Bitcoin (BTC) has started the week on a down note, trading within the $58,000 range after briefly surpassing $60,000.

Analysts warn that conditions might worsen before improving, especially with the presence of a reversal zone that could influence price movement. Additionally, the crypto markets are anticipating key events this month, which could lead to increased volatility for Bitcoin.

Bitcoin Risks a Further Correction

QCP Capital researchers expect Bitcoin to face further correction, with Bitcoin likely to find strong support around the $54,000 level. This comes after Bitcoin ended the month down 8.6%, impacted by the Bank of Japan (BOJ) crash earlier.

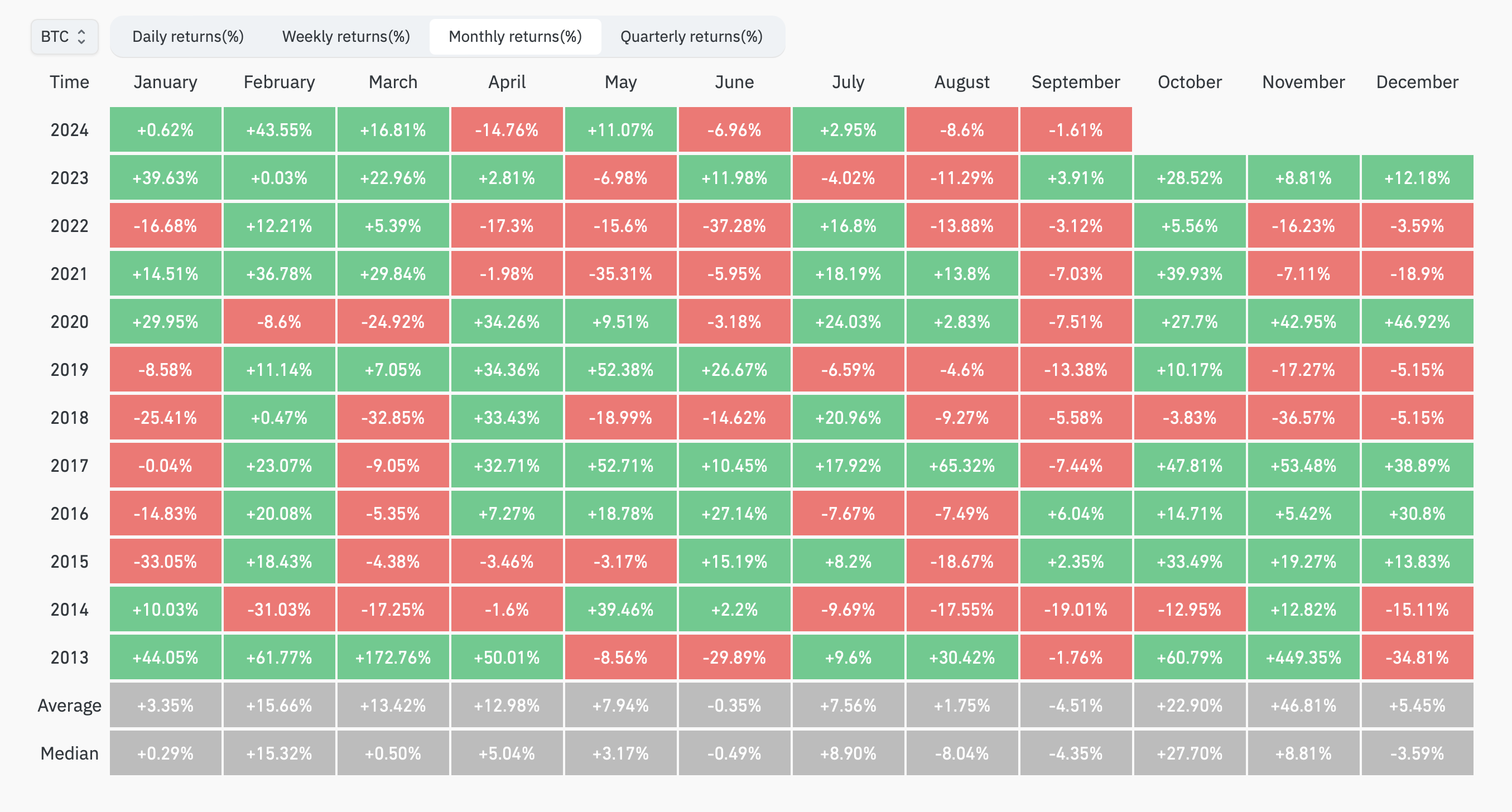

QCP points out Bitcoin’s historical trend of a -4.5% return in September, suggesting a potential retracement to around $55,000. Indeed, historical performance data paints a grim picture for September. According to Coinglass, Bitcoin has consistently underperformed this month, with an average return of -4.78% since 2013.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Moreover, the third quarter (Q3) has historically been tough for Bitcoin and the broader crypto market, with September often bringing caution among investors. This approach is reflected in the poor performance of Bitcoin ETFs, including BlackRock’s iShares Bitcoin Trust (IBIT). The recent CryptoQuant report notes fewer stablecoin inflows, signaling that investors remain wary and believe the downtrend may continue.

However, popular trader Daan Crypto Trades points to the potential for a short-term pullback due to a new CME Gap near $59,000 and last week’s gap.

“A new CME Gap was made this weekend sitting at ~$59,000. Last week’s gap is also still partially open but the price did close most of it during that move to $61,000,” the trader wrote.

A CME gap occurs when Bitcoin’s price on the Chicago Mercantile Exchange (CME) differs between the market’s close and its reopening after a weekend or holiday. These gaps are often filled as the price tends to return to the gap’s level.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Amidst current market volatility, Bitcoin whales are actively adjusting their portfolios. For instance, one whale withdrew 1,100 BTC from Binance, while another bought 1,000 BTC, increasing their holdings.

Avinash Shekhar, Co-founder of Pi42, predicts further fluctuations, especially with upcoming US economic events. He notes that a strong September employment report could temper expectations for easier monetary policy.

“A strong September US employment report could temper expectations for easier monetary policy, potentially leading to further market volatility. However, there’s also a 50% chance of an upward trend,” Shekhar told BeInCrypto.

As of now, Bitcoin is trading at $58,391, down 0,31% in the last 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.