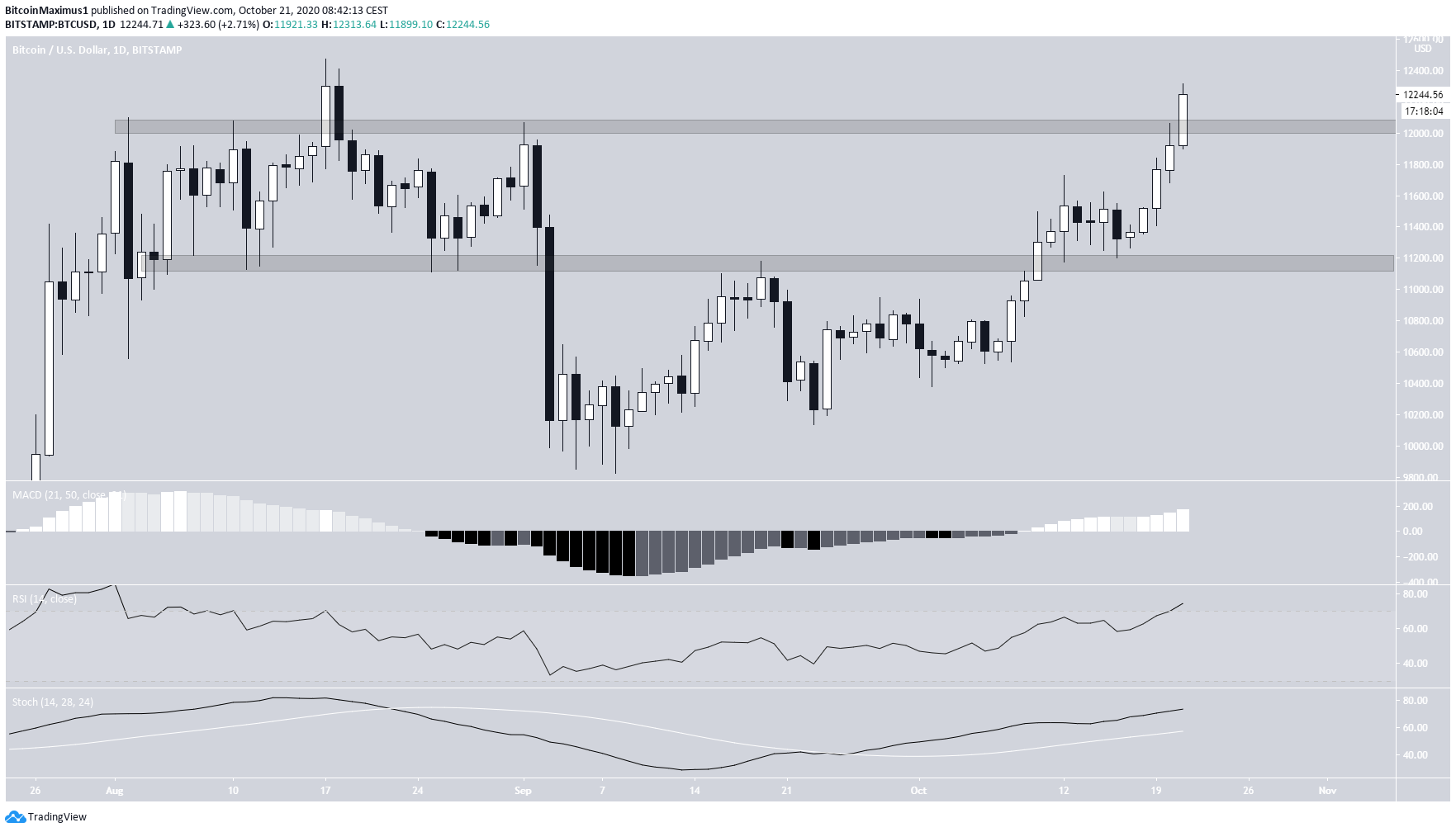

On Oct 20, Bitcoin (BTC) created a bullish engulfing candlestick and proceeded to move above an important resistance area.

A daily close above the $12,050 area would be a significant bullish sign, while a weekly close above the current level would be an even more considerable signal for continuation to new 2020 highs.

Bitcoin Reaches September Highs

On Oct 19, the Bitcoin price created a bullish candlestick and moved above the previous highs at $11,600. The price has continued increasing and is in the process of creating another bullish engulfing daily candlestick, so far-reaching a daily high of $12,313.

If today’s candlestick closes at the current level, it would likely confirm a breakout above the $12,050 area. The area has acted as resistance since the beginning of August, with the exception of a fakeout on Aug 17. A breakout above this level would be a major bullish development.

Technical indicators do not yet show any type of weakness, even though the RSI is overbought.

Despite the increase, the price is trading at a crucial long-term resistance at $12,250. This resistance also rejected the price in July 2019. Bitcoin has not reached a close above this level since January 2018. Furthermore, it coincides with a descending resistance line drawn from the aforementioned July highs.

In addition, both the RSI and MACD have generated unconfirmed bearish divergences.

Therefore, whether the price breaks out or gets rejected from the current level will have major implications for the future trend. A weekly close above $12,250 would be extremely bullish.

No Weakness Present

The shorter-term six-hour chart does not show any structure in place. Furthermore, even though the RSI is overbought, it has not generated any bearish divergence. Similarly, the MACD is moving upwards.

The closest support area, however, is found all the way back at $11,200.

There is no weakness present in the two-hour chart either. While the RSI initially was in the process of generating bearish divergence, it proceeded to move upwards and invalidate it. The MACD is also moving upwards.

The closest support/resistance flip occurred at $11,700 and is now expected to act as support. The level also coincides with a potential ascending support line, drawn from the Oct 16 bottom.

As long as the price is trading above this level, the possibility for continuation remains high.

To conclude, while the Bitcoin rally has become overextended, there is no definite weakness present yet. As long as the price is trading above the $11,700 level and the ascending support line, the trend is considered bullish.

For BeInCrypto’s previous Bitcoin analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto.