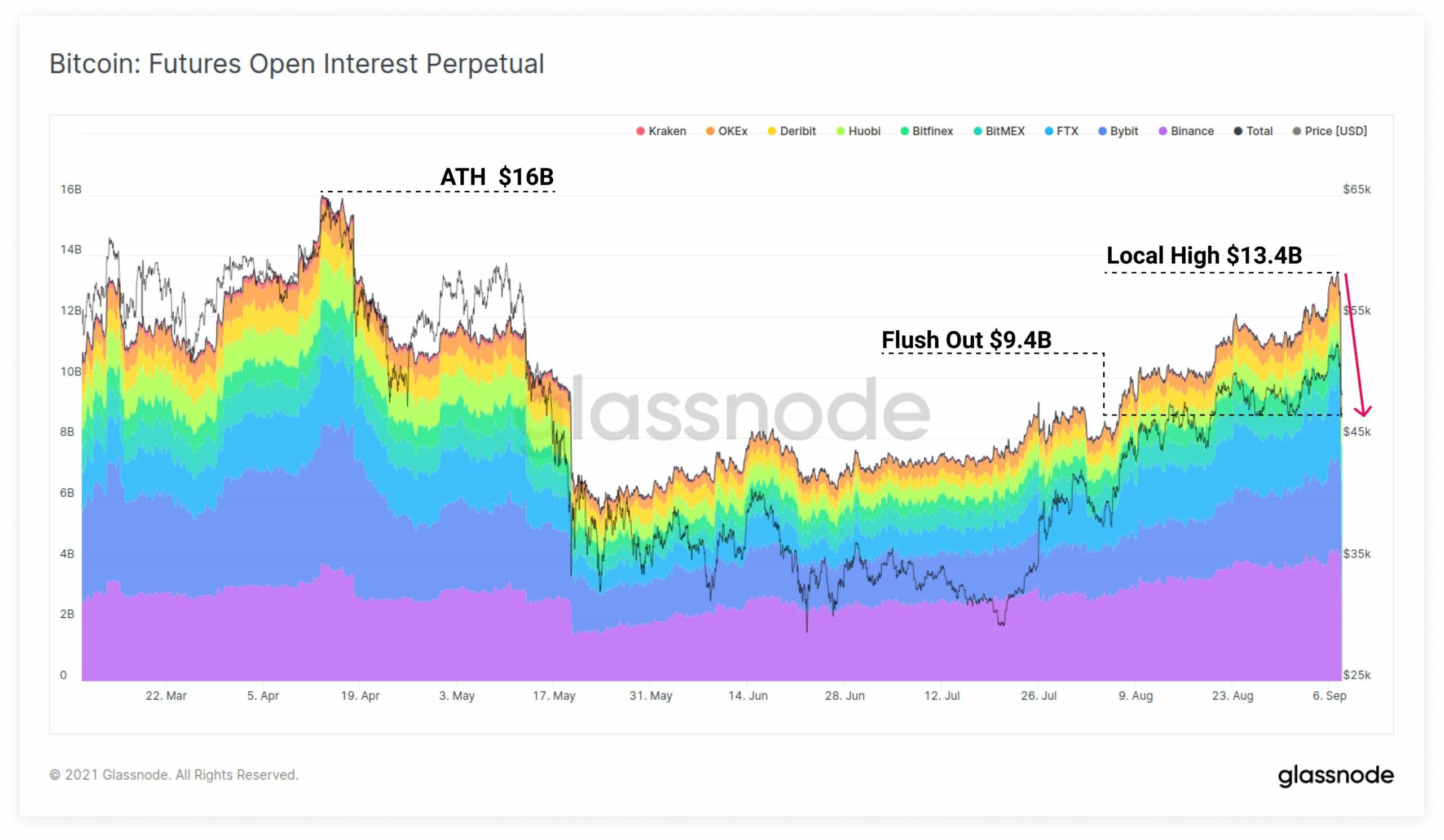

There was a massive liquidation of leveraged long positions yesterday. Traders collectively lost around $4 billion in bitcoin (BTC) futures in a few hours.

