Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and keep your eyes open as crypto progressively leaps into Wall Street’s bloodstream. Neither Bitcoin nor Ethereum is used this time, as two Nasdaq-listed firms make billion-dollar bets on BNB.

Crypto News of the Day: 10X Capital’s $500 Million PIPE to Launch First Public BNB Treasury Vehicle on Nasdaq

10X Capital and CEA Industries Inc. (VAPE) announced a $500 million private placement to create the world’s largest publicly listed BNB-exclusive digital asset treasury company.

The deal, upsized due to oversubscription, will close on July 31, 2025, and, with full warrant exercise, could reach $1.25 billion in gross proceeds.

“Announcing our $500 Million Private Placement to Establish the Largest Publicly-Listed BNB-exclusive Digital Asset Treasury Company in the World!” 10X Capital shared in a post.

YZi Labs (formerly Binance Labs) led the deal, which was participated in by over 140 crypto-native and institutional investors, including Pantera Capital, Blockchain.com, and Arrington Capital.

The offering includes $400 million in cash and $100 million in crypto, plus up to $750 million from potential warrant exercises.

The new treasury vehicle will acquire and manage BNB, focusing on long-term holding and revenue strategies like staking and lending within the BNB Chain and Binance ecosystem.

Incoming CEO David Namdar, co-founder of Galaxy Digital, described the move as an institutional gateway.

“By creating a US-listed treasury vehicle, we are opening the door for traditional investors to participate in a transparent way,” read an excerpt in the press release, citing Namdar.

The venture brings other heavyweights from traditional finance (TradFi) and crypto experts to the table. This development adds to the growing momentum for BNB treasuries.

BeInCrypto recently reported that Windtree Therapeutics and Nano Labs are also pushing the trend.

“Treasury companies have proven to be the cleanest, most transparent gateway for institutions to access digital assets,” said Hans Thomas, CEO of 10X Capital.

Liminatus Pharma Plans $500 Million BNB Investment Through New Subsidiary

Beyond 10X Capital, Windtree Therapeutics, and Nano Labs, another institutional pivot toward crypto and BNB sprouted on Monday.

Liminatus Pharma Inc. (LIMN), a preclinical biopharmaceutical company focused on cancer immunotherapies, revealed plans to raise $500 million to invest in BNB via a newly formed subsidiary called American BNB Strategy.

The move comes after an internal review of blockchain-integrated finance strategies. This reflects a growing trend of traditional public companies seeking treasury diversification via digital assets.

“BNB Coin was selected over numerous digital assets due to its robust technology, global user base, value generating features such as Launchpool participation and staking models, and the ongoing expansion of the BNB Chain,” said Chris Kim, CEO of Liminatus.

For Liminatus, the BNB investment strategy will not interfere with its biotech mission but is intended to support long-term growth and enhance shareholder value.

The proposed structure will focus on long-term holding of BNB, not short-term speculation, and leverage custody infrastructure from Ceffu, a Binance-affiliated entity, to maintain security and compliance standards.

“This is not a short-term speculative initiative, but rather a value-driven strategy based on the long-term growth potential and strength of the BNB ecosystem,” the company noted in its announcement.

Placement agent Digital Offering is managing the capital raise, and the plan remains subject to regulatory approvals and market conditions.

If finalized, Liminatus would become one of the first US-listed biotech firms to anchor part of its capital strategy in a Layer-1 blockchain token.

