On Feb. 18, Binance Coin (BNB), Pancake Swap (CAKE), and Bancor (BNT) reached all-time high prices.

For BNB, the trend still looks bullish, but the rally has overextended, and it’s possible that BNB could reach a local top soon.

Technical indicators for CAKE show significant weakness, suggesting that a trend reversal might soon occur.

While BNT could correct in the short-term, technical indicators have yet to show any weakness, so it appears as if the price is not yet close to the top of the current upward movement.

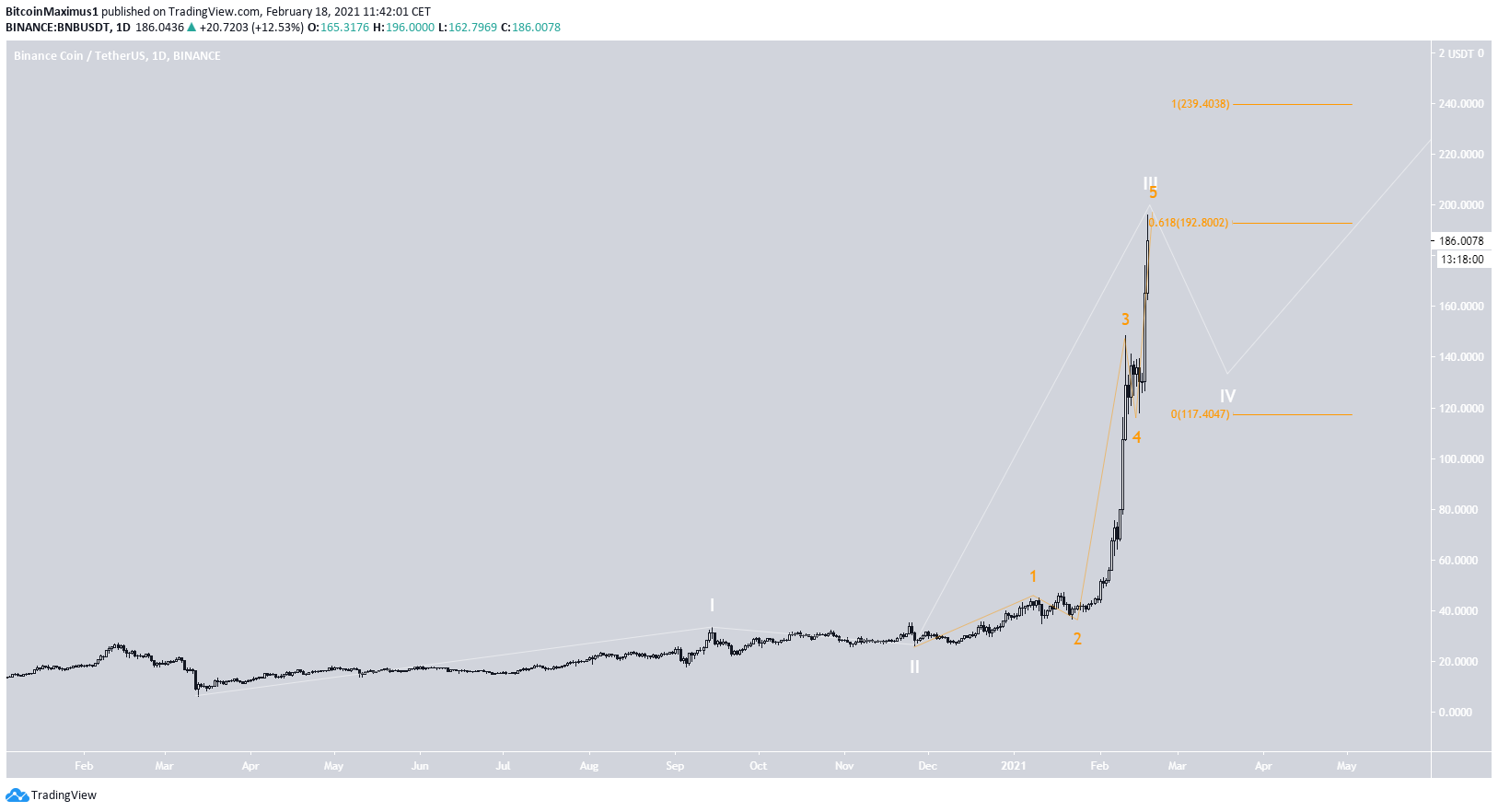

Binance Coin (BNB)

BNB has been increasing rapidly since Jan. 22, when it was trading at a low of $38.85. Since then, it has increased by a massive 431% over 27 days, reaching an all-time high price of $196 on Feb. 18.

Despite showing overbought conditions, technical indicators are still bullish. However, the daily RSI has been overbought for 17 days, a sign that the upward move might be overextended.

The wave count also suggests that BNB is nearing a top.

BNB has seemingly been on an extended third wave since Nov. 2020. However, the sub-wave count shows that it is in sub-wave five, which is the final upward move before a correction.

