Distressed crypto lender BlockFi can auction mining assets to exploit favorable market conditions, a U.S. bankruptcy judge rules.

BlockFi’s assets have courted significant interest given crypto market volatility, necessitating an expedient response, BlockFi’s lawyer Francis Petrie told bankruptcy judge Michael Kaplan.

BlockFi Wants to Exploit Upsurge in Mining

According to Petrie, interested parties can bid for the assets up to Feb. 20, 2023, with the auction following roughly a week later. BlockFi will seek the court’s approval for any material bid from the auction. Any assets that do not attract successful bids will form part of the company’s restructuring plans to exit bankruptcy swiftly, Petrie added.

The auction plans come roughly a week after BlockFi said it would sell $160 million in loans collateralized by Bitcoin mining equipment as part of ongoing Chapter 11 bankruptcy proceedings. It reportedly sold $239 million of its own crypto assets after filing for bankruptcy in November 2022.

The auction also comes at a time of increasing prosperity for the mining industry, stung by what has largely been an extended bear market, despite a recent rally in the price of Bitcoin since the start of 2023. The higher Bitcoin price has boosted miner revenues and seen miners bring more machines online.

Foundry Leads Global Hashrate Resurgence

Mining firms borrowed heavily to fund expansion during the bull markets of 2017 and 2022. However, falling Bitcoin prices and rising energy costs squeezed the liquidity needed to service those debts. As a result, several highly-indebted crypto firms have sold their mining equipment or returned them to repay loans.

The New York Digital Currency Group acquired mining rigs belonging to Greenidge Generation Holdings to reduce the latter’s debt obligation by $57-68 million. In comparison, Sydney-based miner Iris Energy shut down a notable chunk of its mining operations as part of a default on a $108 million loan. Mining giant Core Scientific recently shut down rigs belonging to bankrupt lender Celsius after the lender failed to pay for rising energy costs in connection with a hosting agreement. Others, like Stronghold Digital Mining, have extinguished debt by converting amended notes to equity.

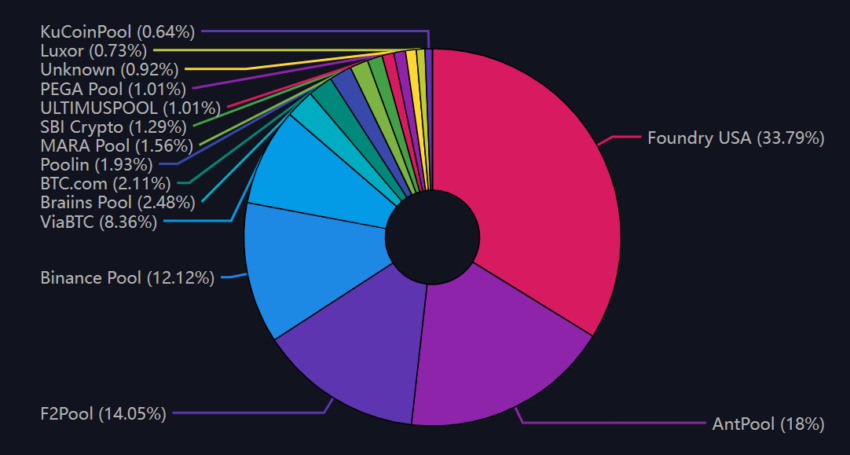

Despite the capitulation, mining hashrate has risen to roughly 290 exahashes per second, according to Blockchain.com. Most of the mining power in the last week came from the world’s largest mining pools, such as Foundry USA, AntPool, and F2Pool, which collectively account for 64% of the current global hashrate. A mining pool consists of a group of miners who earn revenue based on their contribution to the pool’s hashrate, irrespective of whether the pool verifies a Bitcoin transaction block.

According to data from mempool, Foundry USA alone is responsible for more than 90 exahashes per second, with AntPool coming in second at 47.1 exahashes per second. Foundry is part of the Digital Currency Group, a blue-chip crypto firm whose subsidiaries include bankrupt lender Genesis Global Capital and digital asset manager Grayscale Investments.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.