TAO’s price has surged significantly over the past month, driven by growing interest in artificial intelligence coins. With a recent increase of over 60%, several indicators and metrics offer valuable insights into the coin’s potential future performance.

While the current EMA setup signals strong bullish momentum, the distribution pressure on TAO remains a concern that could affect its ability to sustain the uptrend.

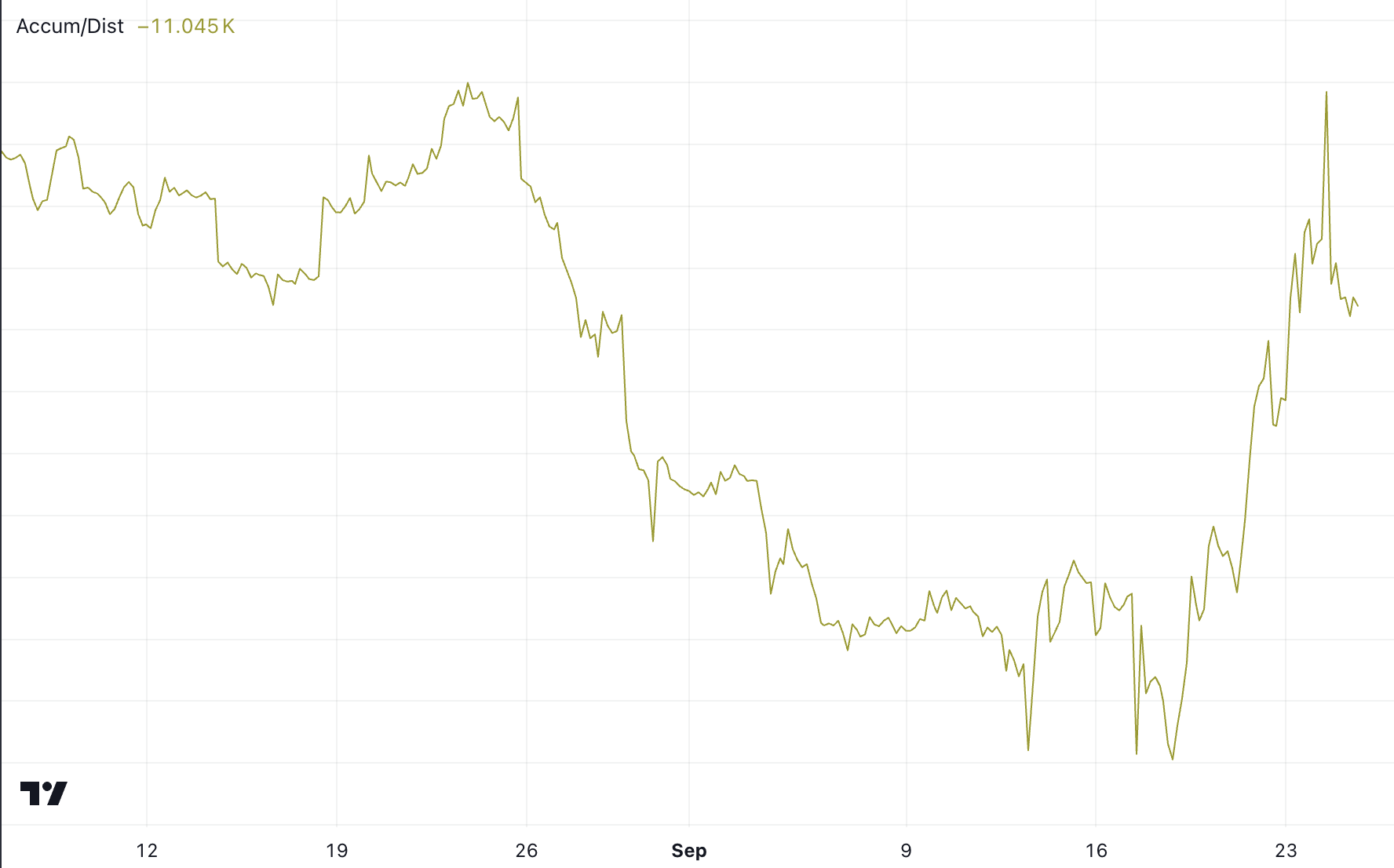

TAO Accumulation/Distribution Is Now Negative, But That’s Not as Bad as It Seems

The Accumulation/Distribution value for Bittensor (TAO) is roughly -11,045, which clearly indicates heavy selling pressure over the recent period. This negative value suggests that more traders have been offloading TAO rather than accumulating it. This could lead to a bearish outlook for TAO price in the near term.

The Accumulation/Distribution (A/D) metric is crucial in understanding this market behavior. It combines both price movement and trading volume to give a clearer picture of whether an asset is being accumulated (more buying) or distributed (more selling).

