Investment giant BlackRock is reportedly considering betting on Ripple (XRP) over Bitcoin. So what impact will this have on the firm’s future investment decisions?

BlackRock’s filing for a spot Bitcoin ETF has driven new enthusiasm within the crypto community. However, rumors exist that the company is also considering investing in Ripple’s XRP token.

BlackRock Ready to Bet on XRP?

What if, while waiting for the highly anticipated opening of its ETF, the investment giant BlackRock took the opportunity to line its pockets in other ways?

According to a recent report published by Investing, BlackRock is eyeing XRP. Worse still, the company would have suggested that XRP would be a more profitable investment than Bitcoin (BTC).

Thus, its management would consider abandoning the little orange coin in favor of the Ripple token, boosted by the setbacks of the SEC and its mass listings.

So, should the investors expect a big bull run on the price of XRP in the coming days? The answer is no. Indeed, BlackRock’s supposed admiration for it is only a rumor.

Some internet users have reportedly noticed that Robert Mitchnick, the current head of crypto investments at the company, was a former Ripple employee. They would, therefore, have concluded that XRP could be the next token to benefit from BlackRock’s favors without reliable sources or conclusive clues.

Note, also, that the reasons for the American giant to turn to XRP at the moment are fewer. While the lawsuit between Ripple and the Securities and Exchange Commission (SEC) remains uncertain, the future of the token remains subject to pure speculation.

Click here to learn what it means to receive a Wells Notice from the SEC

On the other hand, if Bitcoin ETF gets approved, it might potentially benefit Bitcoin investors in the long run. Some experts believe that the approval of spot Bitcoin ETF is expected within four to six months. However, other market pundits have predicted a delay in the approval.

Nonetheless, when Bitcoin starts its bull run, most altcoins also start their uptrend. While XRP investors may not benefit from direct BlackRock support, a Bitcoin bull run could influence the token’s price.

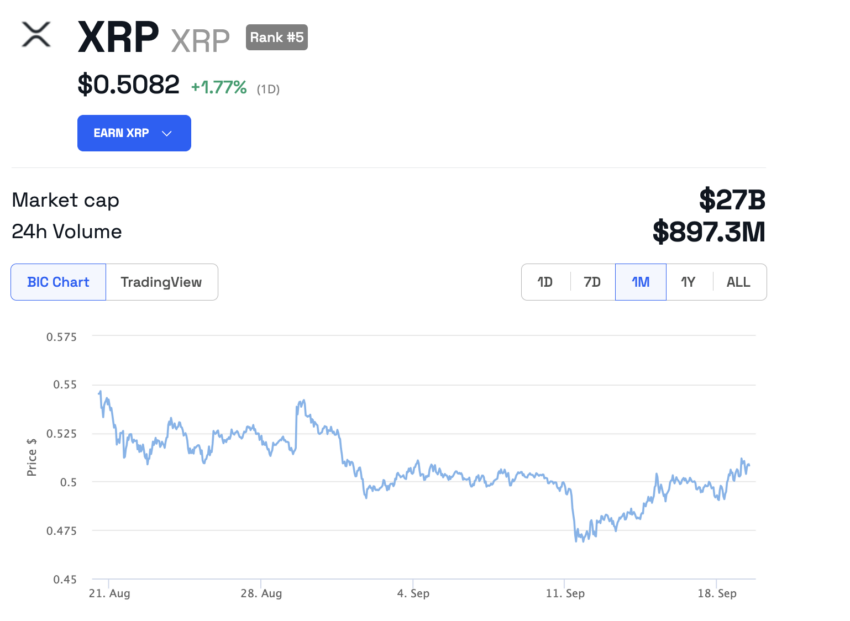

As of writing, XRP is trading at $0.5082, up by 1.77% in the past 24 hours.

Click here to read about the top 5 crypto tokens not to miss in Summer 2023.

Do you have anything to say about BlackRock XRP investment or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.