A look at on-chain indicators, more specifically the Network Value to Transaction (NVT) ratio, in order to determine if the current price increase for bitcoin (BTC) and ethereum (ETH) represents legitimate growth or if it is unsustainable.

The NVT ratio supports the price increase in both ETH and BTC, indicating that it is a period of legitimate network growth.

NVT calculation

The NVT (Network Value to Transaction) is an indicator that describes the relationship between transfer volume and market capitalization. It is often called the price-to-earnings (PE) ratio of cryptocurrencies. It was created by Willy Woo.

NVT is calculated by dividing network value by the daily transaction volume. Therefore, if the network value is higher than the transaction volume, it will give a high NVT value.

As for its readings, a high NVT value suggests that the network valuation is outpacing its transaction volume. This is seen in price bubble. However, in some rarer cases, it measures actual network growth. On the other hand, low NVT values indicate that despite an increased interest, which is seen through a higher number of transactions, the network value is lagging behind.

While the NVT value is not very useful in detecting market crashes before they occur, it can be used to differentiate between a dip and a reversal after the peak. If the value increases after a significant price correction, chances are that a bubble has burst (more on this later).

To summarize:

- Uptrends are generally considered bearish. They occur when transactions are growing at a slower rate than the market cap, meaning that the network is over-valued.

- Downtrends are generally considered bullish. They occur when transaction volumes are outpacing the market cap increase, suggesting that the network is under-valued.

- Sideways trading supports the existing trend, indicating fair value for the network.

Bitcoin (BTC)

