We strongly disagree with the U.S. government’s heavy-handed decision to bring these charges, and intend to defend the allegations vigorously. From our early days as a start-up, we have always sought to comply with applicable U.S. laws, as those laws were understood at the time and based on available guidance.The CFTC filed a civil enforcement action in the US District Court for the Southern District of New York charging “five entities and three individuals who operate the BitMEX trading platform” with operating an unregistered platform against several CFTC regulations.

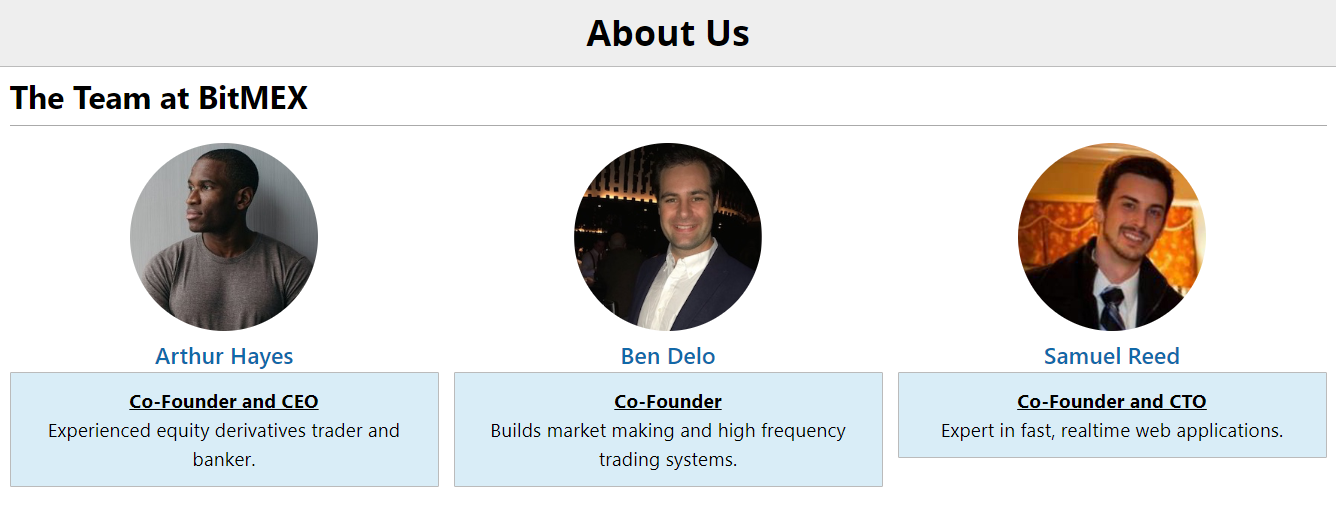

In a press release by the CFTC, authorities stated that these charges include failure to meet anti-money-laundering guidelines. Though the filing hints that BitMEX has been involved in money laundering, it doesn’t go beyond charges of failure to meet guidelines. The Division of Enforcement’s Digital Asset and Bank Secrecy Act Task Forces brought in the case, which charged BitMEX owners Arthur Hayes, Ben Delo, and Samuel Reed. The release says that these men operate BitMEX through a “maze of corporate entities” in multiple nations.CFTC vs Bitmex. Let the fight begin. https://t.co/sryTCEWcz0

— Alex Krüger (@krugermacro) October 1, 2020

According to Coinmarketcap, BitMEX has about $1.4 billion in daily derivatives trading volume.BREAKING: CFTC sues Bitmex, Arthur Hayes "to enjoin their ongoing illegal offering of commodity derivatives to U.S. persons, their acceptance of funds to margin derivatives transactions from individuals and entities in the U.S., & their operation of a derivatives trading platform pic.twitter.com/CacEatcG0T

— Palley (@stephendpalley) October 1, 2020

Stop Turning the Other Cheek

Though BitMEX claims to keep customers from restricted jurisdictions away, the CFTC says that a large portion of their $1 billion+ daily volume comes from the United States, or is done with capital originating in the United States. https://twitter.com/Crypto_Bitlord/status/927603163095474176?s=20 It’s an open secret that users get around poor Know Your Customer (KYC) checks in various ways, including VPN. This lets customers use IP addresses rerouted across the globe, so they don’t appear to be from a restricted territory. This Wild West attitude may have led BitMEX and its users to be lax about regulations. Popular Crypto Twitter personality Crypto Bitlord said in 2017,this is crypto mate… Just use a VPN and deny it.One only has to look at Twitter and the myriad of clearly US-based customers who discuss their longing and shorting of crypto derivatives, often with leverage. People in the US do, indeed appear to be using BitMEX. Though it breaks the terms of service, the CFTC suggested that BitMEX not only knew but encouraged such customers to break these terms for profit. Some Twitter users also said that the KYC of BitMEX was quite weak.

The CFTC agreed, saying:my understand is it's always been there but optional instead of mandatory. they've told me most large traders have been KYC'd for a while

— Zack Voell (@zackvoell) October 1, 2020

BitMEX has failed to implement the most basic compliance procedures required of financial institutions that impact U.S. markets.

A Change Coming

During April 2020, a lawsuit in California accused BitMEX of fraud, misrepresentation, and other counts. Also in April 2020, crypto-friendly CFTC director Brian Quintez stepped-down from his post. With the CFTC taking on Bitmex, along with other lawsuits about ICOs and securities sales, it seems like US regulators are paying more attention.Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.