BUIDL, a tokenized US treasury issued by asset management giant BlackRock in partnership with Securitize, has surpassed the $500 million mark in market value, according to data from RWA.xyz.

This achievement makes BUIDL the largest tokenized fund in the market. It also highlights the growing influence of real-world asset (RWA) tokenization in the financial sector.

BUIDL Gains Ground in the RWA Tokenization Sector

Launched in March this year, BUIDL quickly outperformed more established funds in market capitalization, like Franklin Templeton’s Franklin OnChain US Government Money Fund (BENJI). This rapid ascent highlights the increasing interest in tokenized assets.

BUIDL’s market value surge has also impacted the broader RWA token sector. CoinGecko data shows a 3.5% increase in the total market capitalization of RWA-related assets within the last 24 hours.

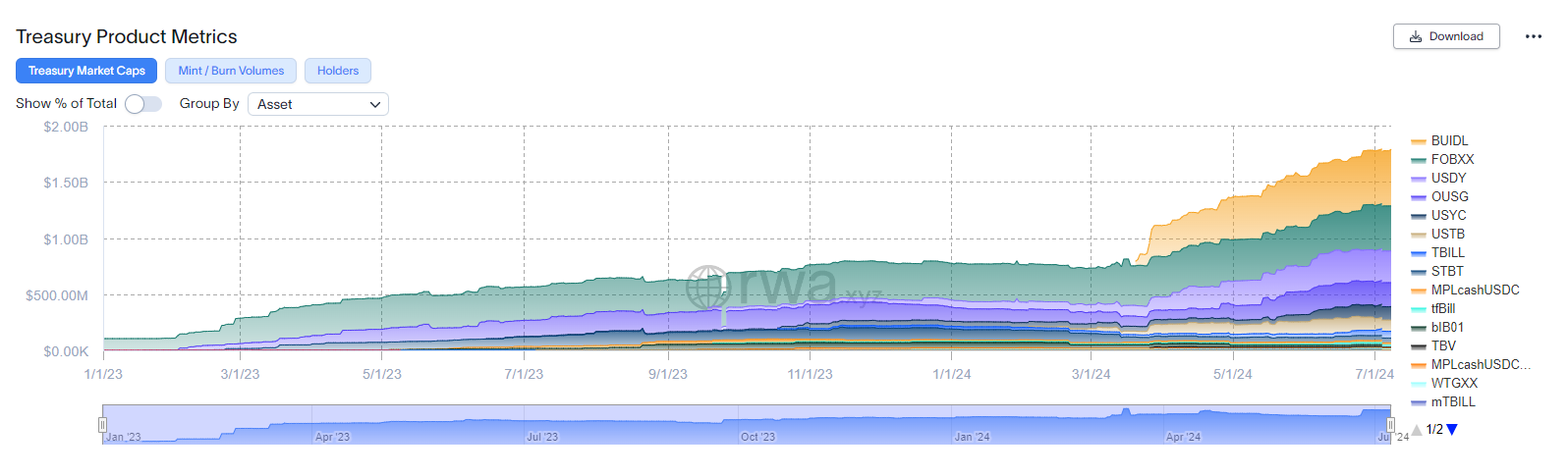

Leading the charge are ONDO and Mantra (OM) tokens, which saw increases of 2% and 5.1%, respectively. The overall tokenized treasury market has also experienced remarkable growth, with its total market capitalization soaring from $572.40 million to $1.79 billion, marking a 212.72% year-on-year increase.

Read more: How To Invest in Real-World Crypto Assets (RWA)?

This growth extends to the practical applications of tokenized treasuries. RWA.xyz notes an increasing trend in using tokenized treasuries as collateral in various financial ecosystems.

For instance, Superstate’s USTB and BUIDL are now accepted as collateral on the FalconX Network, while Ondo Finance’s USDY can be utilized on Drift Protocol. Furthermore, Moody’s recent bond rating upgrade to Hill Lights International Limited, the issuer of OpenEden’s tokenized US T-bills (TBILL). The “A-bf” rating elevates TBILL tokens to investment-grade status, enhancing their appeal to investors.

Companies like Hamilton also push the boundaries of RWA tokenization by exploring different blockchain platforms. Last week, Hamilton announced the tokenization of the first US Treasury bills on Bitcoin layer-2 solutions, including Stacks, Core, and BoB.

RWA tokenization involves converting tangible assets like bonds, real estate, and debt into digital tokens on blockchain networks. These digital representations can be swapped, transferred, and leveraged within DeFi ecosystems. Mohamed Elkasstawi, co-founder and CEO of Hamilton, explained potential new opportunities in the RWA tokenization sector to BeInCrypto.

“We anticipate that tokenized assets will bring increased transparency, liquidity, and accessibility to traditional financial markets. We believe that enabling fractional ownership and 24/7 liquidity will democratize access to high-quality investment opportunities,” he said.

Read more: RWA Tokenization: A Look at Security and Trust

Major financial institutions, including Goldman Sachs, JPMorgan, and Citi, are actively exploring and investing in tokenization technologies. Furthermore, consulting firms like McKinsey and Boston Consulting Group predict the RWA market will reach multi-trillion dollars by 2030. This forecast and interest reflect the enormous potential and growing interest in tokenized assets.