Rumors about an approval of the iShares Bitcoin spot Exchange Traded Funds (ETF) sent the price of BTC skyrocketing, only to come back to Earth when the asset managers, BlackRock, confirmed the news was false.

Rumors about the US Securities and Exchange (SEC) approving the spot Bitcoin ETF sent the BTC price nearly to $30,000. However, the price has started retracing back to the $28,000 level after BlackRock called out the rumors.

Read more: 14 Best No KYC Crypto Exchanges in 2023

Finance journalist Eleanor Terrett wrote on X:

“BlackRock has just confirmed to me that this is false. Their application is still under review.”

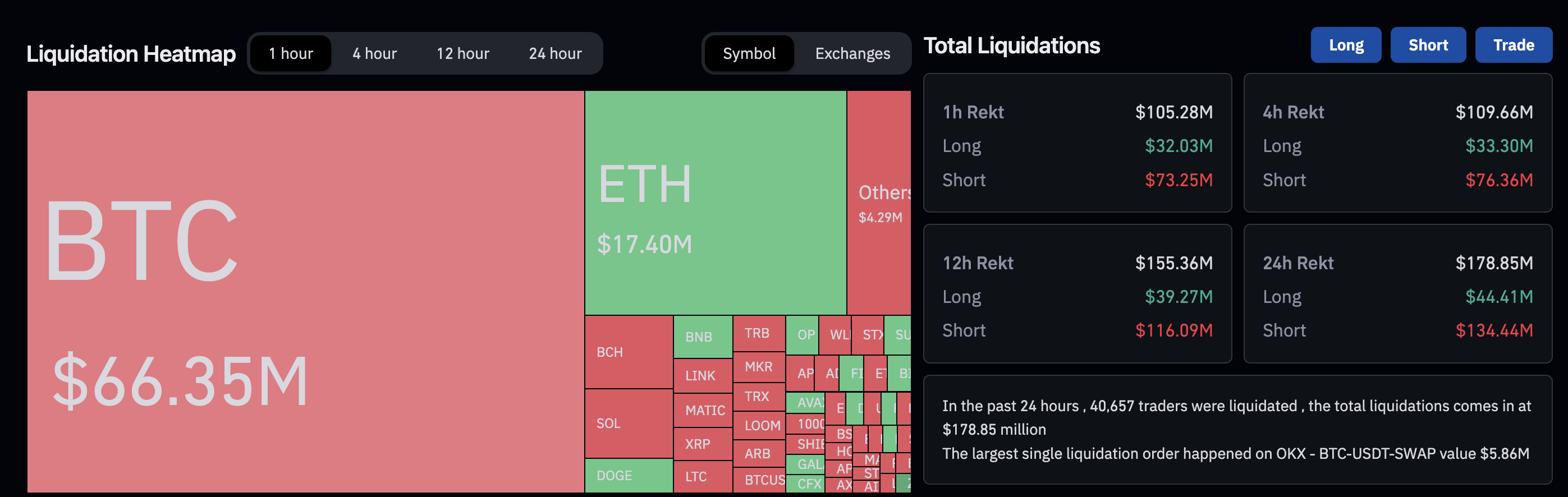

Due to the volatility brought by the rumors, trades worth over $105.28 million were liquidated in one hour. Specifically, $32.03 million in longs and $73.25 million worth of short trades were liquidated

The crypto media publication Cointelegraph issued an apology after breaking the news and said it is conducting an internal investigation into the error. It wrote on X (Twitter):

“We apologize for a tweet that led to the dissemination of inaccurate information regarding the BlackRock Bitcoin ETF.

An internal investigation is currently underway. We are committed to transparency and will share the findings of the investigation with the public once it is concluded.”

Meanwhile, analysts believe there is a high possibility of the approval of spot Bitcoin ETF. The SEC has decided not to appeal an order requesting it to review Grayscale’s application to turn its Bitcoin Trust into an ETF.

Do you have anything to say about this article or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.