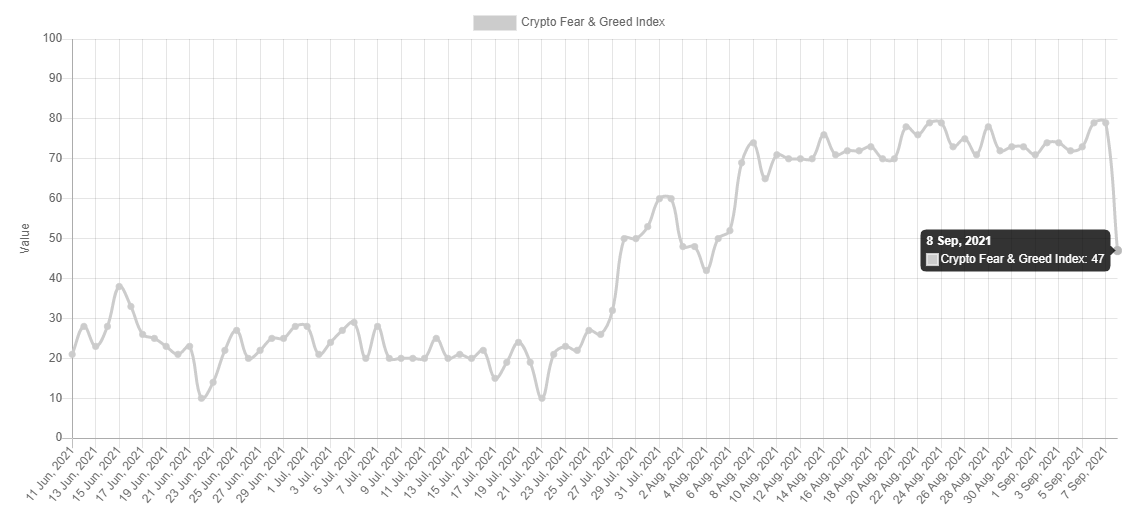

In addition, the funding rate for perpetual futures became negative for the first time in over a month. Furthermore, the Fear and Greed Index has fallen out of extreme greed territory. It’s currently trending at 47, which corresponds to a neutral sentiment.

SponsoredOpen interest breaks down

The cryptocurrency market saw a flash crash yesterday, with the size of Bitcoin’s daily red candle exceeding $10,000. Counting from its peak at $53,000 to its bottom at $42,800, the largest cryptocurrency saw a 19% decline. Most altcoins suffered worse, some even lost up to 30% of their value.

Leveraged traders, some of whose long positions were completely wiped out, suffered the most. Yesterday’s liquidation of leveraged positions for Bitcoin and Ethereum was the largest since the April-May 2021 declines.

