The Bitcoin (BTC) price is consolidating inside a symmetrical triangle that has been in place since Jan. 4. BTC is expected to continue consolidating and eventually break down.

In the short-term, as long as Bitcoin doesn’t reach a daily close below $34,000, it’s expected to move towards the resistance line of the triangle.

Bitcoin Bounces At Support

Bitcoin is still trading above the $34,000 support area, a level which has held since BTC initially broke out on Jan. 6.

While BTC has briefly fallen below this level, it has created long lower wicks and hasn’t reached a close below it. BTC did the same yesterday, initially dropping but creating a long lower wick and reclaiming the level.

Technical indicators provide mixed signals. The MACD is falling steadily and has nearly reached the negative territory. The daily RSI has generated a hidden bullish divergence, a strong sign of trend continuation.

As long as BTC is trading above and does not reach a daily close below this support level, it’s likely that the price will bounce again.

The six-hour chart supports this scenario since it shows that BTC is trading inside a symmetrical triangle and bounced on its support line yesterday. The resistance line of the triangle is currently at $37,700.

However, similar to the daily time-frame, technical indicators on the six-hour chart are neutral.

Therefore, a breakdown from the triangle would also mean a breakdown from the $34,000 support area, confirming that the trend is bearish.

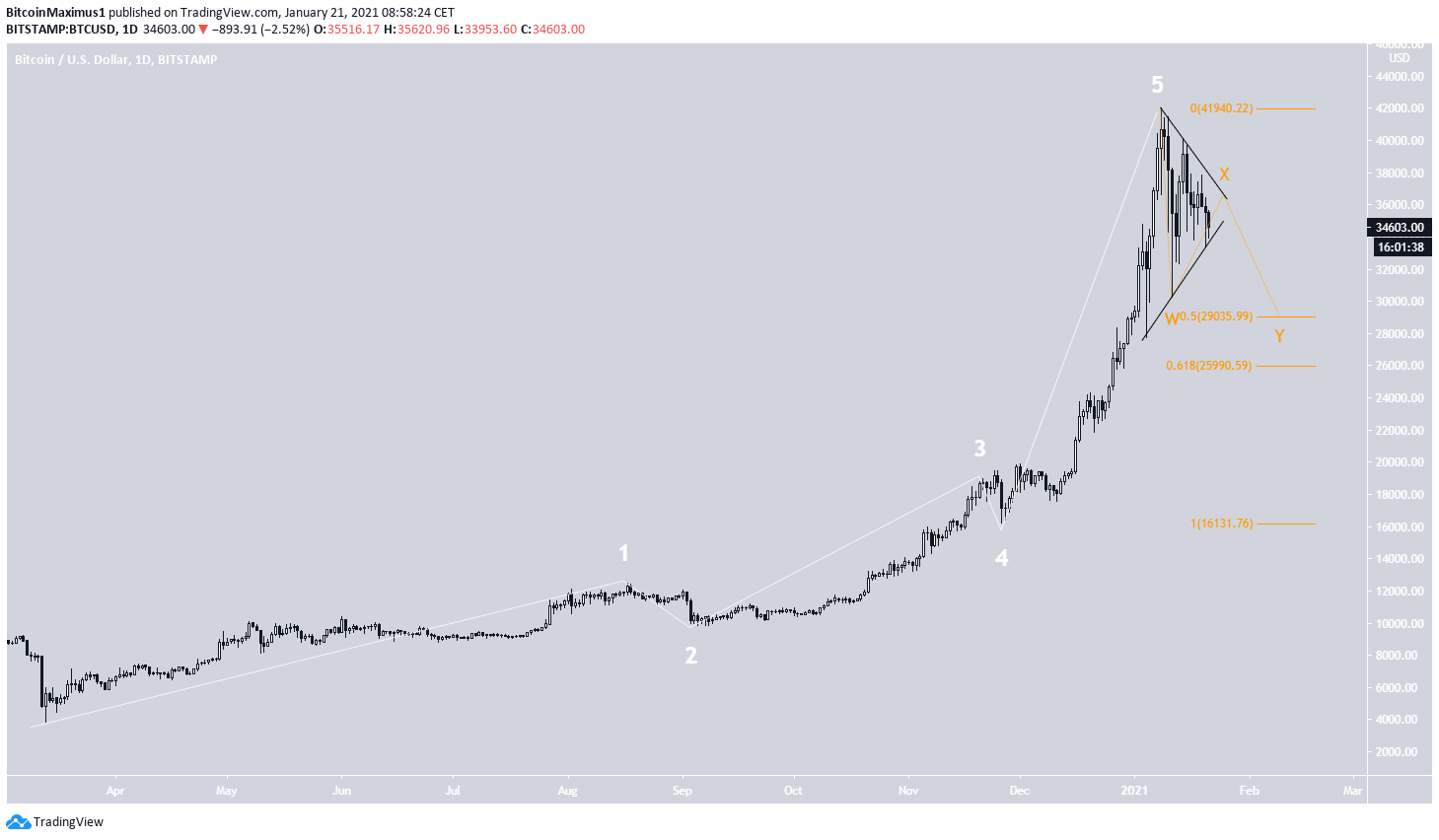

BTC Wave Count

The long-term count suggests that BTC has completed a bullish impulse and is now correcting inside a complex, W-X-Y structure.

A breakdown from the $34,000 support area and the symmetrical triangle would likely confirm that BTC is heading lower, possibly toward $29,000.

The wave count suggests that BTC is likely in the C wave of an A-B-C-D-E structure, which creates the entire symmetrical triangle.

Similarly, a decrease below the B wave low at $33,400 would confirm that BTC has broken down.

Nevertheless, if that occurs prior to the creation of the C, D, and E waves, it would indicate that BTC is trading inside a different corrective structure instead — though the end result would likely be the same.

Alternate Movement

The alternate count would be that BTC is in a bullish fourth wave triangle, and is currently in the D wave. This would not fit with the long-term count at all, since it would suggest that another upward move is in the cards.

Nevertheless, if BTC were to break out from the triangle instead and move above the B wave high at $40,500, it would confirm that BTC is bullish.

At the current time, this seems unlikely.

Conclusion

Bitcoin is expected to continue consolidating inside the current symmetrical triangle before eventually breaking down. An increase above $40,000 would invalidate this scenario.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here!