The number of Ordinals inscriptions on Bitcoin network has crossed 25 million, marking a remarkable milestone for the protocol launched in December 2022. The record number is amid a decline in trading volume for these digital assets.

Since the beginning of the year, Inscriptions on the flagship digital asset blockchain have generated massive interest and significantly impacted network activities.

Bitcoin Ordinals Cross 25 million

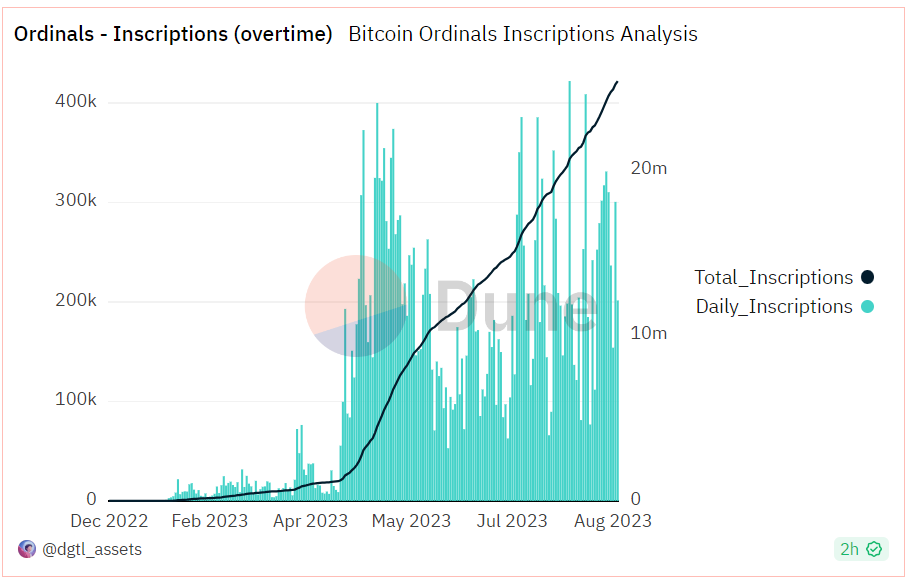

According to Dune analytics data, the number of inscriptions on Bitcoin is now more than 25 million — reaching a daily all-time high of 422,164 on July 30. Ordinals Inscriptions are similar to NFTs that can be inscribed into the smallest denomination of a Bitcoin, Satoshi.

Of the more than 25 million Inscriptions, recursive Inscriptions account for about 140,000. Recursive inscriptions are an upgrade on Ordinals, allowing developers to use data from previous inscriptions in new ones. This will enable developers to bypass the size limit on Bitcoin blocks.

With recursive inscription, Bitcoin might soon be capable of supporting complex applications, video games, and other more advanced usage. This upgrade captures the improvements that Ordinals have brought to the Bitcoin network.

Ordinal Fees Hit $50 Million

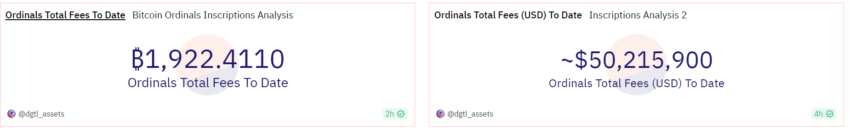

Ordinals have played a significant role in Bitcoin’s network’s fee generation. Per Dune analytics, BTC miners have earned 1,922 BTC, over $50 million, as fees from processing Ordinal transactions.

The fees have been one of the major high points of the protocol as it offered miners a chance to diversify their income source away from the reliance on mining rewards.

However, the fee generation rate declined to 2.72 BTC as of August 19 after peaking at 257.7 BTC on May 8. This decline indicates how interest in the space has gradually waned as the year progressed.

Transaction Volume Falls

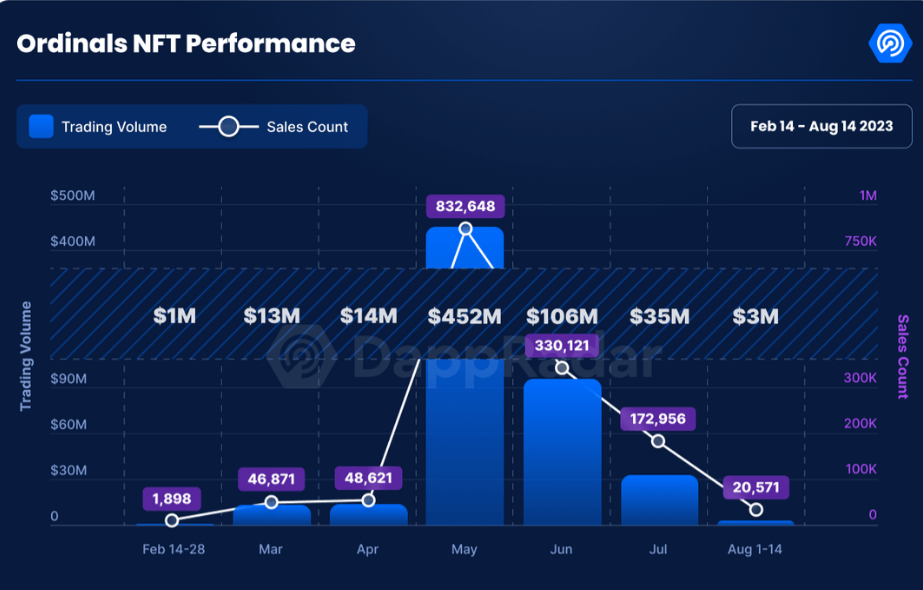

Meanwhile, DappRadar reported that Ordinals trading volume and sales count have fallen by more than 97% since May. The number of unique active wallets trading Bitcoin Ordinals has also decreased by 90%.

The blockchain firm stated that while fluctuations in sales volume could be attributed to market dynamics, a consistent decline in transaction count raises concerns about Bitcoin Ordinals’ longevity and relevance in the NFT space. It added:

“[The] steep decline in both sales volume and count within such a short period is alarming for Bitcoin Ordinals. The diminishing sales count underscores the waning enthusiasm or perhaps confidence in Bitcoin NFTs.”

Interested in AI Trading? 9 Best AI Crypto Trading Bots to Maximize Your Profits

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.