Bitcoin (BTC) has been consolidating just below the $30,500 area over the past five days and short-term readings suggest that the price will not be successful in moving above the area, rather it will break down prior to potentially making another breakout attempt.

BTC has been decreasing since it broke down from an ascending parallel channel on May 5. So far, it has fallen to a low of $26,700 on May 12.

The price bounced afterward and has attempted to initiate an upward movement. Still, it has yet to move above the $30,500 area. This is a crucial horizontal area since it previously had acted as support since June 2021.

As a result, its reclaim is crucial in order for the possibility that the trend is still bullish to remain valid.

The daily RSI supports the resistance at $30,500 since it is following a descending resistance line that aligns with this level.

Short-term BTC movement

The six-hour chart shows that BTC has broken out from a descending resistance line, which had previously been in place since the aforementioned May 5 breakdown.

The breakout from the resistance line was combined with a bullish divergence in the RSI (green line), whose trendline is still intact.

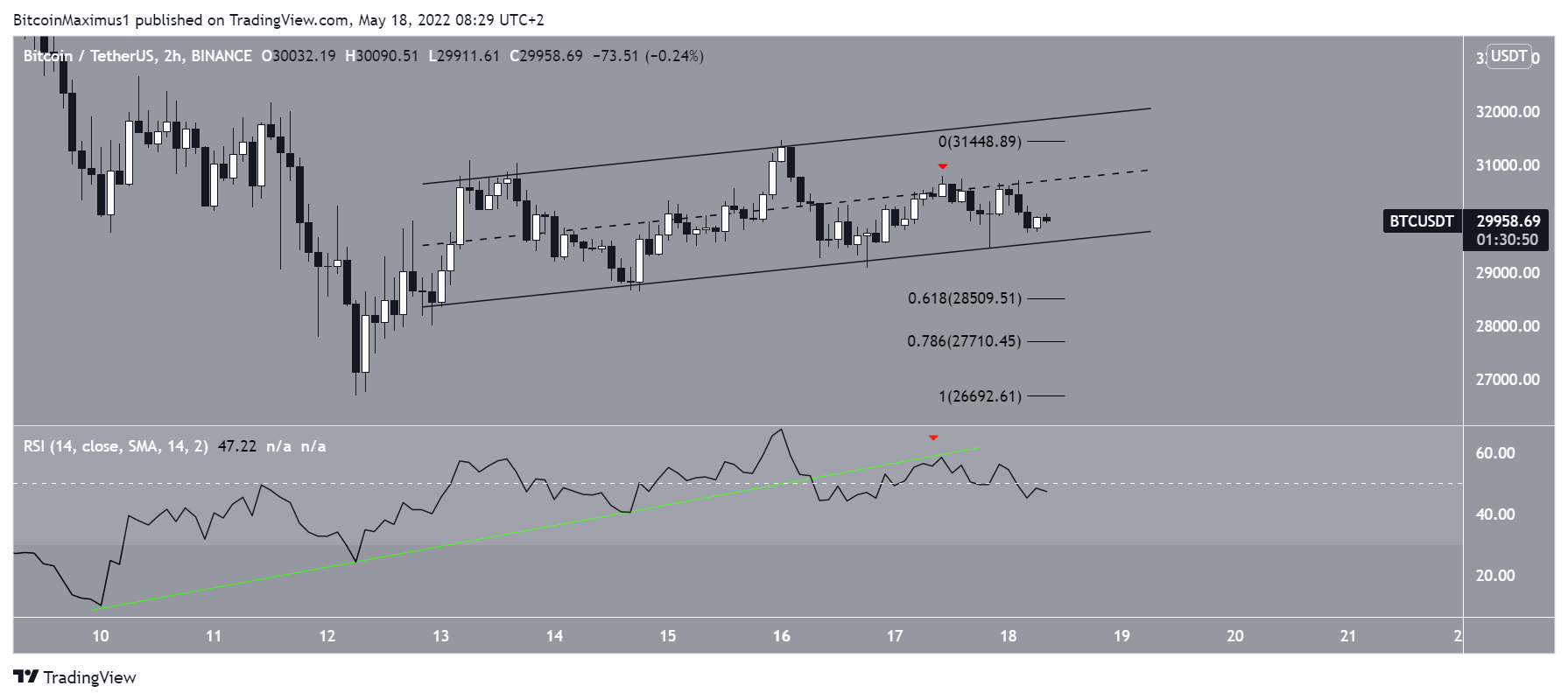

Despite this movement, the two-hour chart suggests that a breakdown is likely.

There are two main reasons for this. Firstly, the bullish divergence trendline has broken. The RSI rejection coincided with a rejection from the middle of the channel.

Secondly, BTC has been trading inside an ascending parallel channel since May 13. Such channels usually contain corrective movements, meaning that a breakdown would be the most likely scenario.

If one occurs, the closest support area would be between $27,700 to $28,500, created by the 0.618 to 0.786 Fib retracement support levels.

For Be[in]Crypto’s previous Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.