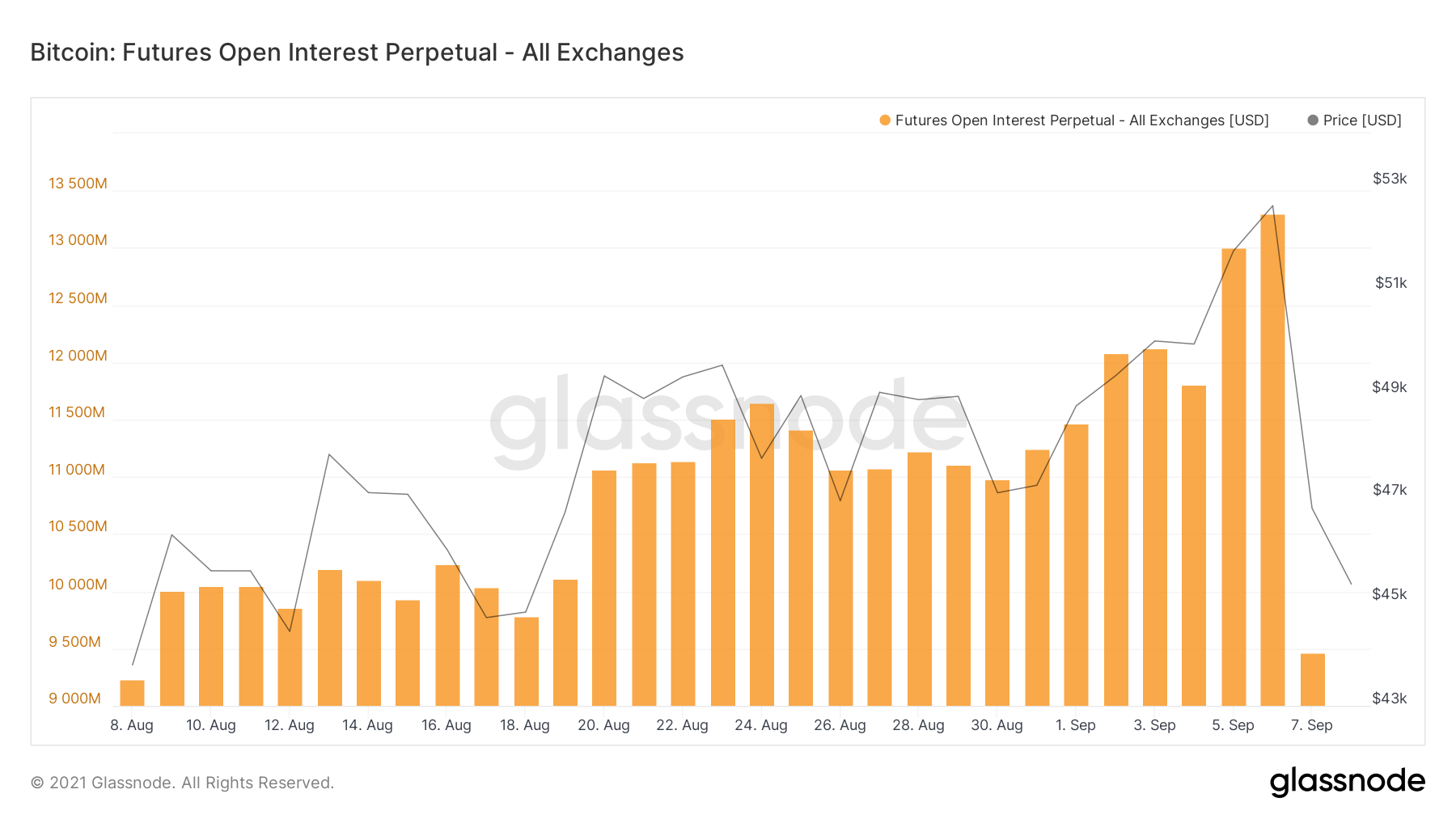

Open interest on perpetual futures fell from $13.3B to $9.46B. This means that the decline wiped out almost $4B in leveraged positions.

This is the biggest plunge in the market this month. The value of open positions in perpetual futures is back to levels seen on Aug 8. The $4B liquidations of leveraged positions yesterday were confirmed by Glassnode.

