Stablecoin issuer Tether Holdings Ltd. has invested $100 million in Bitdeer Technologies Group, a US-listed Bitcoin mining company owned by Chinese billionaire Jihan Wu.

On May 30, 2024, Bitdeer sold 18,587,360 Class A ordinary shares to Tether. The company has an option to purchase 5 million more shares at $10 each, potentially raising another $50 million.

Bitdeer’s Expansion Plans

Operating data centers in the US, Norway, and Bhutan, Bitdeer, founded in 2018 as a Bitmain spin-off, manages equipment procurement, logistics, construction, and daily operations. Additionally, it offers advanced cloud capabilities for AI-intensive tasks. According to the statement, Bitdeer plans to allocate these funds toward expanding its data centers, developing ASIC-based mining rigs, and supporting general corporate activities.

“We regard Bitdeer as one of the strongest vertically integrated operators in the Bitcoin mining industry, differentiated by its cutting-edge technologies and a robust R&D organization. Bitdeer’s proven track record and world-class management team align perfectly with Tether’s long-term strategic vision. We anticipate close collaboration with Bitdeer across several key infrastructure areas moving forward,” said Tether CEO Paolo Ardoino.

Cantor Fitzgerald & Co. acted as the placement agent for the transaction. Bitdeer has not registered the securities under the Securities Act of 1933 or state securities laws, so it can’t offer or sell them in the US without registration or an exemption. The company plans to file registration statements with the SEC for the resale of shares issued in this private placement.

Read more: Is Crypto Mining Profitable in 2024?

This agreement marks a significant step for Tether in its quest to become a major player in Bitcoin mining. Last year, the company began building mining facilities in Uruguay, Paraguay, and El Salvador. It committed to investing $500 million within six months.

Tether’s Strategy Pays Off

However, mining is just one of the areas that Tether is currently focused on. The largest stablecoin issuer has been actively diversifying beyond its core operations. In April, the company reorganized into four divisions: Tether Data, Tether Finance, Tether Power, and Tether Edu. This restructuring aims to extend the influence across various sectors of the emerging crypto industry.

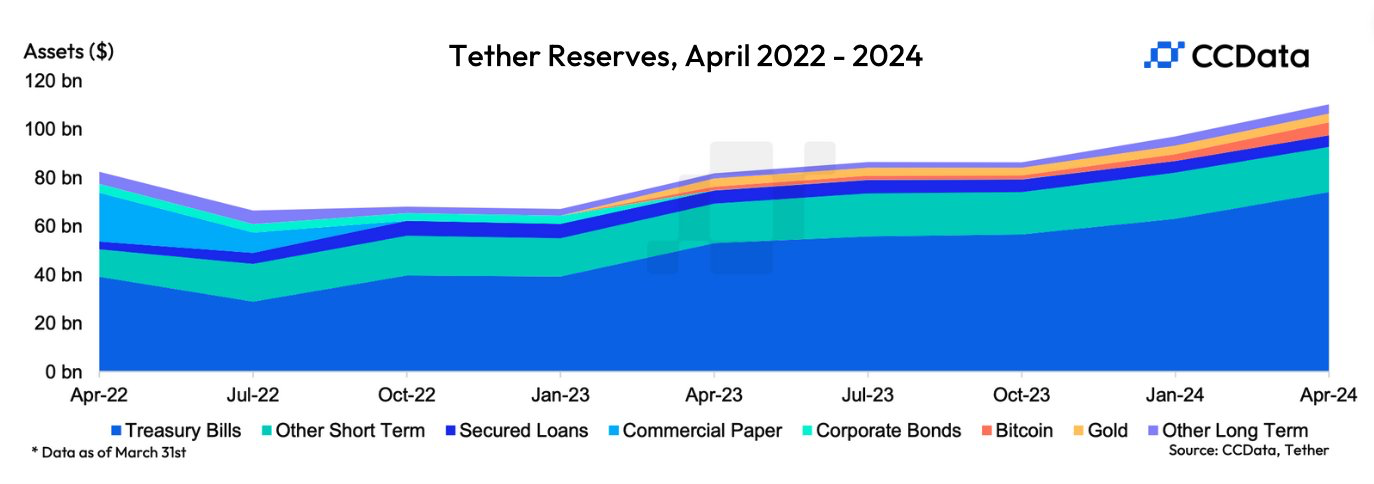

The company’s strategy has proven successful, as evidenced by its financial results. In the first quarter, Tether reported significant profits. USDT’s market capitalization reached a record $111 billion, accounting for 77% of the trading volume among the top ten stablecoins on centralized exchanges.

Read more: Bitcoin Mining From Home: Is It Possible in 2024?

Tether’s investment in Bitdeer is a strategic step in the development of the crypto economy. By supporting Bitcoin mining, the company secures a critical component of the crypto ecosystem. This move aligns with Tether’s broader strategy to diversify its portfolio and reinforce the stability and reliability of its USDT through investments in blockchain technology, exemplified by its partnership with Bitdeer.