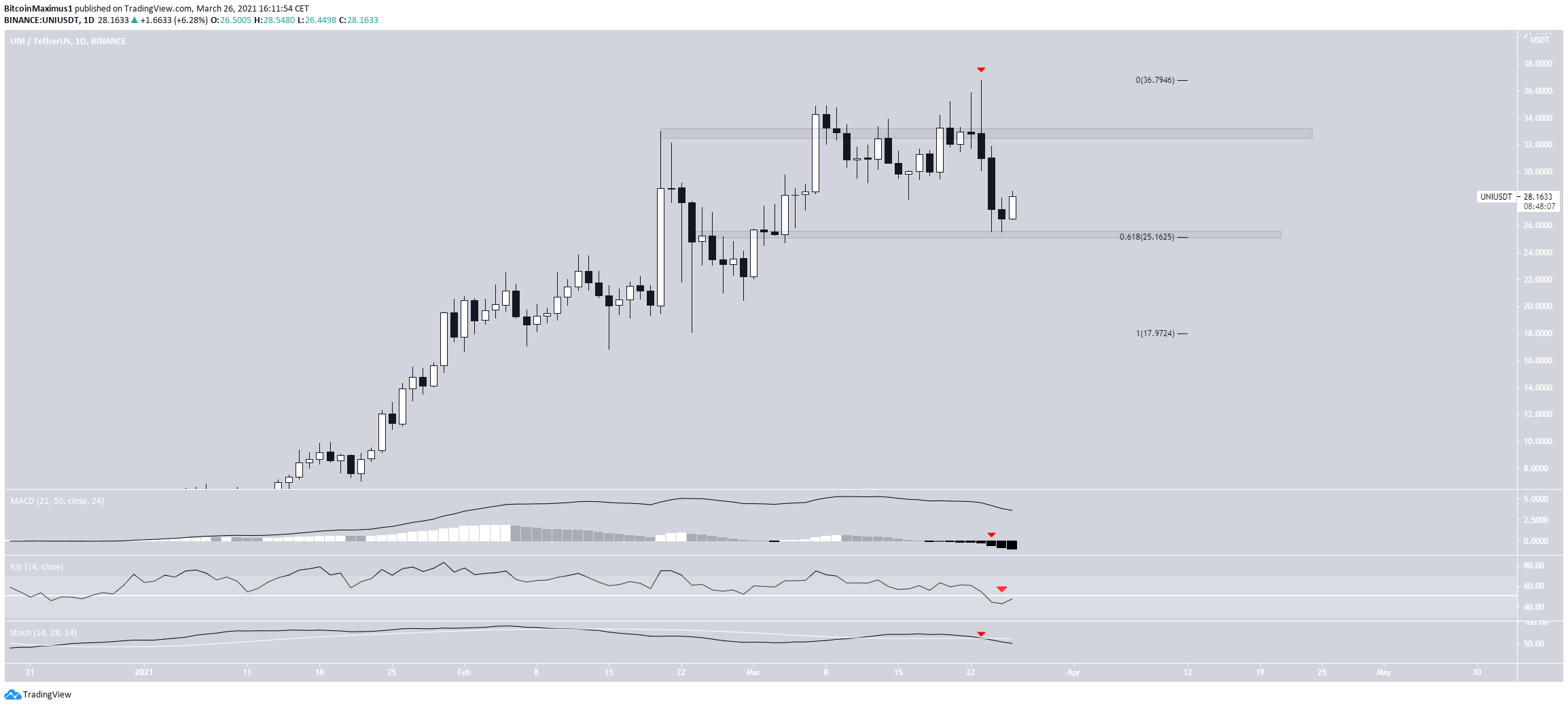

UniSwap has been decreasing over the past four days but bounced at its 0.618 Fib retracement support level.

Bitcoin (BTC)

BTC is trading inside a parallel descending channel. This is usually a corrective movement.

It bounced at its support line yesterday in a move preceded by bullish divergence in the RSI.

Currently, it is trading very close to the middle of the channel.

