On Aug 26, the Bitcoin (BTC) price moved upwards, retracing as a result of the decrease from the day prior.

Based on several indicators, it looks like Bitcoin will be forced to drop back further.

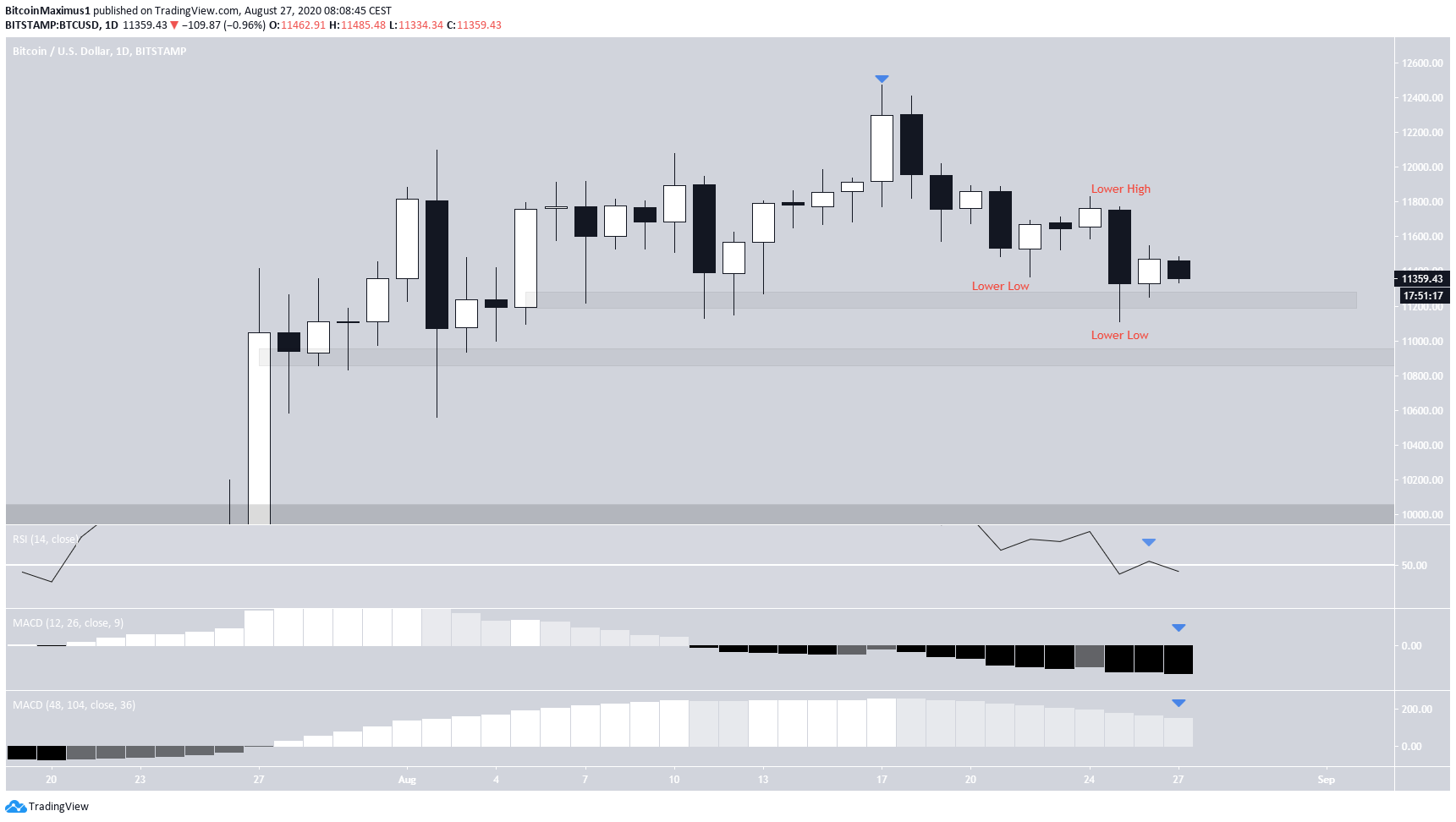

Bitcoin’s Lower High

The Bitcoin price has been decreasing since it reached a high of $12,468 on Aug 17. Since then, the price has created one lower-high and two lower-lows.

After the bearish engulfing candlestick on Aug 25, the Bitcoin price created a small bullish candle the next day and closed below the midpoint of the preceding bearish candlestick.

The price is currently resting a little bit above the support of the bullish engulfing candlestick from Aug 5 and the lower wicks that succeeded it around $11,200. If the price breaks down from this support area, the next support level would likely be found at $10,900. If this secondary support breaks, it could trigger a rapid drop all the way down to $9,900.

Technical indicators are bearish. The RSI has fallen below 50 and validated the line as resistance, the short-term MACD is falling and is in negative territory as is the long-term MACD, although it’s still in positive territory.

Bullish Pattern

Since the aforementioned Aug 17 high the price has possibly been trading inside a descending wedge, which is normally considered a bullish reversal pattern. However, neither the resistance nor support lines are confirmed. The former does not have many touches or the resistance line, while there are numerous wicks seen with the latter. This makes it nearly impossible to outline the correct slope.

We can see that the price has re-tested the $11,200 level as support numerous times, so a breakdown below it would likely trigger a rapid decrease.

Volume has been higher during the decreases, and there is no bullish divergence in the RSI. Furthermore, the latter is not in oversold territory yet but is below 50, giving a bearish reading.

The hourly chart shows that the price initially broke out from the $11,400 area, which had been previously acting as resistance. However, it fell right back under this range and is currently in the process of validating it as resistance.

Unless the price is able to successfully flip this area as support, and then break out from the descending resistance line afterward, the movement is considered bearish.

Wave Count

In our previous analysis, BeInCrypto stated that:

To conclude, the Bitcoin price is correcting in a movement that is expected to end near $9,900. The other possibility is that the move ends near $10,900, but is less likely as there are no reversal signs suggesting that the price will do so.

Nothing has changed to alter this hypothesis, so we still believe this to be the most likely scenario.

To conclude, the Bitcoin price is expected to initially fall towards $10,900, and possibly go lower after.

For our previous Bitcoin analysis, click here!