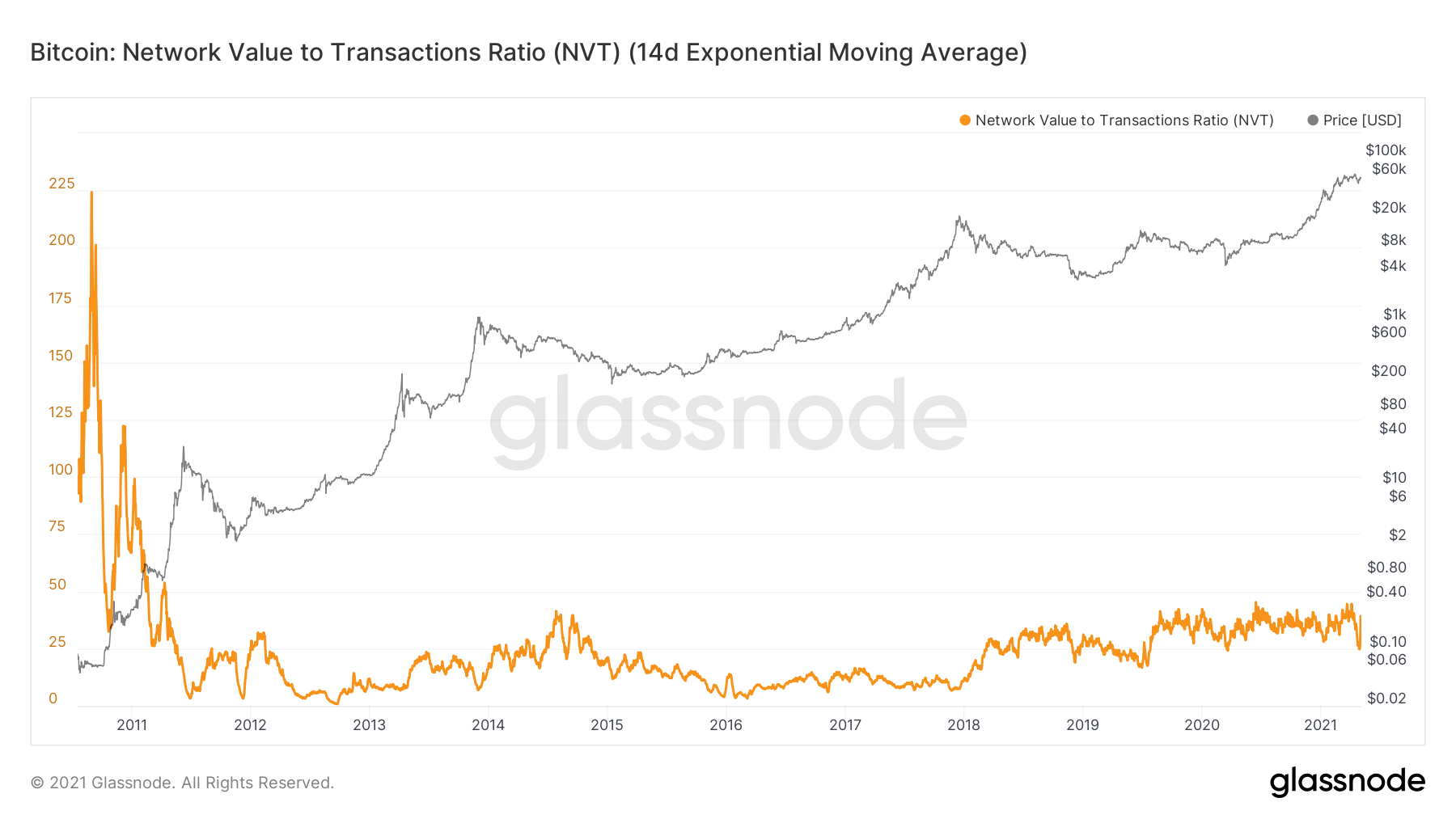

The NVT for BTC has been between 2 and 30 for the majority of its price history. More specifically, it has been in that same range until the 2017 high.

NVT first spiked after the 2013 top, reaching a value of 40. As outlined before, a high NVT value after a price peak is indicative of a bubble. Afterwards, the BTC price corrected for a significant period of time, while the indicator reset.

After the 2017 top, NVT again spiked to 33 before resetting once more.

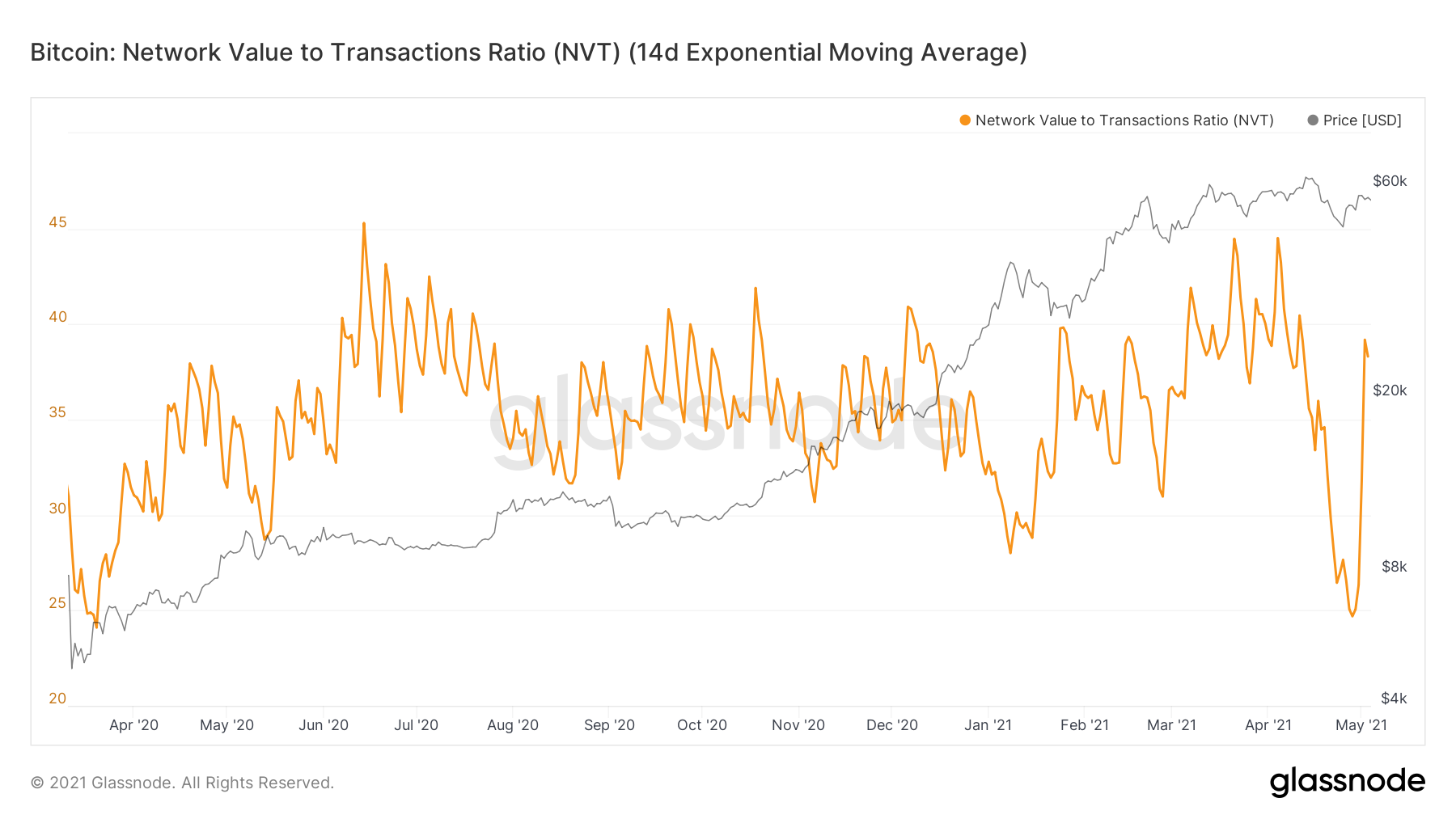

An interesting development is the fact that NVT has been ranging between 24 and 43 since. While initially this can be seen as a sign of a bubble, the fact that it is consistently consolidating inside this range makes it more of a legitimate stage of network growth.