Despite short-term indicators being bullish, this channel’s reclaim is mandatory for the trend to be considered bullish.

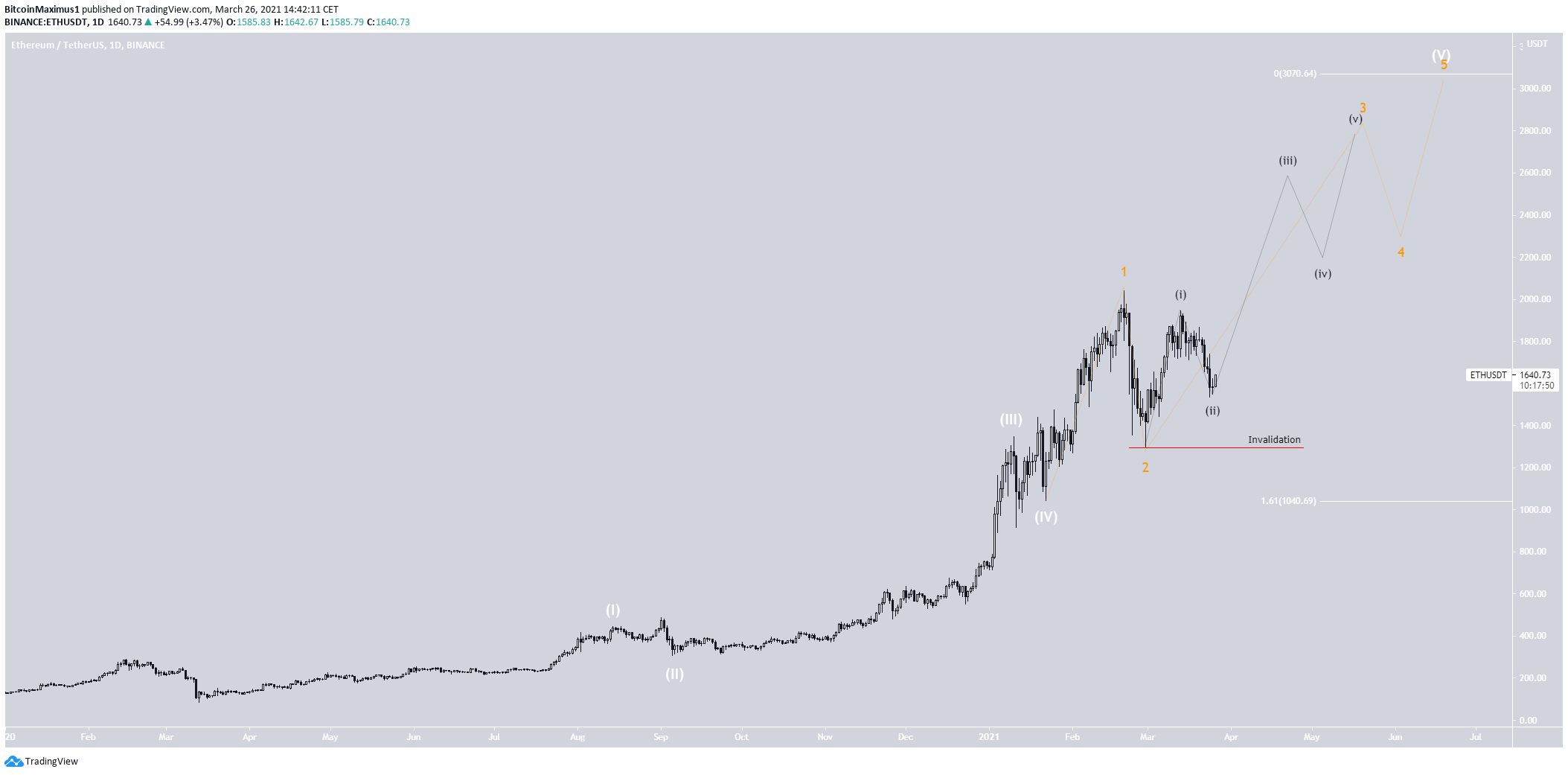

Ethereum (ETH)

On Feb. 20, ETH reached an all-time high price of $2040. It dropped sharply afterward, falling to the $1400 area. This can be seen as a re-test of the previous all-time high since ETH bounced immediately afterward.

