On Monday, July 31, the BGB/USDT and MX/USDT pairs will be introduced on MEXC and Bitget, respectively.

While it is not unprecedented for crypto exchanges to list native tokens of their competitors, the joint timing of these listings suggests a strategic collaboration between Bitget and MEXC.

Mutual Benefits Behind the Collaboration

Though the scope of Bitget and MEXC partnership remains somewhat restricted, their simultaneous listing of tokens implies a planned effort. But what is in it for these two crypto exchanges?

The answer lies in expanding market visibility. By adopting a mutually beneficial strategy, Bitget and MEXC aim to broaden the audience for their BGB and MX tokens.

Read more: 13 Best No KYC Crypto Exchanges in 2023

These tokens serve similar roles as those of Binance’s BNB or OKX’s OKB. Both exchanges encourage using their native tokens by offering perks such as reduced trading fees and staking rewards.

Bitget has made it mandatory for users wanting to participate in its launchpad to transact using BGB. In contrast, MX token holders can vote for candidates within MEXC’s Innovation Zone.

Targeting Non-US Markets for Expansion

Another layer to Bitget and MEXC’s partnership might be a strategic push to grow their tokens’ potential audience.

While giants like Binance and Coinbase are making significant inroads into the United States market, Bitget and MEXC seem to be charting a different path. They prioritize other global markets over the US, leveraging each other’s regional strengths.

Both exchanges have established a notable footprint in Asian territories, notably Singapore and the crypto-enthusiastic South Korea. Targeting these alternative markets might solidify their positions outside the US as the major players compete for the dominant US market.

Read more: 9 Best Bitcoin Exchanges and Platforms in 2023

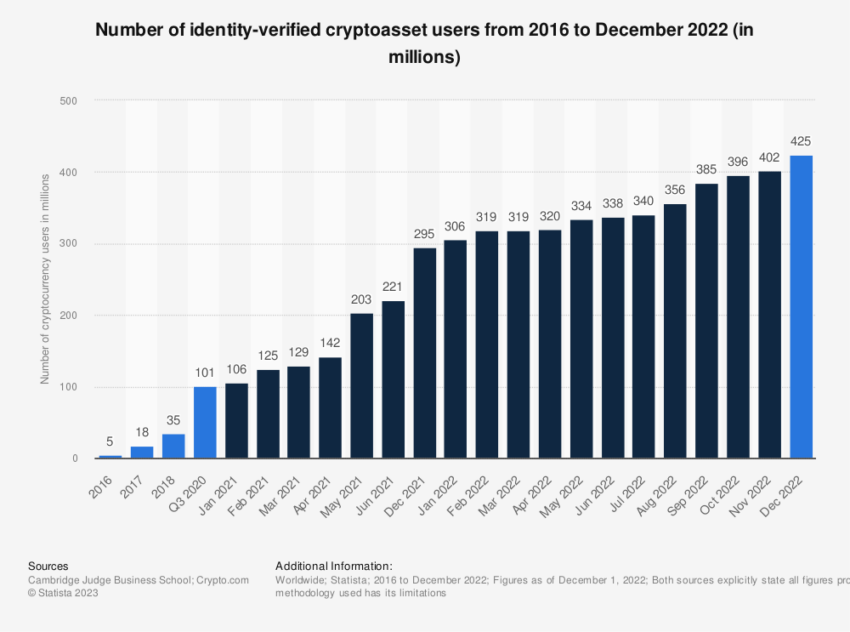

Importantly, several countries have surged ahead of the US in crypto adoption rates, even though the US remains the largest individual market.

To illustrate, the United Kingdom experienced a staggering growth of over 450% in its crypto sector between 2020 and 2022. In contrast, the US cryptocurrency industry expanded by approximately 120% during the same timeframe.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.