Bitwise has applied for an XRP ETF in the state of Delaware. An anonymous spokesperson apparently confirmed on Tuesday that the application is genuine.

An XRP ETF is just one of several ETF-related ventures Bitwise has started recently.

A Surprise Filing

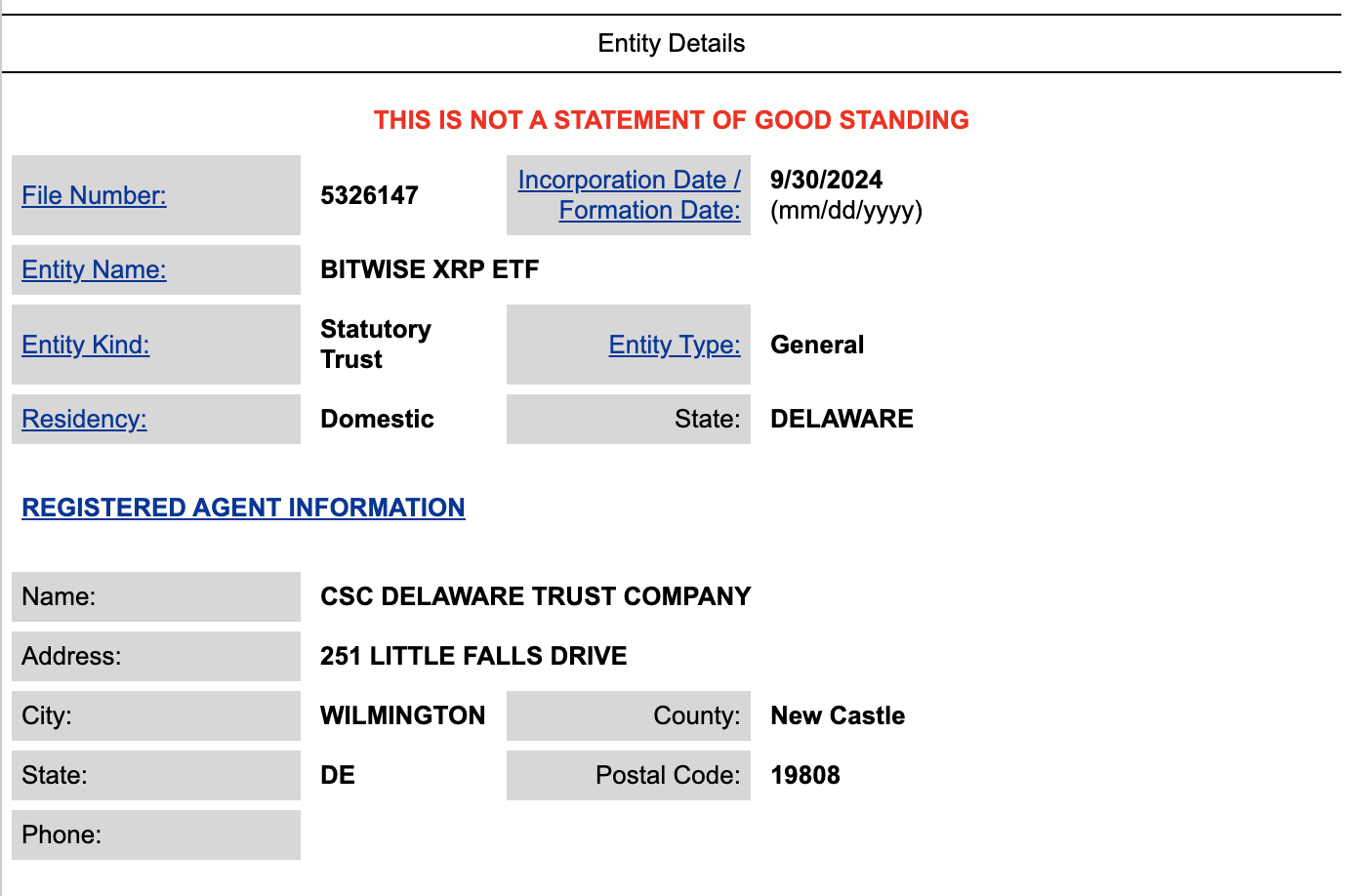

Bitwise Asset Management has applied for an entity named Bitwise XRP ETF in the state of Delaware. According to the filing, publicly available on the Delaware Department of State website, Bitwise filed this ETF on September 30. The registered agent for this filing was CSC Delaware Trust Company, which provides compliance services for legal and corporate endeavors.

“Bitwise positioning to file for XRP ETF is highly noteworthy IMO. Bitwise is highly credible crypto-native fund firm that doesn’t just throw stuff at wall. That’s simply not in their DNA. This is strategic,” Nate Geraci, the President of the ETF store, said.

Read More: XRP ETF Explained: What It Is and How It Works

This agent’s website claims that Delaware is the preferred location for a variety of corporate filings due to its reputation for business-friendly tax and regulation. In fact, BlackRock filed its Ethereum ETF in Delaware less than one year ago. This location suggests Bitwise is making a genuine effort despite the difficulty of winning regulatory approval.

Later on Wednesday, Bitwise officially announced that it had filed a registration statement with the US SEC for the Bitwise XRP exchange-traded product (ETP).

“The launch of the Bitwise XRP ETP is pending effectiveness of the Form S-1 as well as approval of a Form 19b-4 filing,” Bitwise stated.

The XRP ETF has its supporters, but generally, it is not viewed as the most likely cryptoasset to become the third US ETF.

Read More: How To Buy XRP and Everything You Need To Know

Still, this bold move is very in character for Bitwise. Chief Investment Officer Matt Hougan made publicly bullish statements on new ETF approvals just two weeks ago, and Bitwise acquired a European crypto ETP issuer in August.

A new project like this would fit right in. Ripple’s executives, too, are bullish that the SEC will eventually give an XRP ETF the green light.

“I think it’s just a matter of time, and it’s inevitable there’s gonna be an XRP ETF, there’s gonna be a Solana ETF, there’s gonna be a Cardano ETF, and that’s great,” Ripple CEO Brad Garlinghouse stated.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.