BlackRock is reportedly seeking a significant overhaul of its board of directors for its flagship spot Bitcoin ETF – IBIT. Effective November 6, 2024, Lindsey Haswell will step into a key role, succeeding Kimun Lee.

Haswell currently holds the position of Chief Legal and Administrative Officer at Web3 payment company – MoonPay.

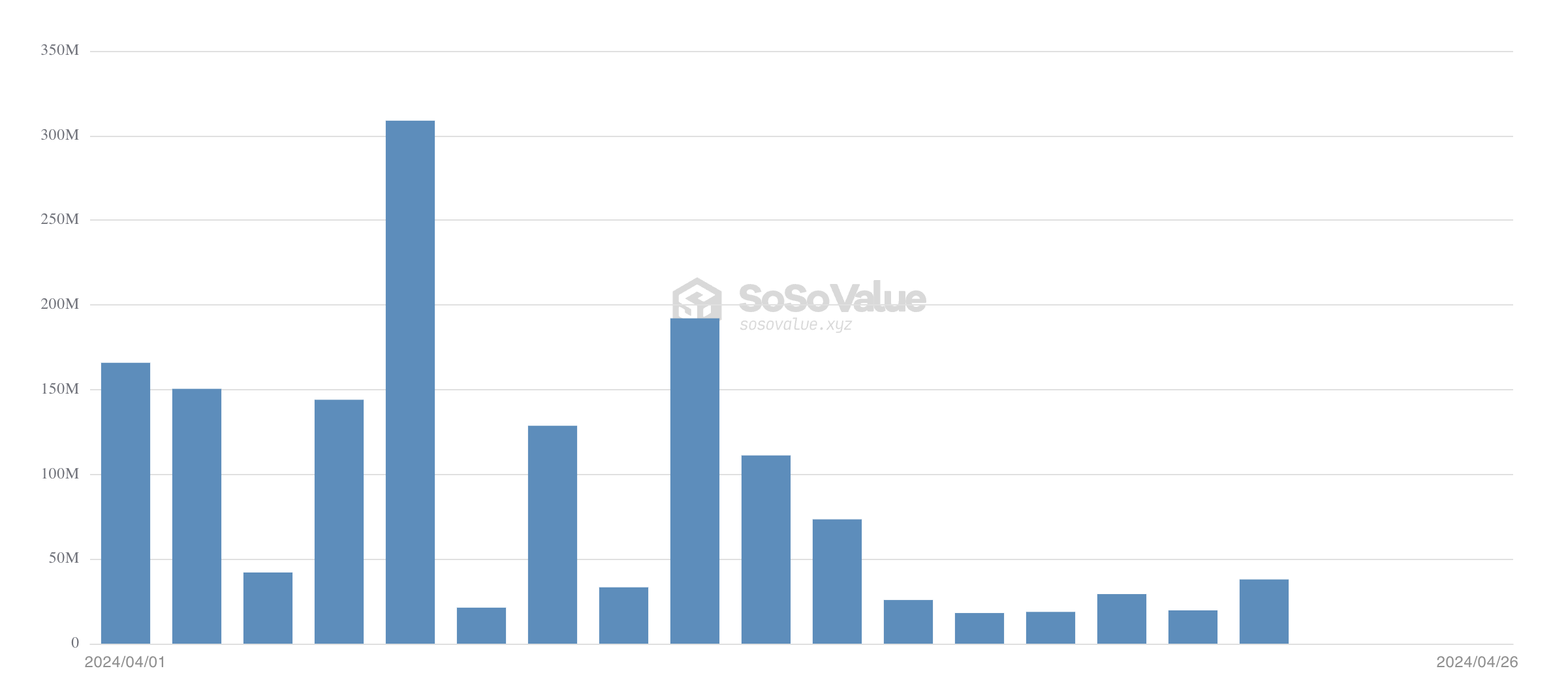

BlackRock Appoints Haswell Amidst Three Consecutive Days of 0 Netflows

Her extensive background includes similar roles at Blockchain.com and as a founding member of the Core blockchain. Hence, her expertise is anticipated to bring innovative governance to BlackRock’s IBIT.

Notably, BlackRock’s IBIT is the second-largest spot Bitcoin ETF by assets under management. This change in governance arrives at a pivotal moment for IBIT, which has recently seen a halt in its 71-day streak of consecutive inflows, reporting zero netflows over the past three days.

Despite this anomaly, IBIT has maintained a robust presence in the market, with inflows totaling $57.6 million in the previous week, even as other spot Bitcoin ETFs faced outflows.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

The sudden halt in inflows and outflows raises several questions about the dynamics at play within the ETF. Finance analyst Rajat Soni has voiced concerns about the transparency of these figures.

“How is it possible that there were 0 inflows and outflows from IBIT for three days straight (April 24, 25, 26)? Is it possible that Blackrock isn’t selling their holdings when their clients sell?” Soni questioned.

Conversely, James Seyffart, an ETF analyst from Bloomberg, offers a reassuring angle, suggesting that the observed zero flow trend aligns with broader ETF market behaviors. He further explained that minor mismatches would see the market makers handle the trading of shares just like they would for stocks.

Read more: Crypto ETN vs. Crypto ETF: What Is the Difference?

According to Seyffart, significant discrepancies must occur to prompt market makers to engage in the creation or redemption of ETF shares.