Bitcoin prices have fallen to their lowest levels since mid-March. However, the asset has retained its store of value properties, outperforming gold by a large margin this year.

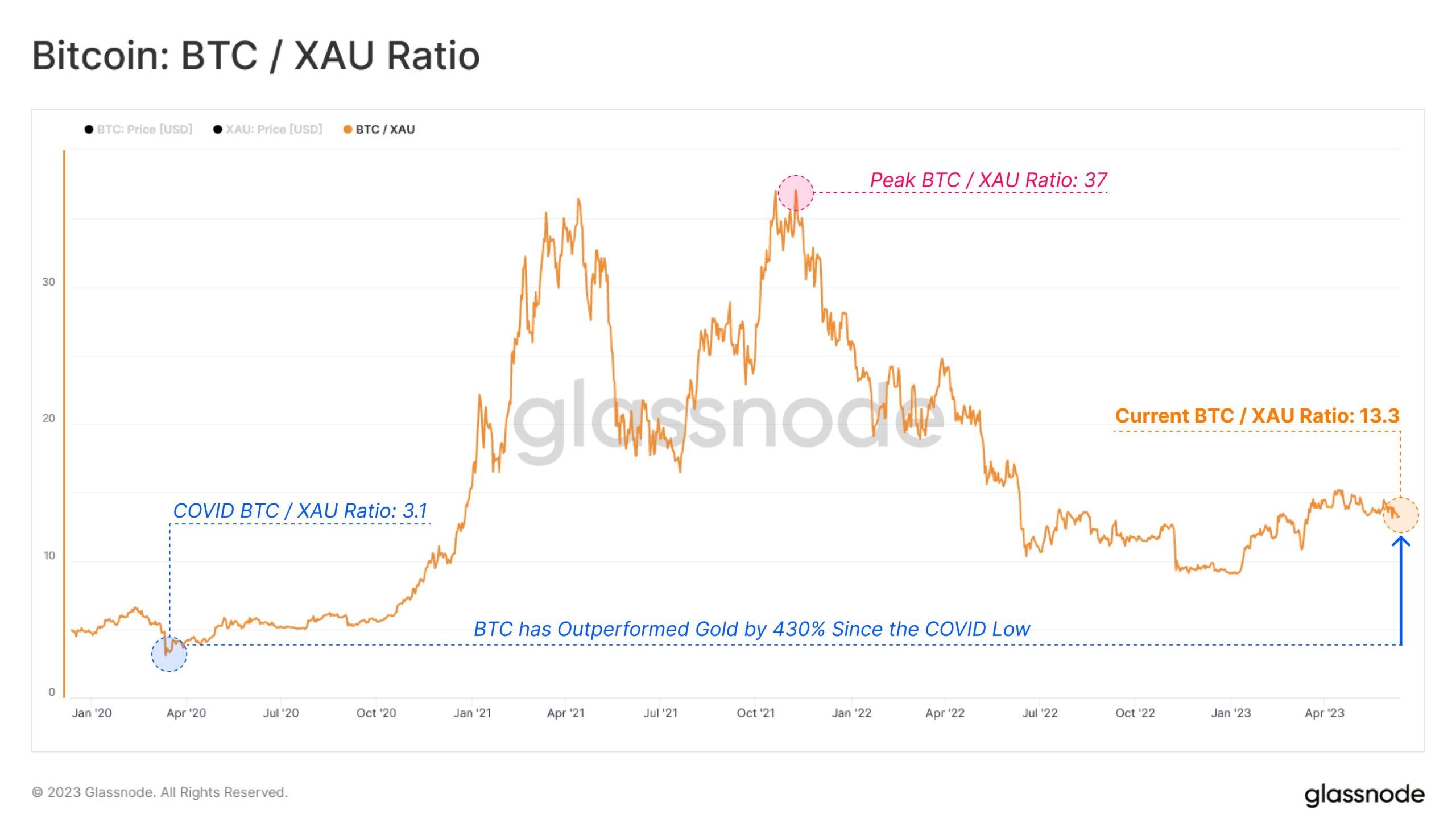

On-chain analytics firm Glassnode has been comparing Bitcoin prices with gold prices. Furthermore, the spot price of Bitcoin is equivalent to 13.3 ounces of gold, a year-to-date increase of 46%.

Bitcoin Vs Gold — The Battle Rages On

Additionally, Bitcoin has outperformed gold by a staggering margin of around 430% since the COVID-19 low in March 2020.

The data suggests that Bitcoin is still considered a store of value, despite its current price volatility.

Since the beginning of 2023, Bitcoin’s value has increased by 51.6%. If counting its peak price for the year in mid-April, that increase would be a doubling in value.

Comparatively, gold prices are up just 6.2% since the beginning of the year. Gold is currently trading at $1,940/oz, falling 5% from its mid-April all-time high of $2,040/oz.

However, the more volatile Bitcoin is in a worse position, losing 63.7% from its all-time high of $69,000 in November 2021.

The takeaway is that they are both excellent stores of value or safe havens, with gold being slow and steady and BTC being more of a roller-coaster ride.

Find out more on the origins of digital money:

What Is Bitcoin? A Guide to the Original Cryptocurrency

Conversely, the U.S. dollar has devalued significantly over the past few years due to high levels of inflation. According to Inflation Tool data, cumulative inflation from 1956 to 2022 is a whopping 976%. This means that $100 back then is equivalent to almost $1,000 now.

Inflation in America is currently 4% after falling from over 9% this time last year due to Federal Reserve interest rate hikes.

On June 14, the Fed announced that it was pausing rate hikes for the month. It is the first such suspension since it started hiking them in March 2022 in response to the galloping inflation.

Bitcoin Prices Drop to Three-Month Low

Bitcoin has reacted badly to the Fed announcement and increasingly negative market sentiment amid America’s crypto crackdown.

BTC slumped to a three-month low of $24,879 a few hours ago in the early hours of June 15.

The asset has recovered to hover just above the $25,000 level at the time of writing but is looking increasingly bearish.

BTC has broken out of its long-term consolidation channel and has found support at current levels. A break below this level could see more support at $23,600, where it bounced several times in January and February.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.