BlackRock Investments (BlackRock) has filed an S-1 prospectus (S-1) for an Ethereum exchange-traded fund (ETF) with the US Securities and Exchange Commission (SEC). The investment manager, which filed to launch a Bitcoin exchange-traded fund (ETF) in June, could be instrumental in making crypto available to a wider audience.

BlackRock has applied to launch its iShares Ethereum Trust with the US SEC in Delaware. The ETF will be listed on the Nasdaq, use the CME CF Ether-Dollar Reference Rate, and launch “as soon as is practicable” following approval.

BlackRock Thinks Market is Ready

It is unclear from the S-1 filing whether BlackRock would stake Ethereum on behalf of clients. Staking allows investors to earn rewards for locking tokens to secure the Ethereum blockchain.

Read more: What Is Crypto Staking? A Guide to Earning Passive Income

Reports of a registration filing for a BlackRock Ethereum ETF application first surfaced on Friday. Daniel Schweiger, listed on LinkedIn as a BlackRock director, appeared to have driven the application in Delaware.

Many consider BlackRock’s filings to be bellwethers others can follow. But ARK Invest and its partner 21 Shares have already filed an S-1 for an Ethereum ETF in September. Later, Grayscale Investments applied to convert its Ethereum ETF to a spot ETF.

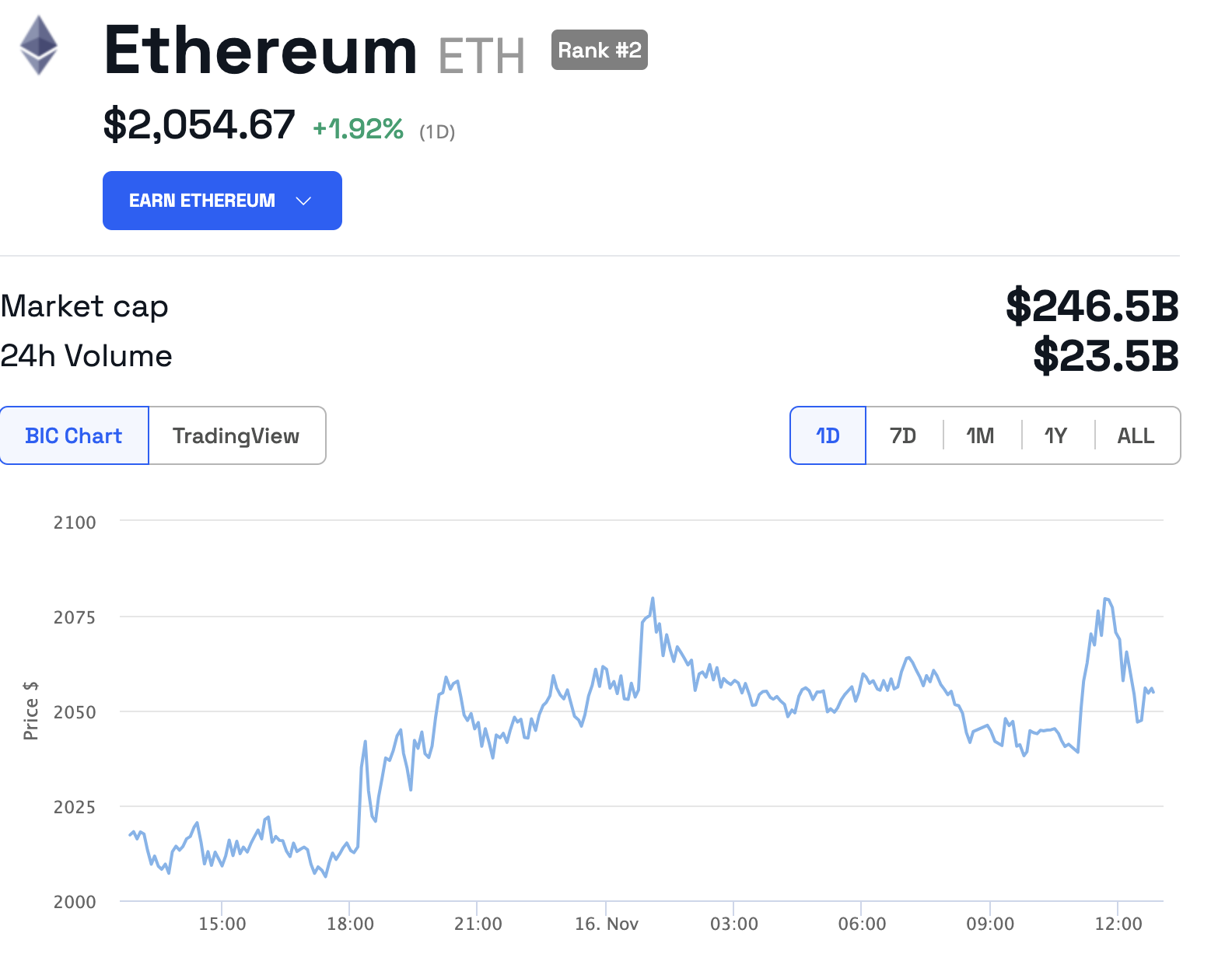

After the BlackRock filing was published, Ethereum peaked at $2,079.50 before falling back to $2,054.67 at press time. It is up 1.9% in the last 24 hours.

Read more: How To Buy Ethereum in 3 Simple Steps – A Beginner’s Guide

Will ETF Filings Widen Crypto Audience?

The US SEC has until Nov. 17 to approve, reject, or delay Bitcoin ETF applications from nine financial companies, including BlackRock, WisdomTree, and Valkyrie. What impacts these rollouts will have on investors is still up for debate, but several experts have expressed varied views in recent days.

Bryan Armour, a director of passive strategies research for North America at Morningstar, implied that a spot Bitcoin ETF would attract an ETF audience to crypto. He opined that other options, for example, futures contracts that give exposure to Bitcoin indirectly, have problems.

“All the other options right now have flaws to varying degrees.”

Ben Smith, a certified financial planner from Milwaukee, said that while these ETFs have the ability to bring crypto to a wider audience, their uptake depends on an investor’s appetite for risk. Bitcoin’s volatility suits the diversified portfolios of high-risk investors.

To date, most advisers tell clients to allocate 1-5% of their portfolios to crypto. Intuitively, ETF investors may not pull customers, especially day traders looking for small price swings, away from crypto exchanges.

Do you have something to say about whether BlackRock ETF applications can bring crypto to a wider audience, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).