The most likely targets for the top of this move are $192 and $240, respectively. BNB has already reached the former, so if it has not yet reached a top, it could increase to $240 before undergoing a significant correction.

Highlights

- BNB reached an all-time high on Feb. 18.

- It is approaching or has reached the top of wave three.

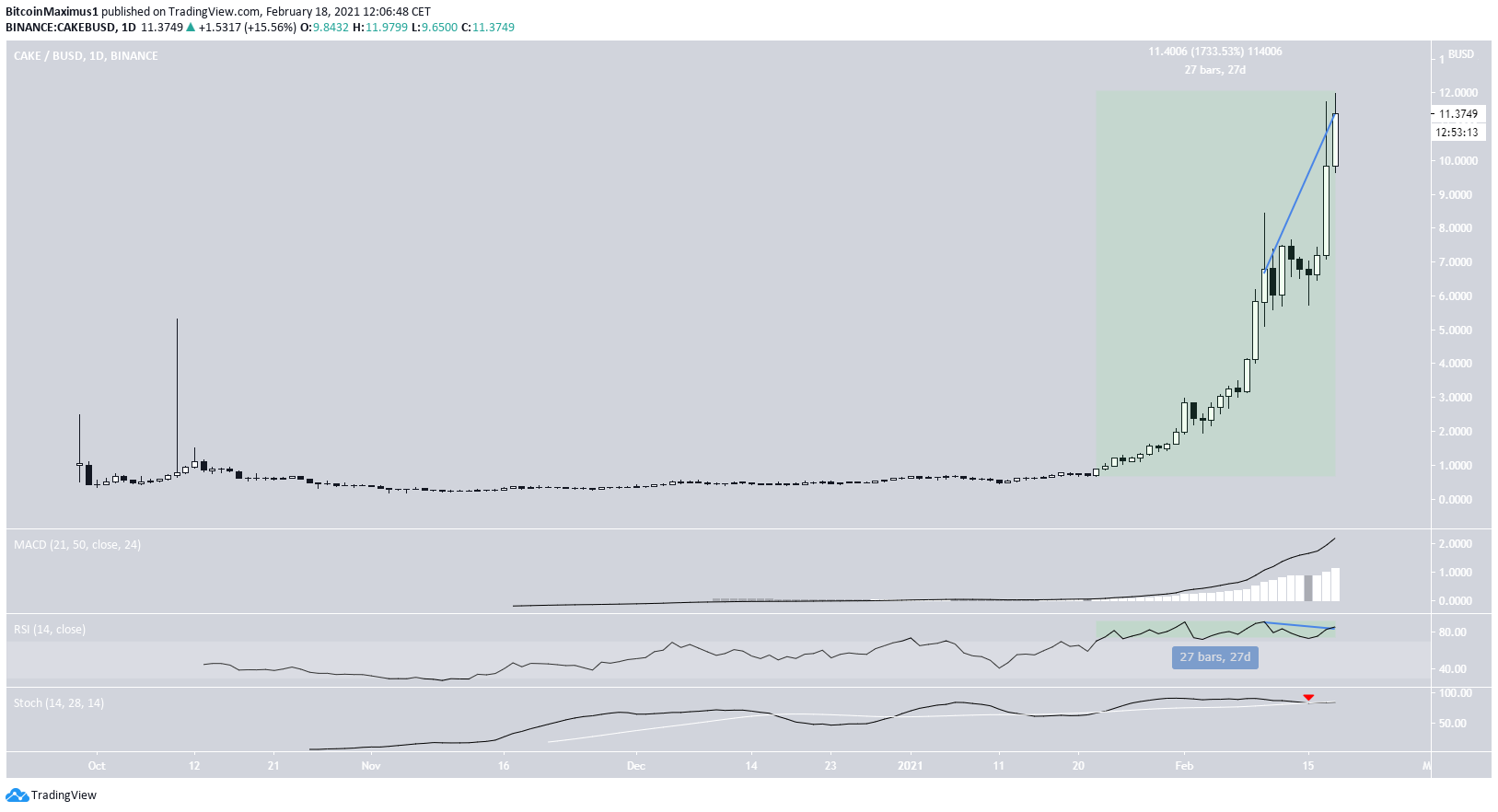

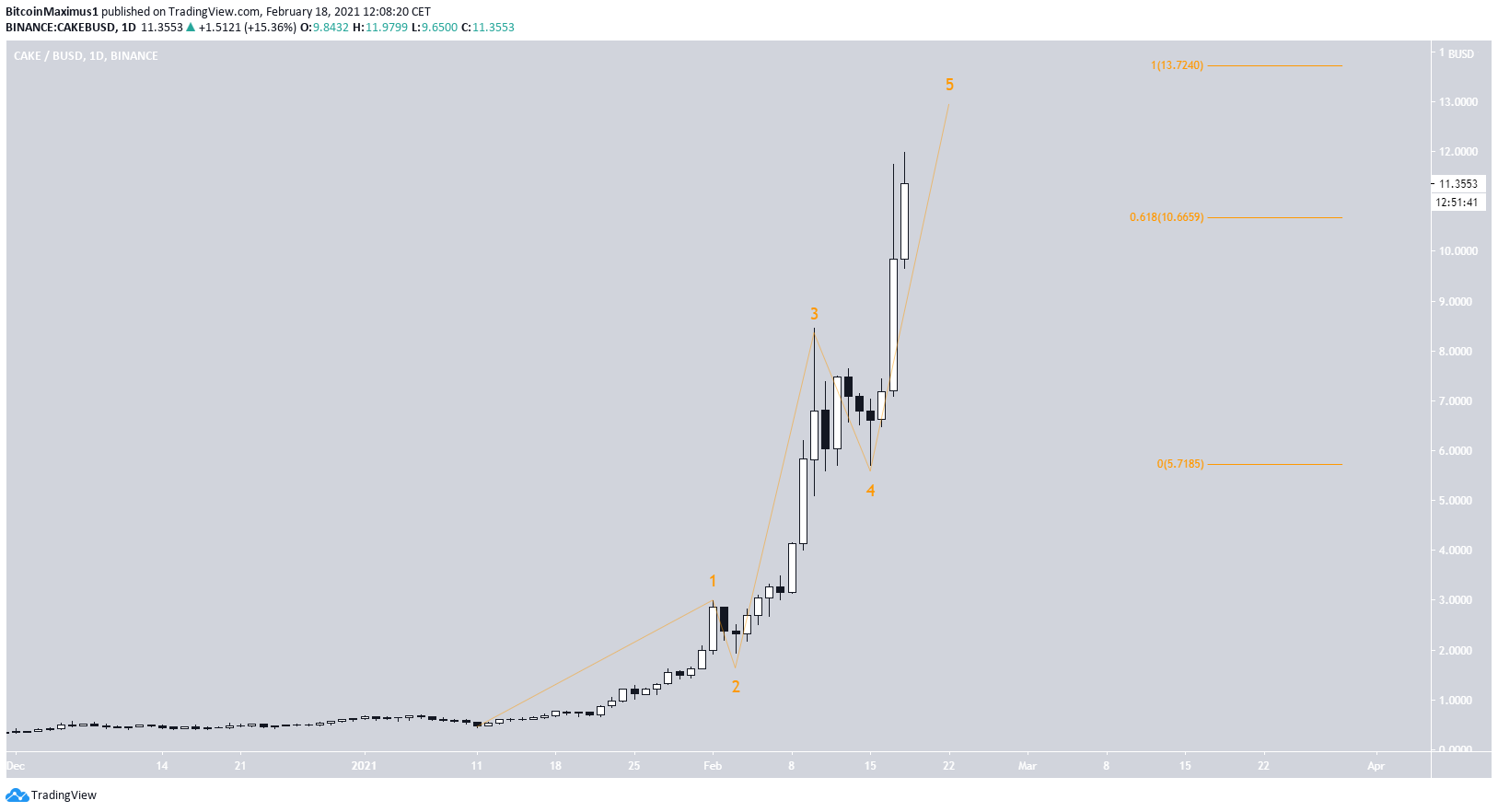

Pancake Swap (CAKE)

CAKE has been increasing rapidly since Jan. 22, when it was trading at a low of $0.65. Since then, it has increased by a massive 1,733%, reaching an all-time high price of $12.45 on Feb. 18.

Despite the massive increase, technical indicators on the daily time-frame have begun to show weakness. The daily RSI has been overbought for 27 days and has formed considerable bearish divergence.

Furthermore, the Stochastic oscillator has already made a bearish cross, a sign of a trend reversal (red arrow).

The wave count suggests that CAKE is in the fifth and final sub-wave of a bullish impulse that began on Jan. 11. The two most likely targets for the top of the move are at $10.66 and $13.72, found using the length of waves 1-3.

Since CAKE has already moved well above the former, the $13.72 area would likely act as the top.

Highlights

- CAKE is likely in the fifth and final wave of a bullish impulse.

- Technical indicators show weakness.

Bancor (BNT)

BNT initially reached a new all-time high price on Feb. 11, breaking out above the previous resistance area at $2.70. However, the rate of increase accelerated after the wick low on Feb. 15, which nearly validated the previous resistance area as support.

Since then, BNT has increased by 78.50% in only three days, reaching the current all-time high price of $5.21. Technical indicators are still bullish since the MACD, RSI, and Stochastic oscillator are all increasing. None have formed any bearish divergence yet.

The wave count suggests that BNT is still in wave three of a bullish impulse that began on Mar. 2020. The sub-wave count is in orange, indicating that BNT is also in sub-wave three.

The most likely target for the top of the movement is at $6.52, found using an external Fib retracement on wave two. BNT will likely correct after this.

Highlights

- Technical indicators for BNT are still bullish.

- BNT is in wave three of a bullish impulse.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.