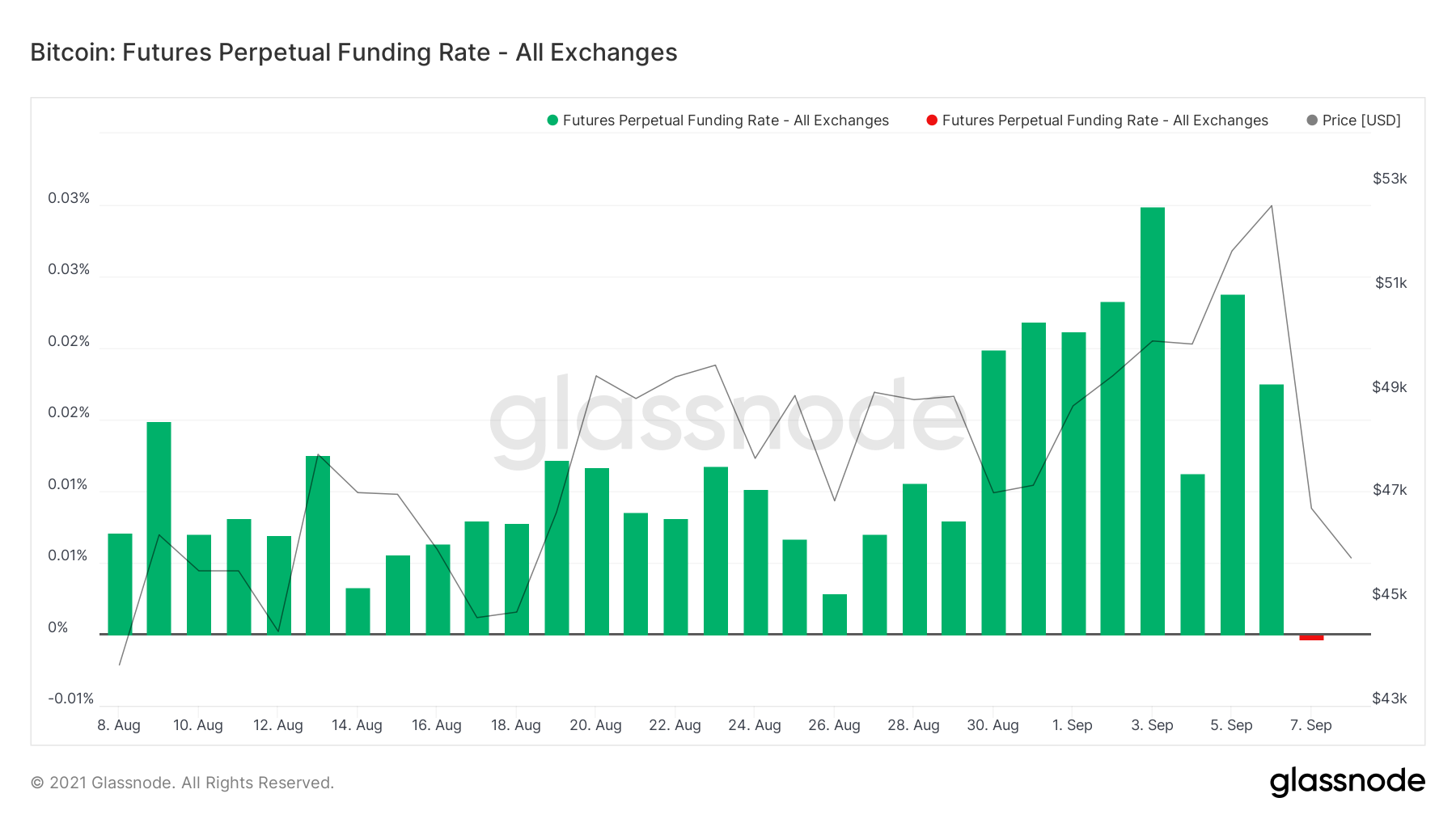

Negative funding rate

Another indicator that confirms the liquidation of long leveraged positions and a change in trader behavior is the funding rate for perpetual futures. When the rate is positive, long positions periodically pay short positions. Conversely, when the rate is negative, short positions periodically pay long positions.

Yesterday, for the first time since the beginning of August, the funding rate for all cryptocurrency exchanges became negative. This means that more and more traders are betting on further declines and are willing to pay extra to hold their short positions.

Cryptocurrency trader @dilutionproof highlighted the negative funding rate in a tweet today. He emphasized that “there is currently a tendency to short Bitcoin” and added:

“Now that over-leveraged longs have been flushed out of the market, could this be fertile ground for a nice little recovery bounce? (Or is this perhaps a bit too soon?)”

The end of extreme greed

One other macro indicator that reacted to yesterday’s flash crash was the Fear and Greed Index. Yesterday it fell from a reading of ‘extreme greed’ at 79 to neutral sentiment at 47. This indicator too is currently back to its early August value.

The last time that the Fear and Greed Index gave neutral readings was when bitcoin experienced its first wave of gains after rebounding from a long-term low at $30,000. Then, the largest cryptocurrency stabilized its price in the range of $38,000-$42,500, only to continue rising a few days later.