Binance’s native token, BNB, has seen its price decline substantially since yesterday amid reports that Binance and its CEO Changpeng Zhao could face criminal charges from the U.S. Department of Justice (DOJ). According to sources, the DOJ is preparing to charge both Binance and Zhao, sending BNB tumbling as much as 9% on the news alone.

At the time of writing, BNB is trading around $230, marking a decline of over 10% in the last 24 hours. Adding fuel to the fire are rumors that Binance may need to pay a massive $4.3 billion settlement to resolve its issues with the DOJ. Should these reports prove accurate, it would constitute one of the largest fines ever levied against a crypto firm by U.S. regulators.

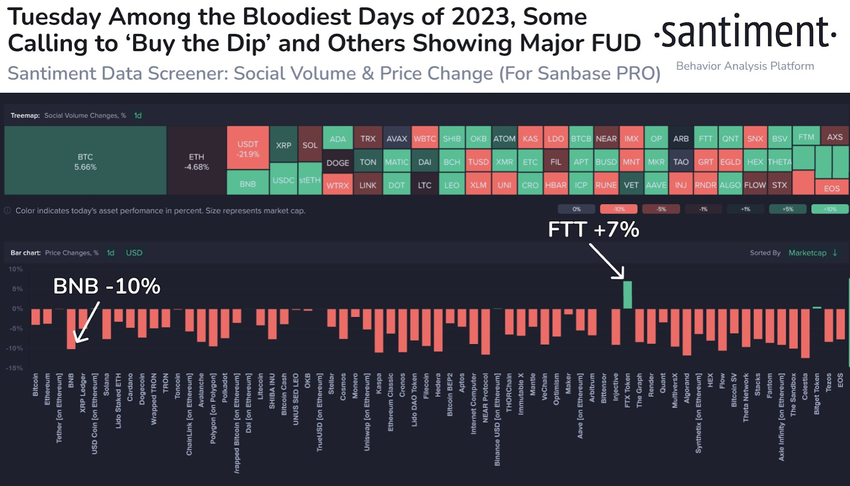

The one-two punch of DOJ charges and a multi-billion dollar settlement has created substantial downward pressure on BNB. As on-chain analytics firm Santiment reported, BNB’s retracement is further exacerbated by shrinking market caps across altcoins in general. Interestingly, some traders appear to be swapping their BNB holdings for FTX’s native token FTT. This could indicate a rotation out of BNB specifically and into other major exchange tokens like FTT.

Meanwhile, prominent crypto analyst LookOnChain has observed that in the aftermath of Binance settling with the DOJ, large BNB whales have been accumulating the token heavily at lower price levels. In particular, one whale added over 17,000 BNB worth $4 million to their holdings since May 10th, demonstrating a bullish outlook among major stakeholders.

However, open interest data from derivatives tracking platform Coinglass shows that BNB’s recent volatility has also fueled liquidations. Over $3.7 million in long positions for BNB were liquidated, compared to $1.6 million in shorts, underlining how leverage may be exacerbating downside moves. Options trading activity involving BNB has also increased sharply, with volumes up 68% and open interest 29% higher every week.

All told the double whammy of DOJ action against Binance and the circulating $4.3 billion settlement figure has triggered a noteworthy correction in BNB. While whale accumulation hints at an underlying bullish thesis, regulatory and legal overhangs could continue weighing on the world’s largest altcoin soon. But with its role as the backbone of the popular Binance ecosystem, BNB might well be positioned for a potential rebound as more clarity emerges.

BTCETF Offers Exposure to Surging Institutional Demand via ETF Approval Catalysts

For investors seeking exposure to the promising but uncertain crypto regulatory environment in the U.S., one token gaining traction is Bitcoin ETF (BTCETF). As its name implies, BTCETF aims to capture upside from the launch of the first Bitcoin ETF products approved by the Securities and Exchange Commission (SEC).

Major asset managers like Fidelity, VanEck, and WisdomTree have all filed to launch their own Bitcoin ETFs this year. Bloomberg analysts put the probability of SEC approval by January 2024 at over 90%. When a Bitcoin ETF finally gets the green light, it could unleash trillions of new capital into crypto markets from institutional players.

To position itself for this expected influx, BTCETF employs a deflationary token model. Its total supply will be reduced by 25% through a series of staged burn events tied to ETF approval milestones. For example, 5% of BTCETF tokens will be withdrawn once the first Bitcoin ETF launches. Achieving $1 billion in ETF inflows or Bitcoin hitting $100k will trigger further burns.

This innovative tokenomics structure incentivizes long-term holding of BTCETF by early investors. It also aligns the project’s success directly with progress on U.S. Bitcoin ETF regulations.

Through community engagement and education around the evolving ETF landscape, BTCETF has attracted over $1.3 million in its ongoing presale so far. If history is any guide, the token stands to generate substantial returns as institutional adoption of crypto ramps up in the years ahead. BTCETF has seen its price rise from $0.005 to $0.0056 during presale.

As uncertainty continues around Binance and BNB, speculators may see BTCETF as an appealing hedge, given its direct correlation to unlocking the next phase of crypto demand. Only time will tell if the token’s strategy pays off.