With this strong distribution, the price is likely to face resistance in establishing a sustainable upward trend unless a shift in sentiment occurs.

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

If the A/D line starts to stabilize or shift upward, it might indicate renewed interest and accumulation, potentially reversing the downward momentum. Since TAO grew more than 60% in the last month, that could lead to strong selling pressure in the short term.

However, the Accumulation/Distribution metric at -11000 may not be strong enough to spark a bearish trend on TAO. It’s important to keep an eye on this metric. If it continues to go down, it could change the sentiment about the coin.

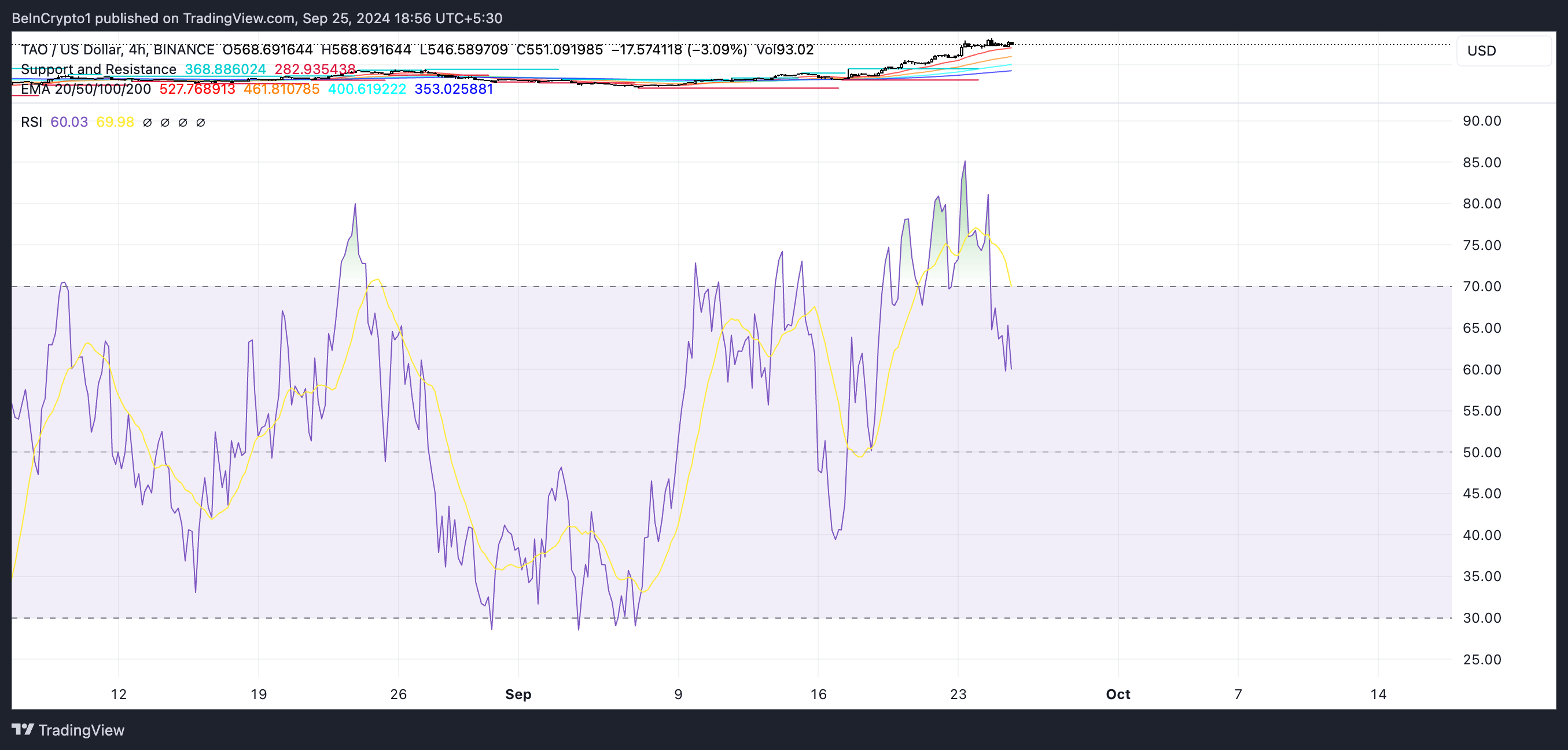

TAO RSI Is Still Healthy for More Growth

Bittensor’s Relative Strength Index (RSI) currently sits at 60. This is significant because it reflects a notable shift in momentum since September 16, when the RSI was at 39. This rise suggests that buying interest has increased over this period, indicating stronger bullish sentiment for TAO.

