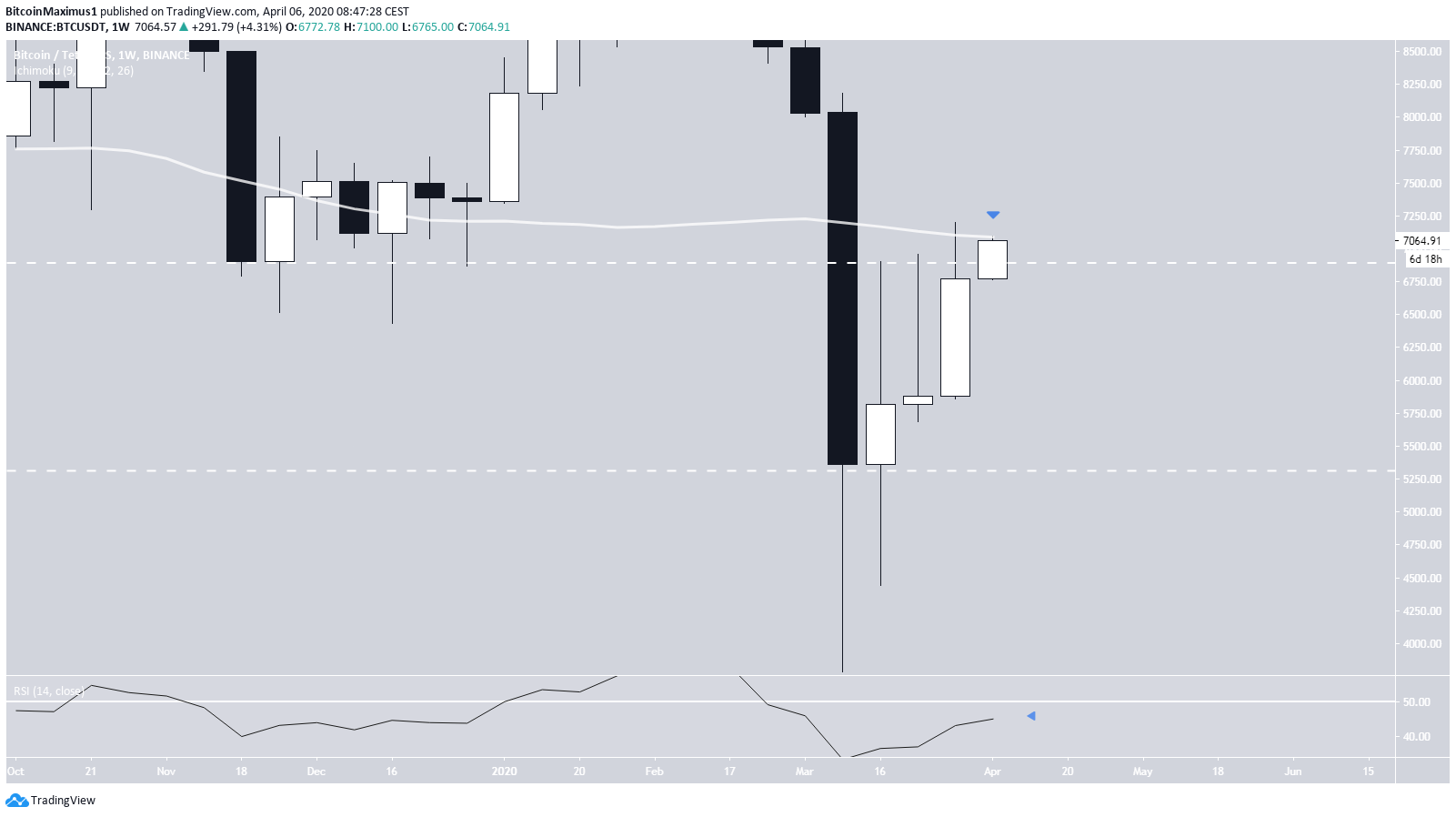

The Bitcoin price increased considerably during the week of March 30-April 6. The price began the week at $5,880 and increased all the way to $7,198 before reaching a close of $6,772.

The price created a bullish candlestick that closed well inside the resistance from the previous long upper-wicks.

Bitcoin’s Weekly Close

Despite the considerable increase that is clearly visible in high time-frames, the BTC price has yet to reach a close above the main resistance area found at $6,900. This level coincides with the 100-week moving average (MA). Until the price successfully moves above this level and flips it as support, we cannot consider the long-term trend bullish. In addition, the RSI has yet to reach the 50-line and move above it, which would also be a bullish sign.

Ascending Wedge

In the medium-term, it definitely seems as if the price is trading inside an ascending wedge. The price has been unable to sustain a breakout once moving above $6,900. This is indicative that the resistance line is ascending and invalidates the previous possibility that the price was trading inside an ascending triangle, which is a bullish pattern. The retracement has reached the 0.618 Fibonacci level, which is a level that could initiate a reversal, especially considering that the price has created a bearish pattern. However, there is no bearish divergence yet to confirm that a breakdown will occur. Due to the lack of overhead resistance, a breakout above this level could trigger a rapid price increase towards $8,000. In the current climate, however, that seems unlikely.

Short-Term View

In the short-term, the price has broken out from a symmetrical triangle and is in the process of creating a double-top near $7,200. Furthermore, low time-frames have begun to show bearish divergence in the RSI, a sign that the price wants to move downwards. Therefore, considering that the price is trading at important resistance levels in high time-frames and has begun to show weakness in short-term, a price decrease is expected.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored