On Aug 27, the Bitcoin (BTC) price moved upwards, retracing as a result of the decrease from the day prior.

Unless Bitcoin can break out from the current resistance area and line, the price movement is considered bearish.

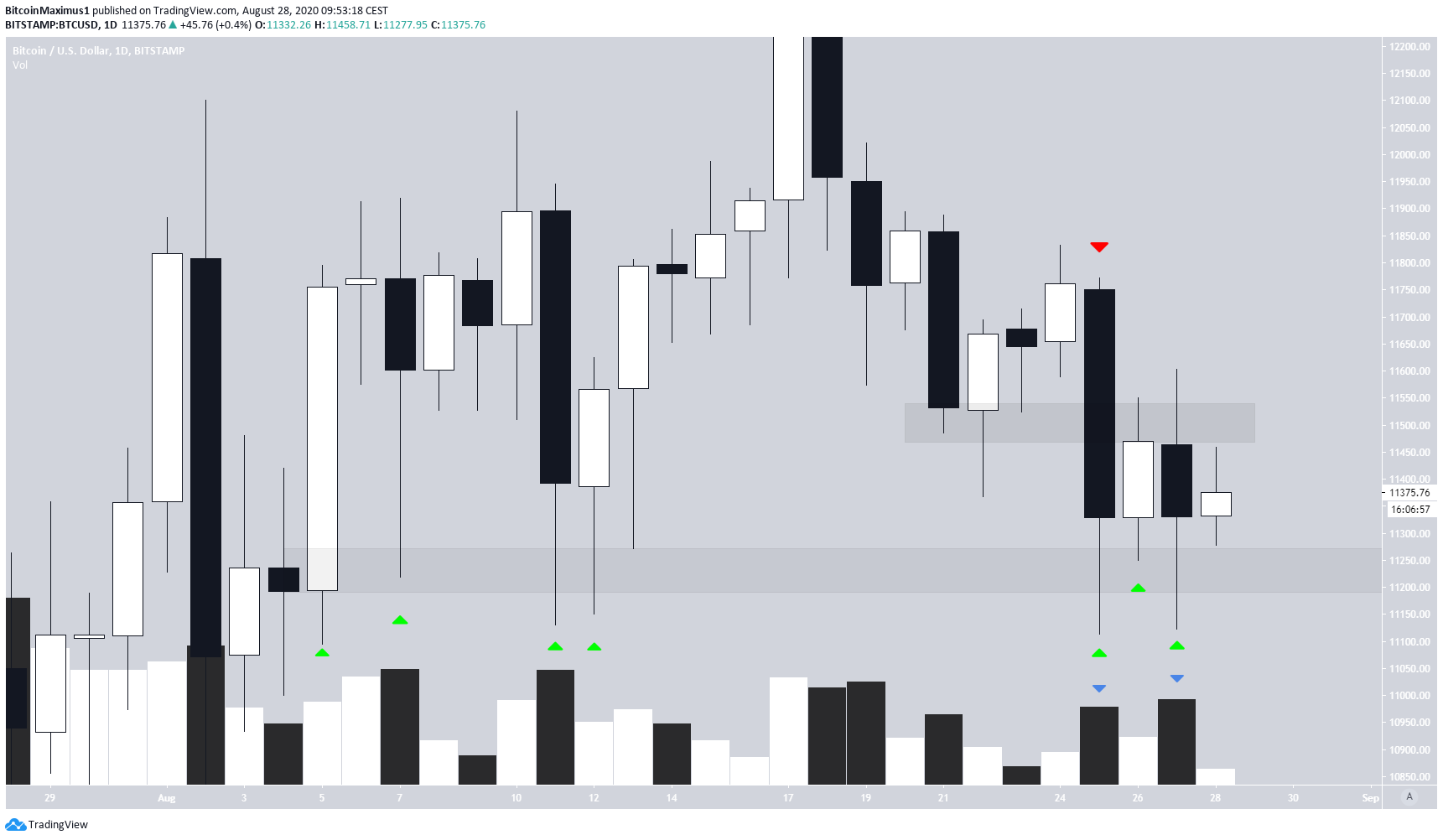

Bitcoin Daily Candlestick Outlook

The Bitcoin price has been decreasing since Aug 17, when it reached a local high of $12,467.

On Aug 25, BTC created a bearish engulfing candlestick and has been retracing since. However, the retracement has failed to breach the $11,500 area, which previously acted as support and has now turned to resistance. This is a sign that the upward move since the drop is likely to be a retracement.

The main support level is found near $11,200, first created by the bullish engulfing candlestick on Aug 5 (red arrow).

Each time the price has reached this level, it has created a long lower-wick and bounced upwards. However, the price has tapped this level seven times until now (green arrows), making it more likely to be broken. Also, each bounce has been weaker than the one that preceded it.

In addition, volume has been higher during bearish candlesticks than their bullish counterparts.

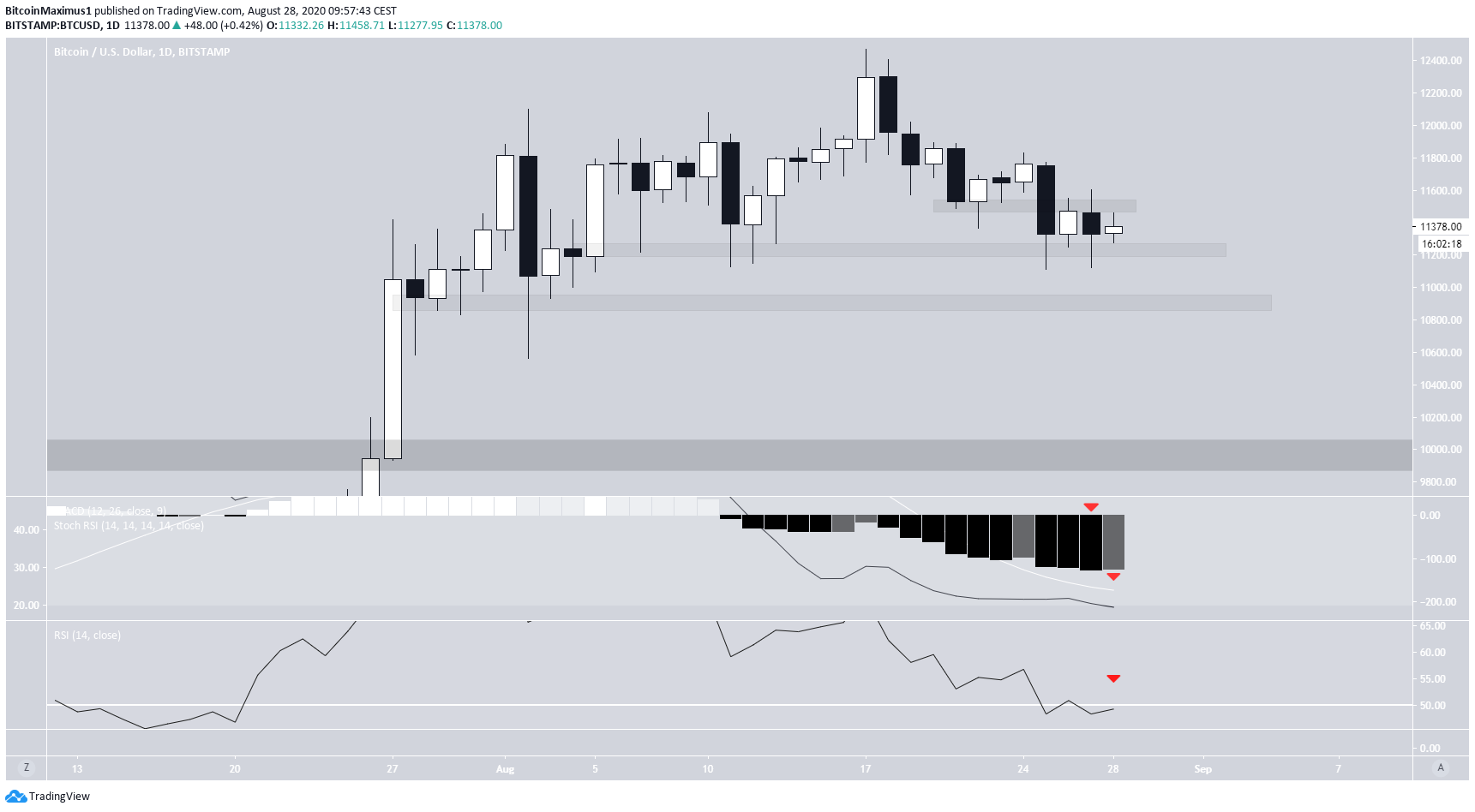

Technical indicators are bearish.

The MACD is decreasing and is in negative territory. While the current momentum bar is higher than the preceding one, there are 16 more hours till the candle closes, so it is not yet relevant in the daily analysis.

If the bar closes in the same place it is now, it would be a bullish sign. The Stoch RSI is decreasing and seems to have rejected a bullish cross, but is in oversold territory, so a bounce might be near.

The RSI has fallen below the 50-line and is validating it as resistance.

Combined with the candlestick signs, this makes it likely that the price will break down and head towards the next support area at $10,900.

Bullish Pattern

The shorter-term chart shows that the price has been following a descending resistance line since the aforementioned Aug 17 high. Until the price breaks out from this line, the price movement cannot be considered bullish.

Furthermore, the price has twice failed to break out above the $11,500 resistance area, creating a very long upper-wick the second time.

However, the price has created a double-bottom pattern, which has been combined with a bullish divergence in the RSI. While this is a bullish sign, it is currently only visible in time-frames higher than 6-hours.

The hourly chart shows a minor resistance area at $11,400, above which the price deviated twice yesterday. In addition, there is a hidden bearish divergence present, visible up to the 6-hour time-frame, which could be seen as neutralizing the previous bullish divergence.

Wave Count

In our previous analysis, BeInCrypto stated that:

To conclude, the Bitcoin price is correcting in a movement that is expected to end near $9,900. The other possibility is that the move ends near $10,900, but is less likely as there are no reversal signs suggesting that the price will do so.

Nothing has changed to alter this hypothesis, so we still believe this to be the most likely scenario with the price likely being in a C wave. However, the recent movement has made it very difficult to outline the correct wave count in this pattern, so the focus will be on the short-term count.

It seems that the price has completed a five-wave formation and a complex w-x-y correction with yesterday’s wick high of $11,592. If so, BTC has probably begun another five-wave formation.

This particular wave count would be invalidated with an increase above the aforementioned wick high at $11,592.

To conclude, the Bitcoin price is expected to break down from the $11,200 support area and head towards $10,900.

For our previous Bitcoin analysis, click here!