BlackRock has spearheaded a $47 million investment round for Securitize, a firm focused on tokenization of real-world assets (RWA).

Announced on May 1, this strategic infusion of capital marks a crucial step in the evolution of digital asset securities.

How Securitize Plans to Use $47 Million Funding

Securitize is set to use this funding to propel product development, expand internationally, and enhance partnerships across the financial industry. Investors in this round include Hamilton Lane, ParaFi Capital, and Tradeweb Markets, alongside other key players such as Aptos Labs, Circle, and Paxos.

Consequently, Joseph Chalom, BlackRock’s Global Head of Strategic Ecosystem Partnerships, will join the Securitize Board of Directors.

“In our view, the transformative potential of blockchain technology to reshape the future of finance in general – and tokenization in particular – is promising,” Carlos Domingo, the co-founder of Securitize said.

In March, BlackRock partnered with Securitize to launch its first tokenized fund on Ethereum, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL). This fund offers a stable $1 value per token and distributes dividends directly to investors’ wallets as new tokens monthly.

Investing primarily in cash, US Treasury bills, and repurchase agreements, the fund aims to provide yield while maintaining liquidity on the blockchain.

“The focus here is on institutional use of RWAs, and it makes perfect sense for a firm like Blackrock, who already transacts in the RWAs, to find a “large enough” actor they could trust to tokenize those assets and step into the sector. Also interesting to see the mix of investors who joined them in the round. They represent a really strong signal that Tokenizing RWAs is not only becoming mainstream, it’s where the big, smart, industry, and trendy money are all going,” D.J. Bodden, Operations Director at Storm Partners, told BeInCrypto.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

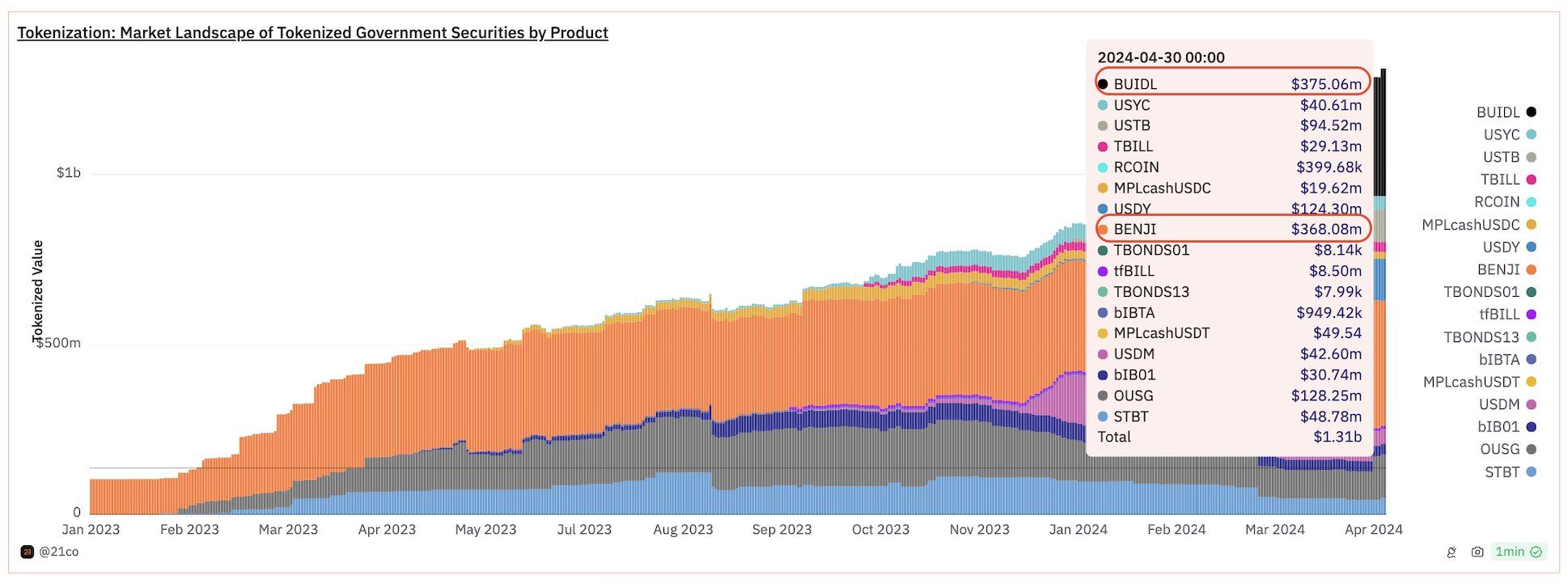

BeInCrypto reported that BUIDL has become the world’s largest treasury fund tokenized on a blockchain as of May 1. It surpassed Franklin Templeton’s Franklin OnChain US Government Money Fund in market capitalization.

Since its launch six weeks prior, BUIDL has swiftly attracted market attention, with its market capitalization skyrocketing from $274 million to $375 million in April, an impressive 36.5% increase.

This surge aligns with a wider trend towards debt-based, high-yield investments. As of April 26, the total value locked in tokenized real-world assets reached a record $8 billion, marking a nearly 60% rise since February. These statistics exclude fiat-backed stablecoins and cover various assets, including commodities, securities, and real estate tokenization protocols.