An RSI in this range points to a market that is gaining strength but is not yet overbought, making it a potential indicator of further price appreciation in the near term if the momentum continues.

The RSI is a popular momentum oscillator used to measure the speed and change of price movements. It ranges from 0 to 100, with thresholds typically set at 30 and 70. An RSI below 30 indicates that the asset is potentially oversold, signaling a buying opportunity, while an RSI above 70 suggests the asset may be overbought, indicating a possible correction or pullback.

With TAO’s RSI currently at 60, the token is in neutral to slightly bullish territory. This could suggest that TAO still has room for growth before hitting overbought levels.

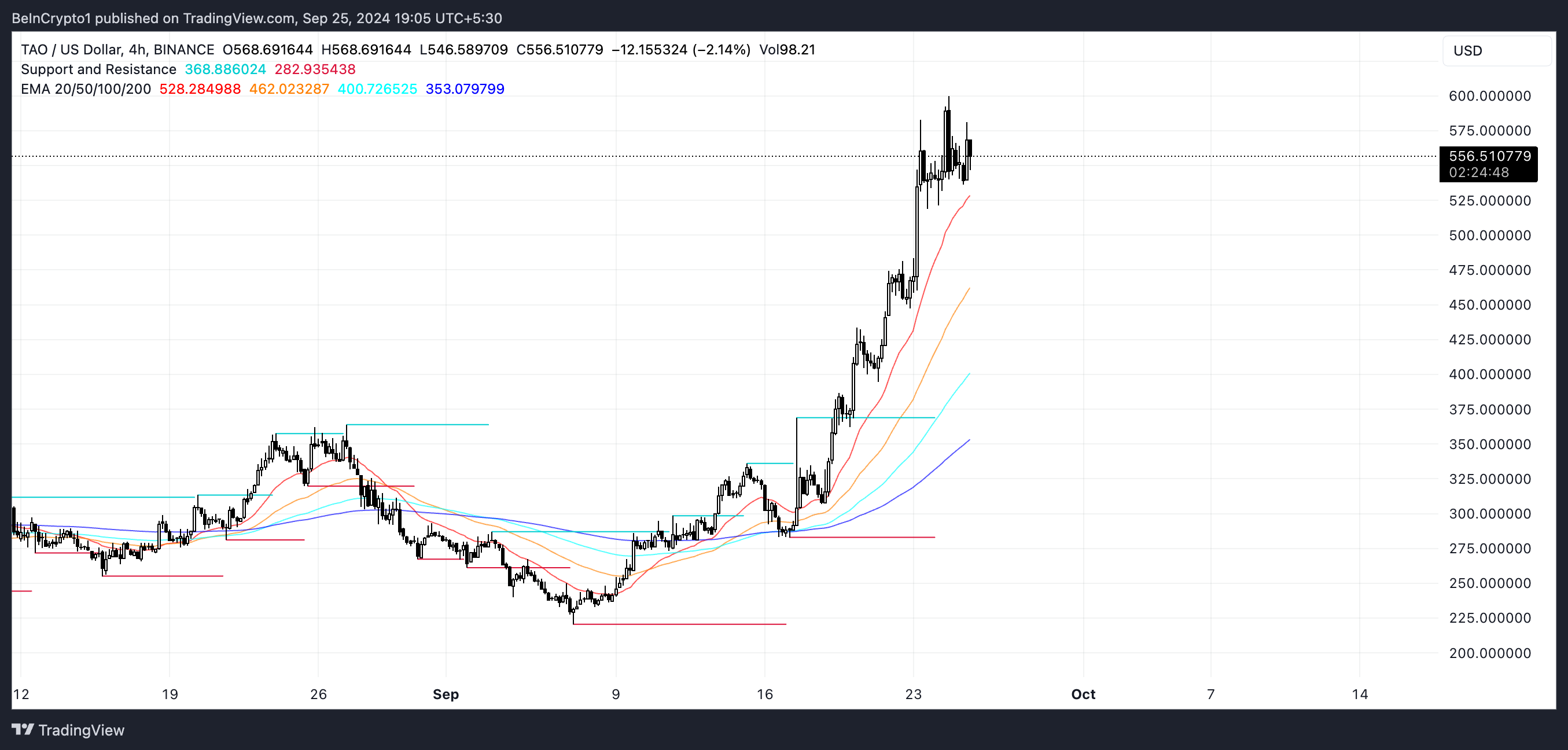

TAO Price Prediction: Is It Possible to Reach $700 By October?

TAO is currently showing an extremely bullish setup, as its Exponential Moving Average (EMA) lines are widely spread. This spread indicates that the shorter-term EMAs are significantly higher than the longer-term ones, signaling a strong uptrend. The widening gap between these EMAs reflects consistent price increases and growing upward momentum.

