The past 24 hours have been challenging for the short-sellers as Bitcoin (BTC) hit the $28,000 mark after spending nearly one month below it. As a result, over $100 million worth of shorts got liquidated.

October has ushered in a bit of pressure on crypto bears. And according to historical bullish patterns in October, the pressure may just be getting underway.

Over $100 Million Worth of Crypto Short Positions Liquidated

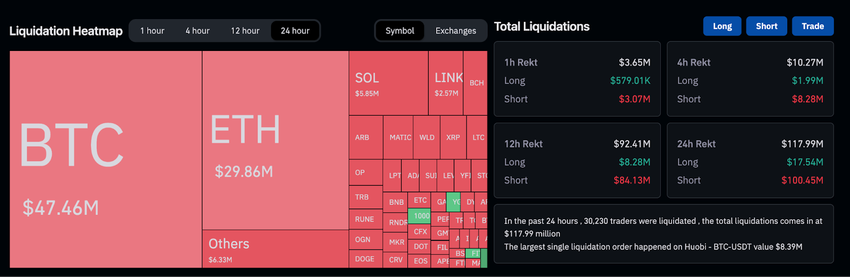

According to the data from Coinglass, traders lost over $117.99 million to liquidations in the past 24 hours. While some long positions were also liquidated, the majority of losses came from short positions.

In the past 24 hours, short-sellers ate more than $100 million in losses

Read more: What are Perpetual Futures Contracts in Cryptocurrency?

The markets showed a sudden uptick in the price, particularly in the past 12 hours. The data shows that over $84 million worth of short positions faced liquidations in just the past 12 hours.

The liquidations came as BTC shot up by nearly 5%, trading at $28,416 at press time. Meanwhile, the Ethereum (ETH) price increased by 3.2% in the past 24 hours.

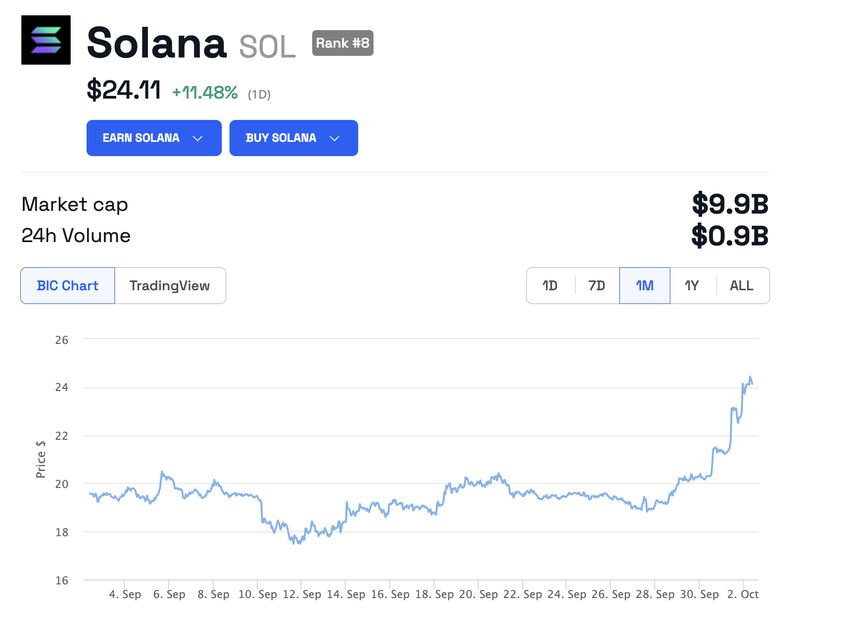

Among the top 20 cryptocurrencies based on market capitalization, Solana (SOL) has given the highest 24-hour price gain. As of writing, it is trading at $24.11, up by 11.48%. Meanwhile, BeInCrypto reported that Solana’s Total Value Locked (TVL) reached $337.49M, its highest in 2023.

Read more: How to Buy Solana (SOL) and Everything You Need To Know

Is it ‘Uptober?’

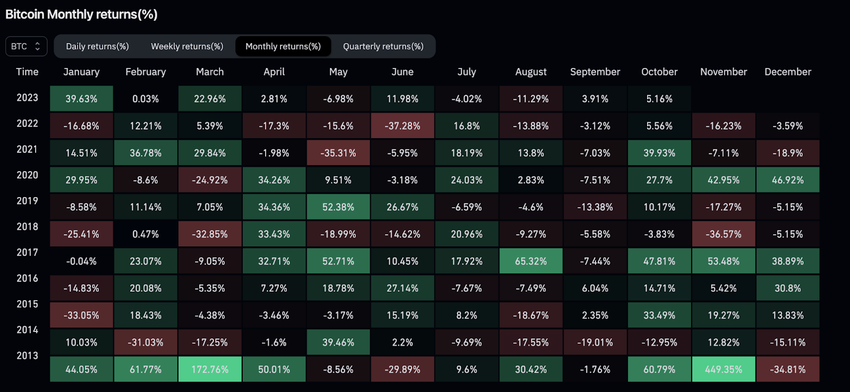

The screenshot below shows that October has historically been a bullish month for Bitcoin. Since 2013, BTC has given negative returns only twice, in 2014 and again in 2018.

Due to this, some crypto community members have coined the term “Uptober,” referring to the normal bullish price action for October:

“Is it another UPtober for Bitcoin??”

Do you have anything to say about Bitcoin short-sellers, the October rally, or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.