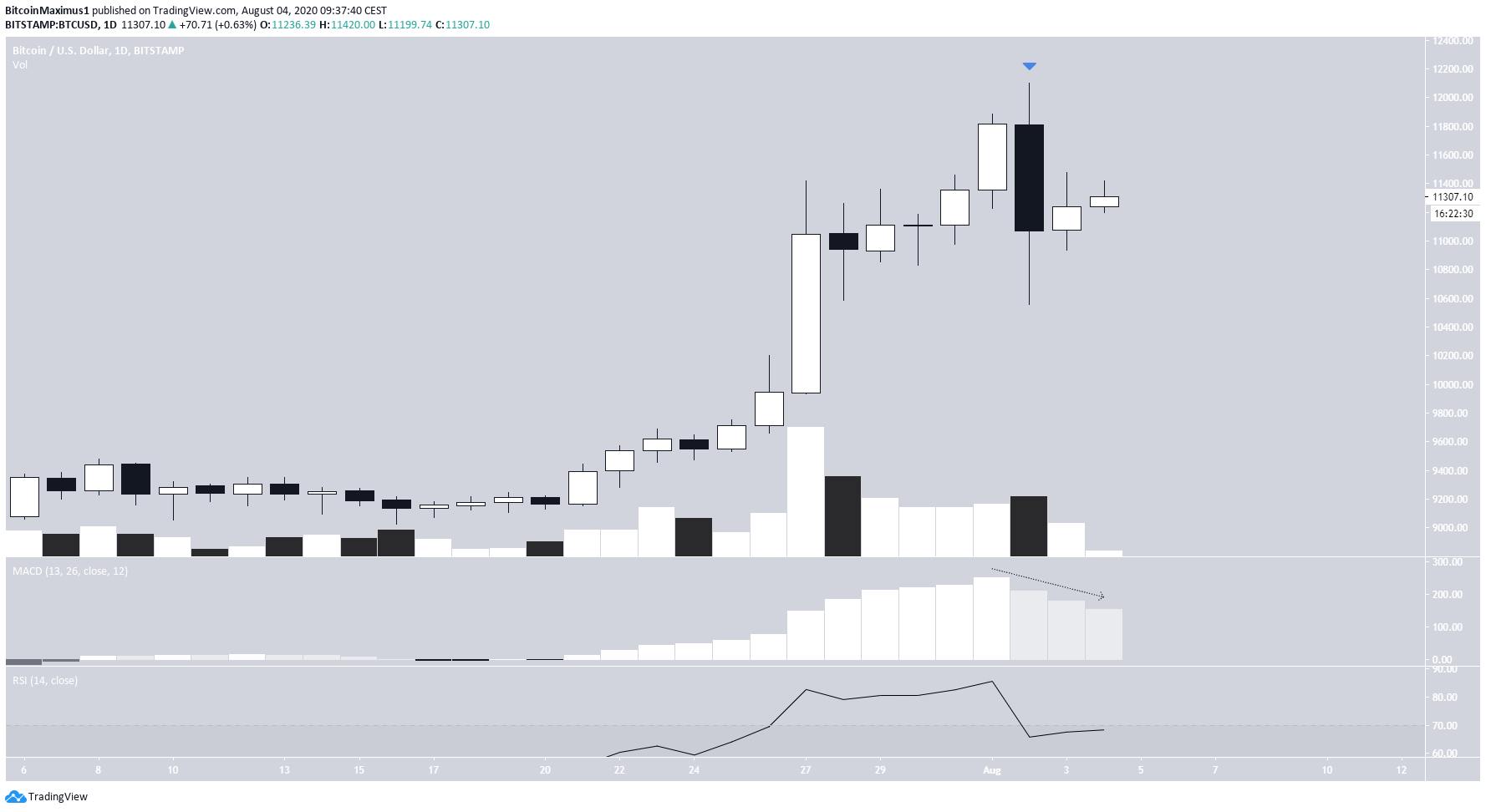

The Bitcoin (BTC) price decreased considerably on August 2, creating a very significant bearish engulfing candlestick.

The price has been increasing since, but the move is more akin to a retracement as a result of the decrease rather than the beginning of a new upward trend.

Bitcoin Retracing

On August 2, the Bitcoin price created a bearish engulfing candlestick that reached a close well below the preceding bullish candle, possibly indicating that the previous upward move has ended. However, while volume was significant, it was not considered above average.

The MACD is showing weakness, as it has generated two successive lower momentum bars, a bearish sign in an uptrend. The RSI has begun to fall but has not generated any bearish divergence yet.

Correction Or Impulse?

After the decrease on August 2, BTC has been gradually moving upwards, almost reaching the 0.618 Fib level of the entire previous decrease at $10,515. If successful in breaking out, the next resistance would likely be found at the 0.786 Fib level near $11,775.

Short-term technical indicators are neutral, leaning towards bearish. The MACD has lost steam but is not in negative territory yet, and a bearish cross has not transpired. The RSI is hanging around the 50-line.

A bearish cross and/or an RSI decrease below 50 would confirm that the price is likely heading downwards.

The shorter-term chart shows a possible ascending channel, whose resistance line coincides with the previously mentioned 0.618 Fib level. In addition, the price is following a descending resistance line. A breakout from this line would likely take BTC towards the first resistance outline below:

Wave Count

As for the wave count, it is likely that the price began an A-B-C correction on August 2, completing the A wave immediately with a low of $10,518. Currently, it is likely in the B wave, which is transpiring with a W-X-Y formation.

If the length of waves W and Y are the same, the price would be expected to reach a high near $11,775, the 0.786 Fib level.

To conclude, the Bitcoin price is likely retracing in response to the decrease that transpired on August 2. The retracement could end between $10,515-$10,775.

For our previous analysis, click here.