A closer look at the movement since March 2020 shows that NVT has dropped to 24 only twice: on March 12, 2020, and on April 26, 2021.

The March 12 low marked a long-term bottom, and it remains to see if the April 2021 will be the same.

Ethereum (ETH)

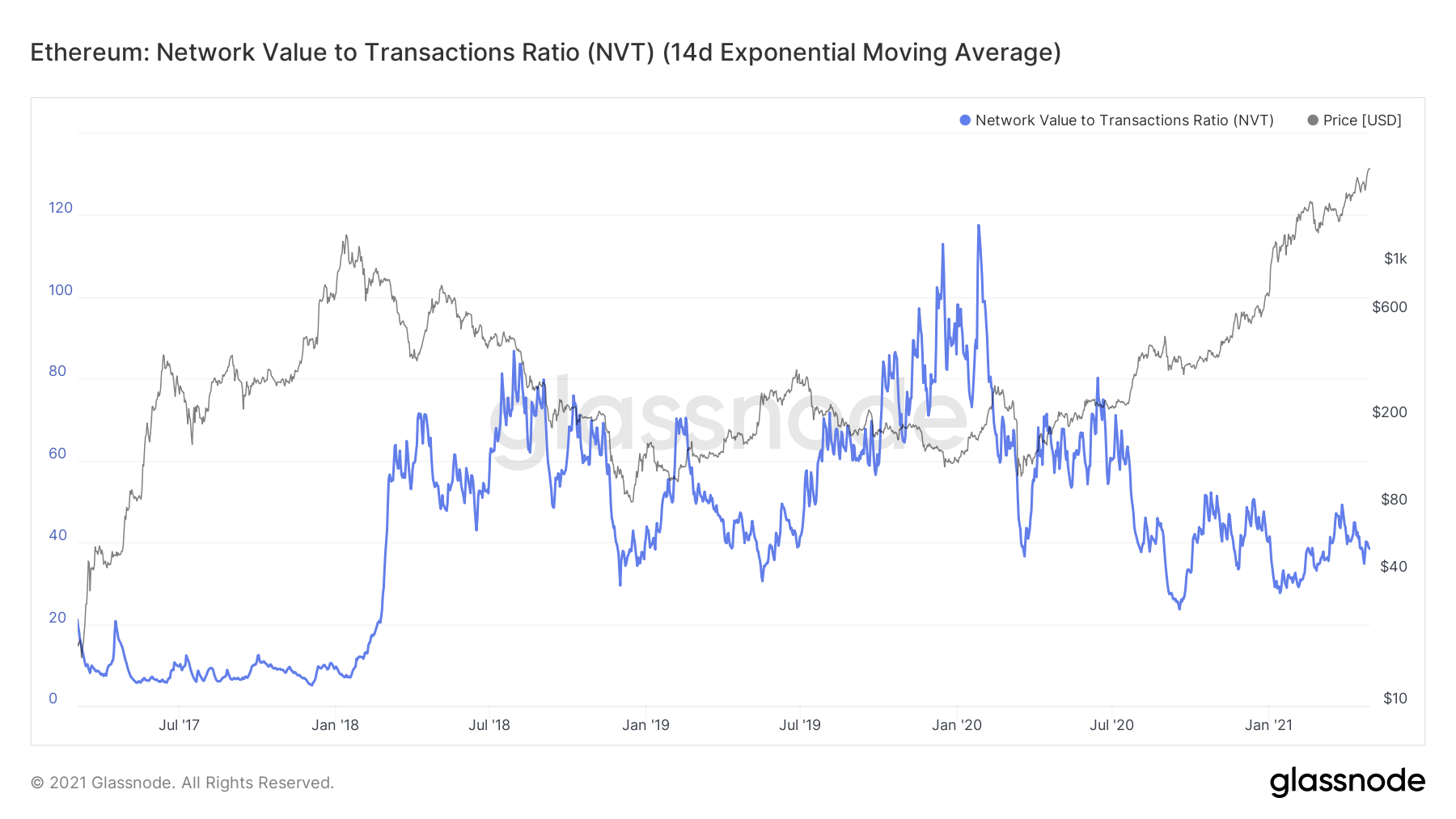

The NVT value for ETH first spiked to 70, after the 2018 top, and went to 110, after the 2019 top.