Also, the bounce was combined with a significant hidden bullish divergence in the RSI. However, this is at risk of being invalidated. Therefore, the current week’s close is critical.

Both the MACD & Stochastic oscillator are still bullish. Therefore, it is likely that the long-term trend is still bullish.

The most likely wave count suggests that ETH is in an extended wave five (white). This has a potential target of $3070, found by the 1.61 Fib extension of waves 1-3.

The sub-wave and minor sub-wave counts are given in orange and black, respectively.

A decrease below the sub-wave two low at $1293 would invalidate this particular wave count.

XRP (XRP)

XRP has been increasing since Feb. 23, when it re-tested the previous resistance of $0.35.

It has now reached a descending resistance line that has been in place since Nov. 2020.

Technical indicators are bullish; thus, a breakout is expected. If so, XRP would find the next resistance area at $0.63.

The latter resistance level is also a higher time-frame resistance. XRP has been struggling to break out above it over the past six months.

Both the weekly RSI & MACD are bullish, indicating that XRP is likely to break out. If so, the next resistance area would be found at $0.90.

While the Stochastic oscillator has yet to make a bullish cross, it seems ready to do so.

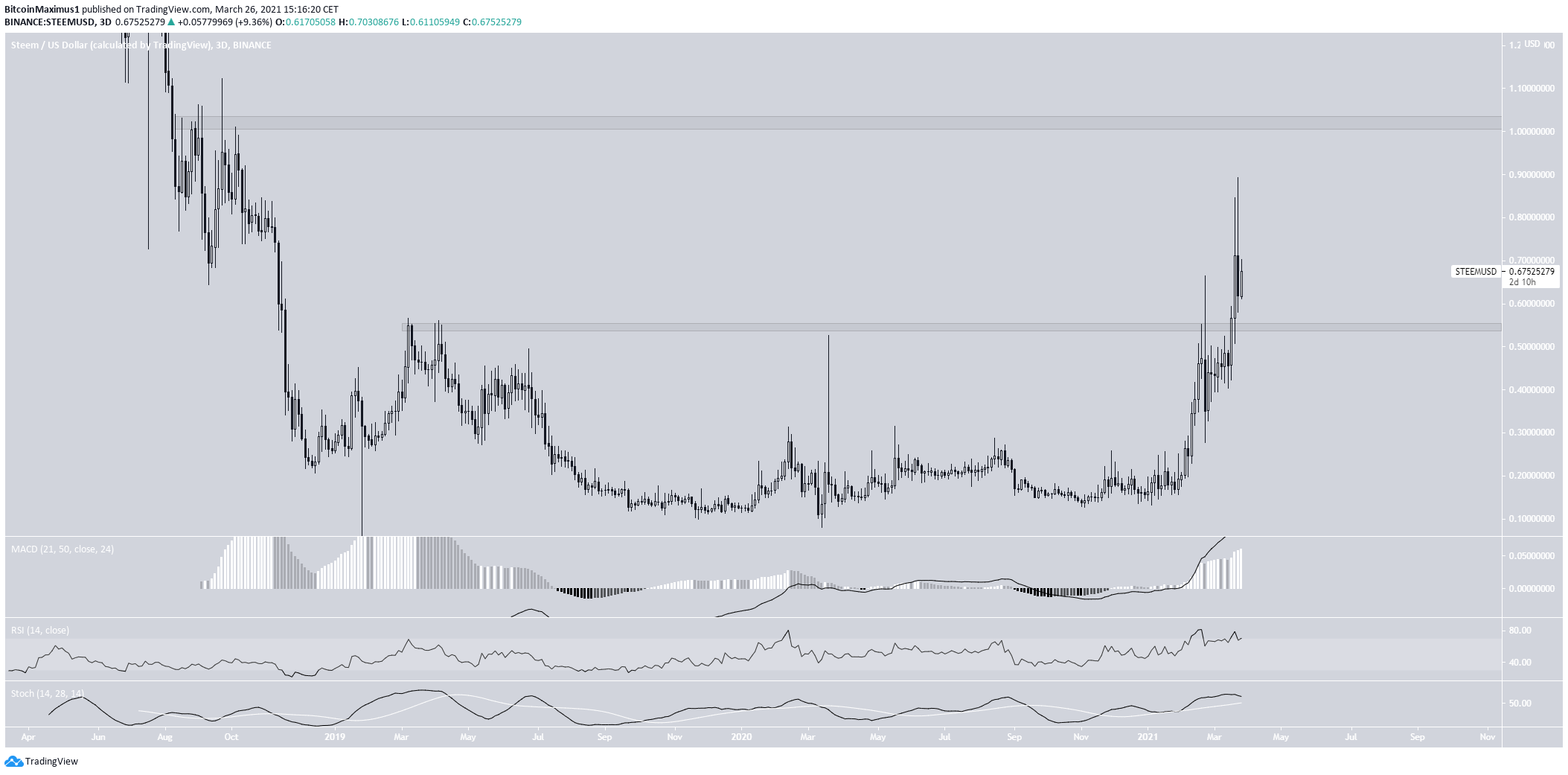

Steem (STEEM)

STEEM has just broken out from the $0.54 resistance area, which had been in place since the beginning of 2019.

Currently, STEEM is in the process of validating it as support.

As long as it is trading above this level, the most likely scenario has it moving upwards. If so, there is virtually no resistance until $1.05.

Technical indicators support the possibility of this upward movement transpiring.

Augur (REP)

At the beginning of February, REP managed to break out above the $24.50 resistance area. It proceeded to reach a high of $46.33 next week. However, it decreased immediately afterward. This validated the $43 area as resistance.

Technical indicators are relatively neutral. Therefore, some consolidation between these two levels is expected before a potential breakout.

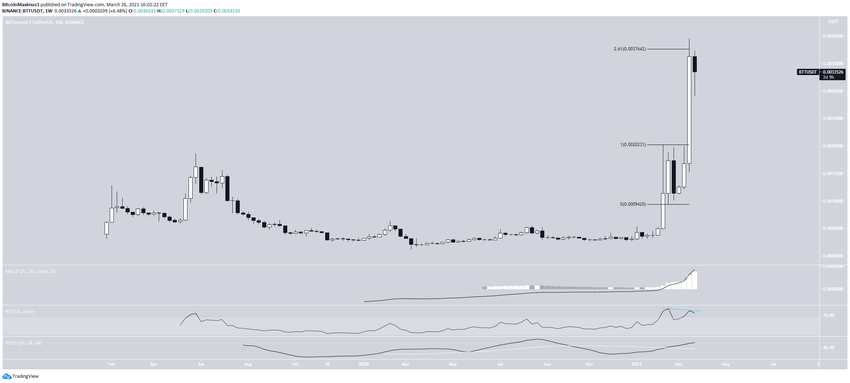

BitTorrent (BTT)

BTT increased considerably last week, managing to reach a high of $0.0039. However, this was combined with a bearish divergence in the RSI.

Furthermore, the high was made at the 2.61 external Fib retracement level of the most recent drop. This is a likely reversal area.

Therefore, BTT would expect a short-term correction before potential continuation.