EMA lines are technical indicators that give more weight to recent prices, making them responsive to market activity. When the price stays above the EMAs, and shorter-term EMAs are positioned above longer-term ones, it confirms a solid uptrend.

Read more: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

If TAO can maintain this momentum, supported by the rising interest in AI coins, it has the potential to surpass $600 for the first time since April 2024. Breaking through the key resistance level of $625 could push the price further, potentially reaching $700 — a 26.81% increase from its current value.

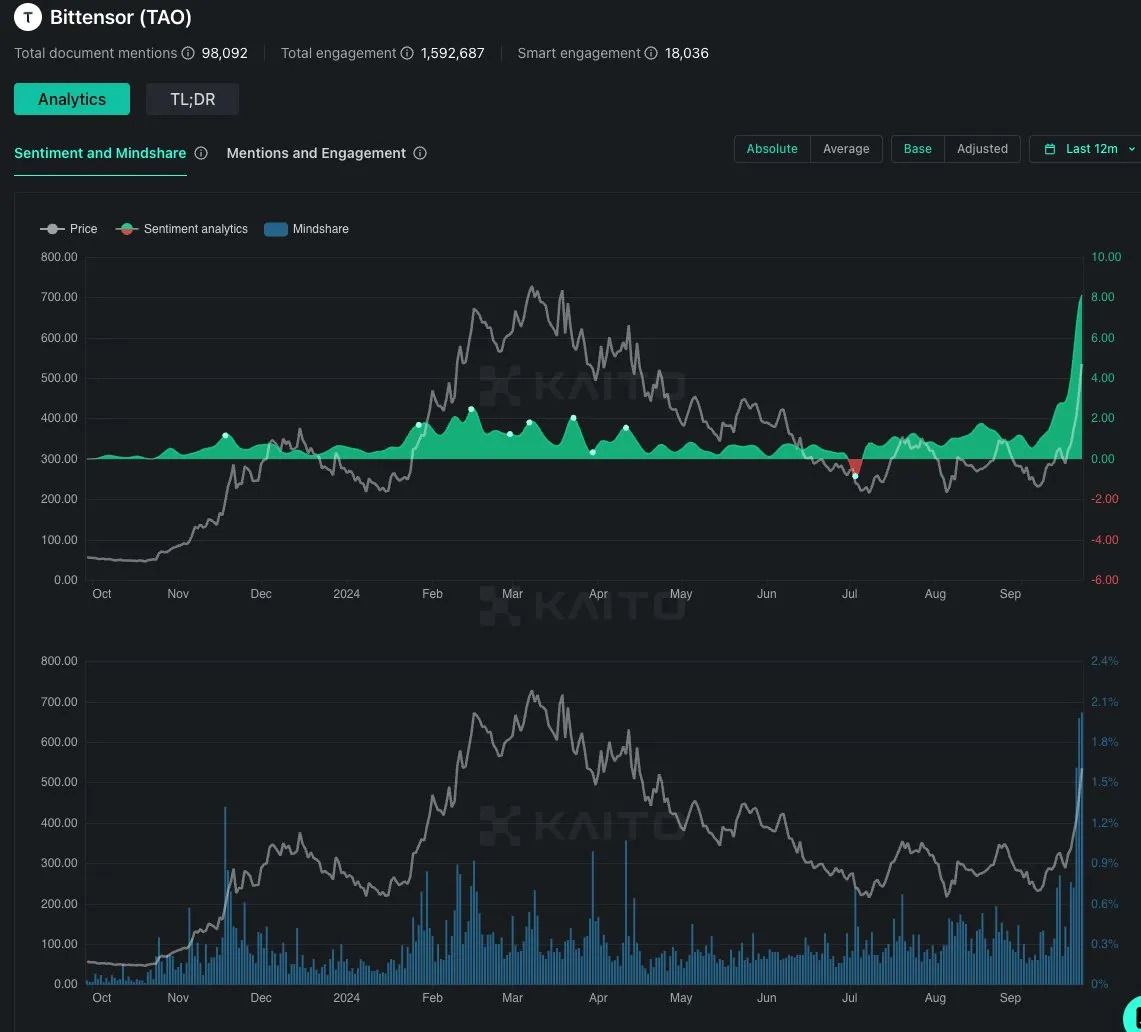

Elsewhere, Bittensor mindshare and sentiment recently hit new all-time highs, which could contribute to a new price rally.

However, if TAO is unable to sustain this upward momentum, there are risks to consider. If the Accumulation/Distribution value turns increasingly negative, suggesting more selling pressure, and if the RSI moves into overbought territory (above 70), the price could see a significant pullback. In that case, TAO price could drop as low as $284 over the coming weeks.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.