Friday is the big Bitcoin options expiry day, and total open interest, including Ethereum options, is $730 million. Crypto markets have fallen back again this week and have resumed their state of stagnation, but will today’s expiry event move them?

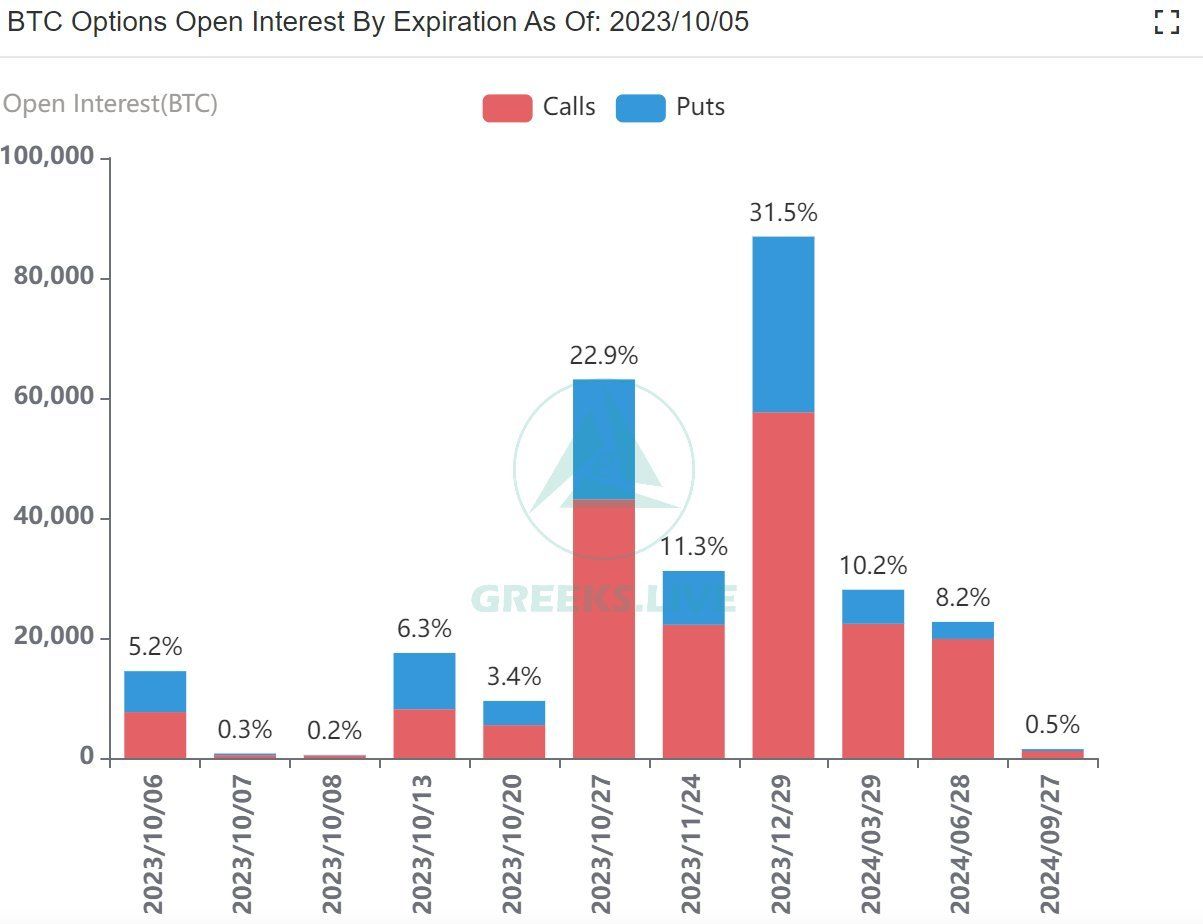

On October 6, around 14,000 Bitcoin options contracts will expire with a notional value of around $400 million. Today’s options expiry event is not as big as last week’s, which was both the end of the month and quarter.

Bitcoin Options Expiry

The max pain point for today’s batch of Bitcoin options is $27,000—around $500 lower than the asset’s current spot price.

The price level with the most open contracts is referred to as max pain. It is also the level where most losses occur when the contracts expire.

The put/call ratio for today’s options is 0.89, meaning sellers of longs and shorts are pretty evenly matched.

Greeks Live noted that Bitcoin drove the week’s uptrend, but major implied volatility remains subdued. It added that holiday factors led to lower volume in Asia time.

October and the fourth quarter have been uptrends in previous years, it said before adding:

“Puts position share remains high and with liquidity continuing to deteriorate lately, the big market could be coming this month.”

Ethereum Options Expiry

Around 200,000 Ethereum options contracts are also set to expire on October 6. They have a notional value of $330 million, bringing the total for the two to $730 million.

Furthermore, the Ethereum contracts have a put/call ratio of 0.87, which is very similar to that of the BTC derivatives.

This week’s options expiry event is unlikely to impact spot markets, which have been falling back.

Since its brief spike to $28,500 on Monday, Bitcoin has retreated 3.5% to trade at $27,485 at the time of writing. Without any additional impetus, it will likely return to support at the $27,000 level.

Meanwhile, Ethereum has lost 6.6% since its Monday pump, falling to $1,620 during Asian trading on Friday. Support for ETH is currently just below $1,600.