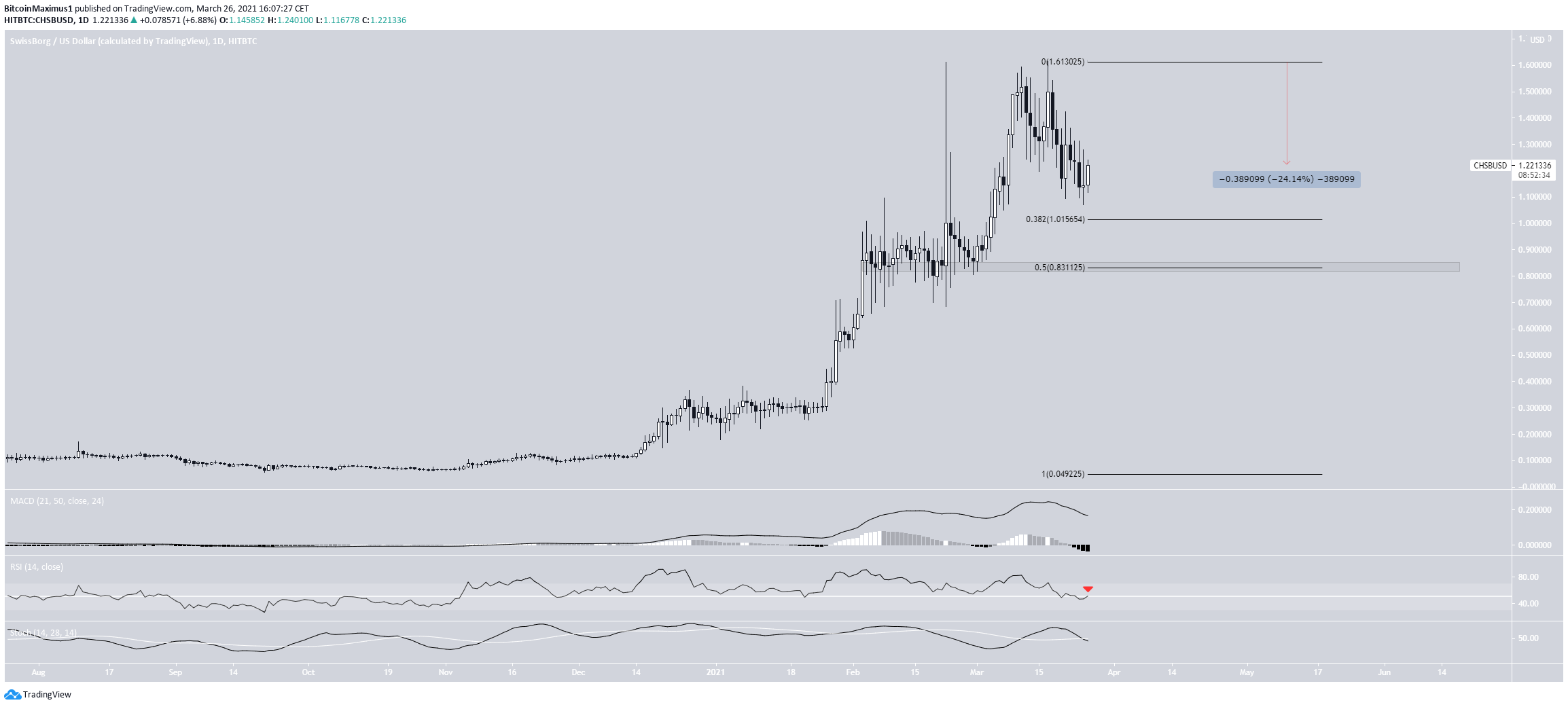

Swissborg (CHSB)

CHSB has been decreasing since reaching an all-time high of $1.61 on March 17. So far, it has decreased by 23%.

It is currently approaching the 0.382 Fib retracement support at $1.01. The token would find the next support area at $0.83.

Technical indicators in the daily time-frame are bearish. The RSI has just fallen below 50, and the Stochastic oscillator has made a bearish cross.

Therefore, while a short-term bounce could occur, it is likely that CHSB eventually drops towards the 0.5 Fib retracement support at $0.83.

Uniswap (UNI)

UNI has been decreasing since reaching an all-time high of $36.80 on March 23. It dropped until it reached the $25.22 support area. This is the 0.618 Fib retracement level of the previous upward movement.

Despite the ongoing bounce, technical indicators in the daily time-frame are bearish. Therefore, while consolidation inside the current range could occur, a breakout seems unlikely.

For BeInCrypto’s latest bitcoin (BTC) analysis, click here.