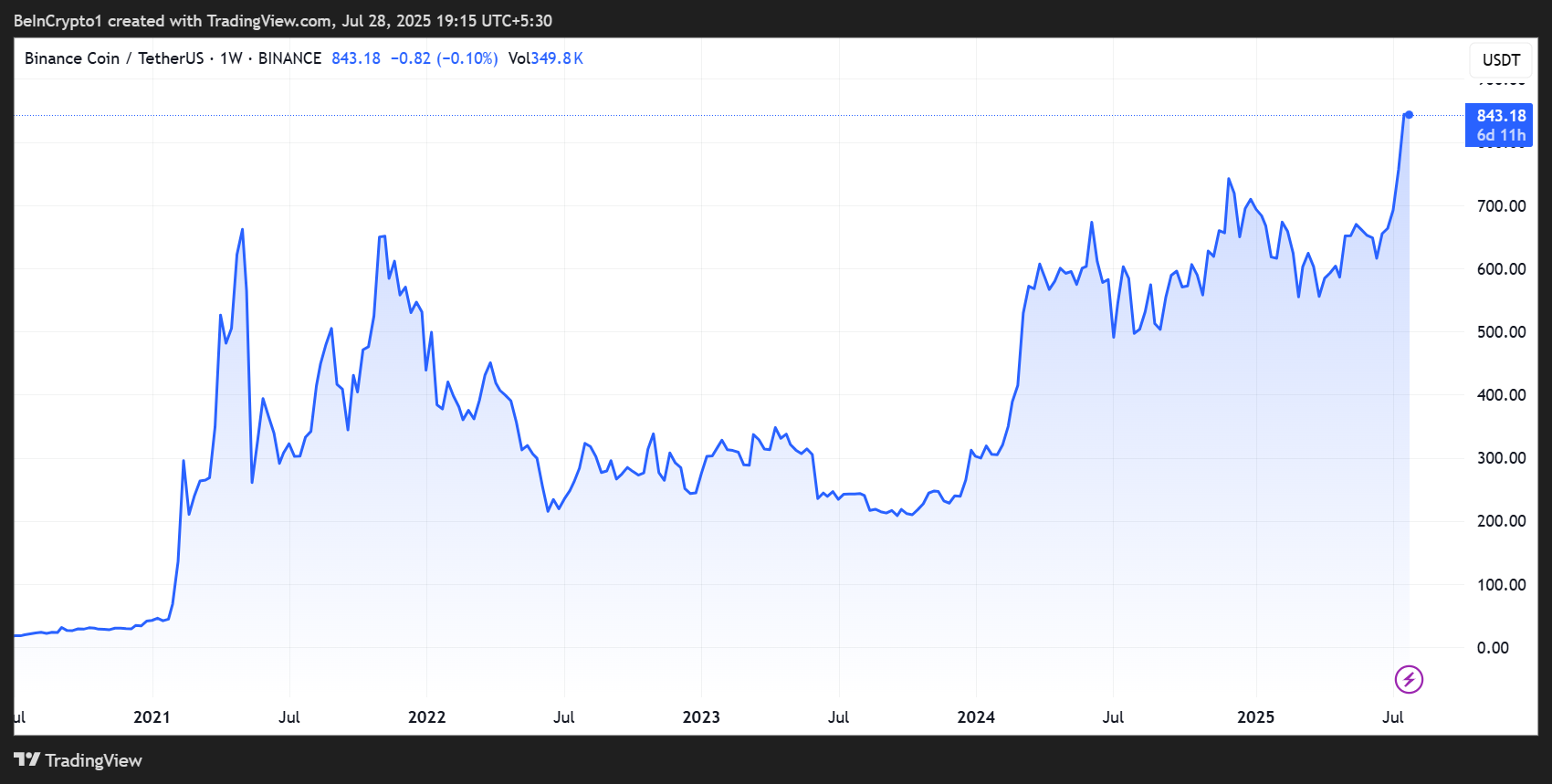

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Crypto inflows near $2 billion as Ethereum outshines Bitcoin in altcoin-led rally.

- ETH whale activity spikes as SharpLink Gaming stakes $300 million worth of Ethereum.

- ZORA price hits all-time high: What’s driving the 360% surge?

- Ethereum nears 10-year uptime, but critics question its scaling and legal risks.

- China busts $20 million Bitcoin laundering ring tied to TikTok-style app.

- XRP eyes a new all-time high as whale sell pressure eases by 93%.

- Optimism (OP) price skyrockets to a two-month high as Upbit announces new listing.

- VINE nears 100,000 holders amid whale accumulation and growing hype.

Crypto Equities Pre-Market Overview

| Company | At the Close of July 25 | Pre-Market Overview |

| Strategy (MSTR) | $405.89 | $416.00 (+2.49%) |

| Coinbase Global (COIN) | $391.66 | $395.30 (+0.93%) |

| Galaxy Digital Holdings (GLXY) | $30.59 | $31.85 (+4.12%) |

| MARA Holdings (MARA) | $17.25 | $17.74 (+2.84%) |

| Riot Platforms (RIOT) | $14.54 | $14.65 (+0.76%) |

| Core Scientific (CORZ) | $13.76 | $13.87 (+0.80%) |