However, it has been consistently decreasing since.

An interesting development is that it is also falling during the price increase that began in March 2020. This is unlike what we saw in BTC.

Interestingly, the lowest NVT value was reached in September 2020.

It is possible that this is occurring because of the rise of decentralized exchanges such as Uniswap (UNI), which require ETH for the majority of token swaps. In addition, the release of ETH 2.0 has likely incentivized some users to stake ETH outside exchanges.

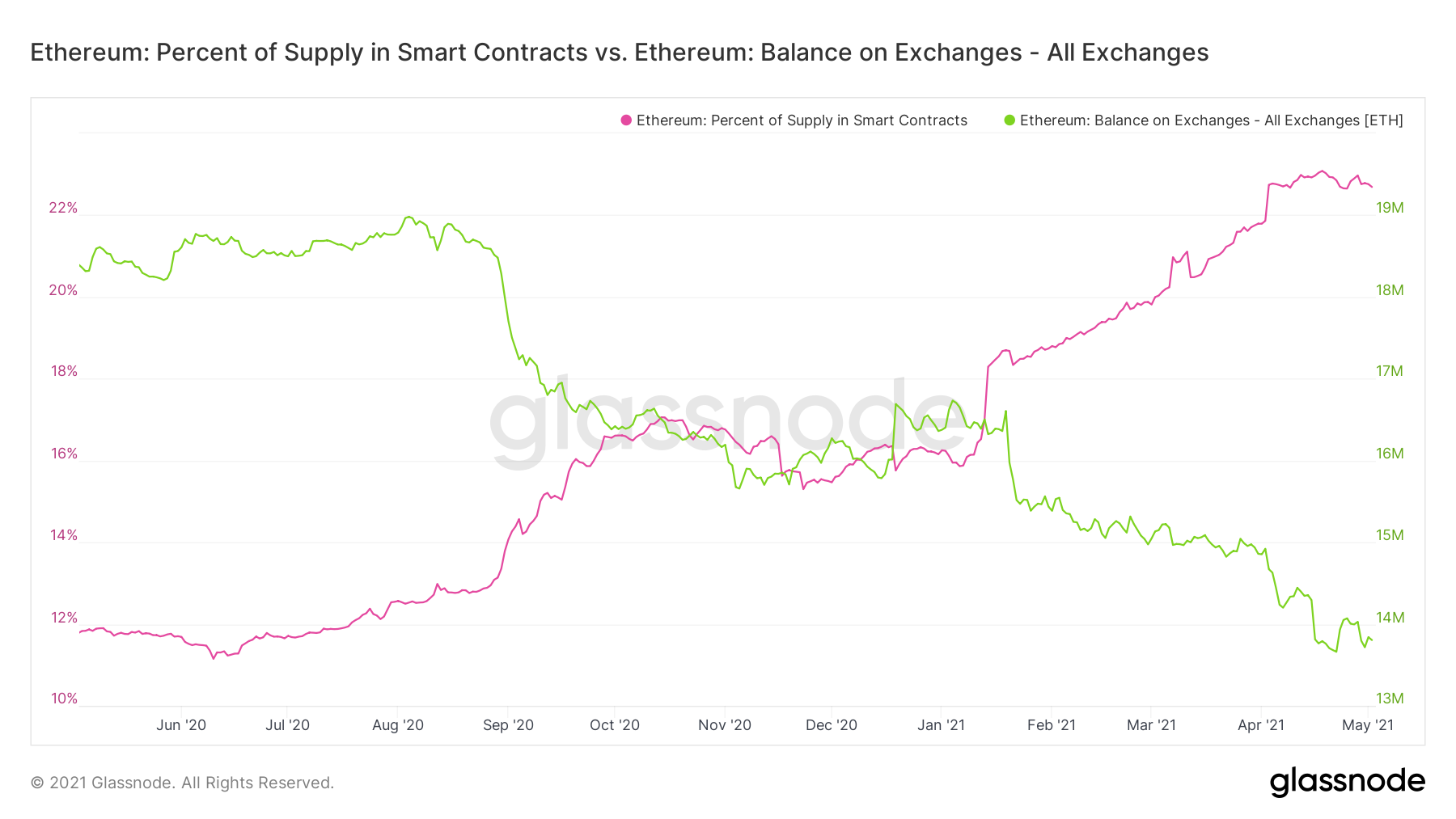

This is visible when looking at the percentage of ETH supply that is locked into smart contracts, which has been increasing since March 2020. This aligns with the decrease of NVT, most likely due to increasing transactions.

In addition, it has been combined with a decrease of ETH held on exchanges.

For BeInCrypto’s latest bitcoin (BTC) analysis, click here.